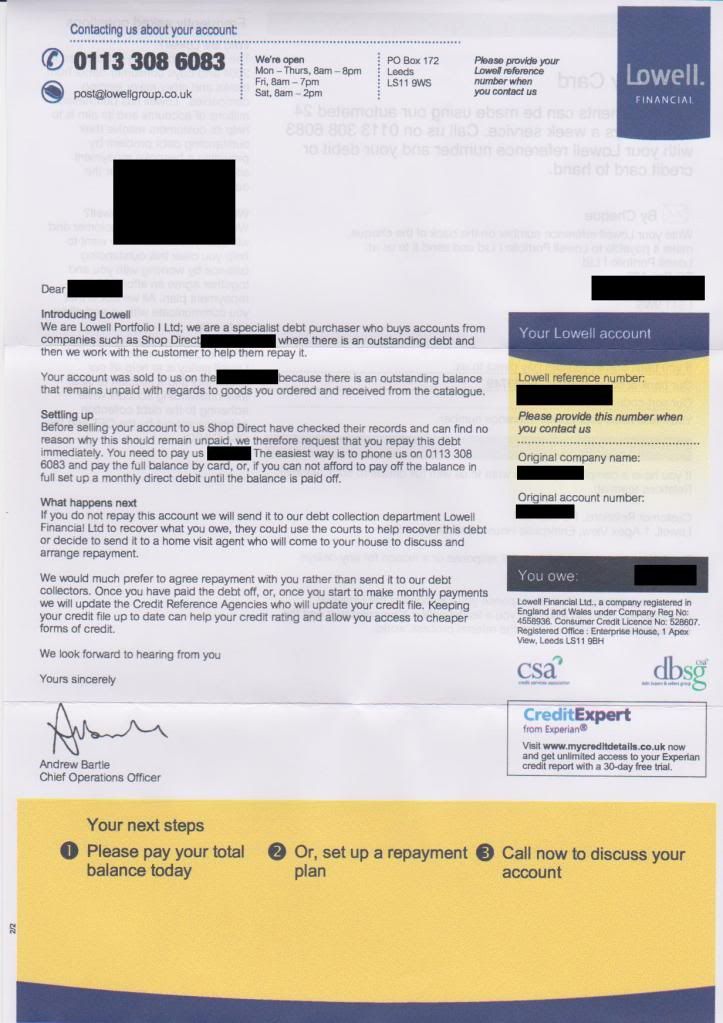

Re: Letters from DCA's - Some sample letters you may have received

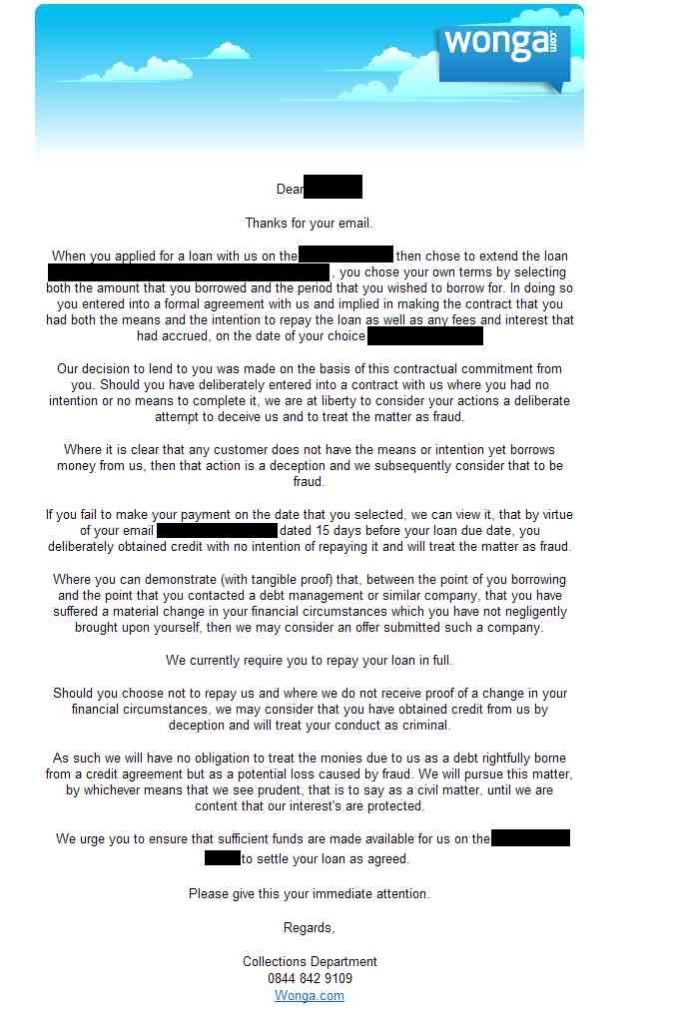

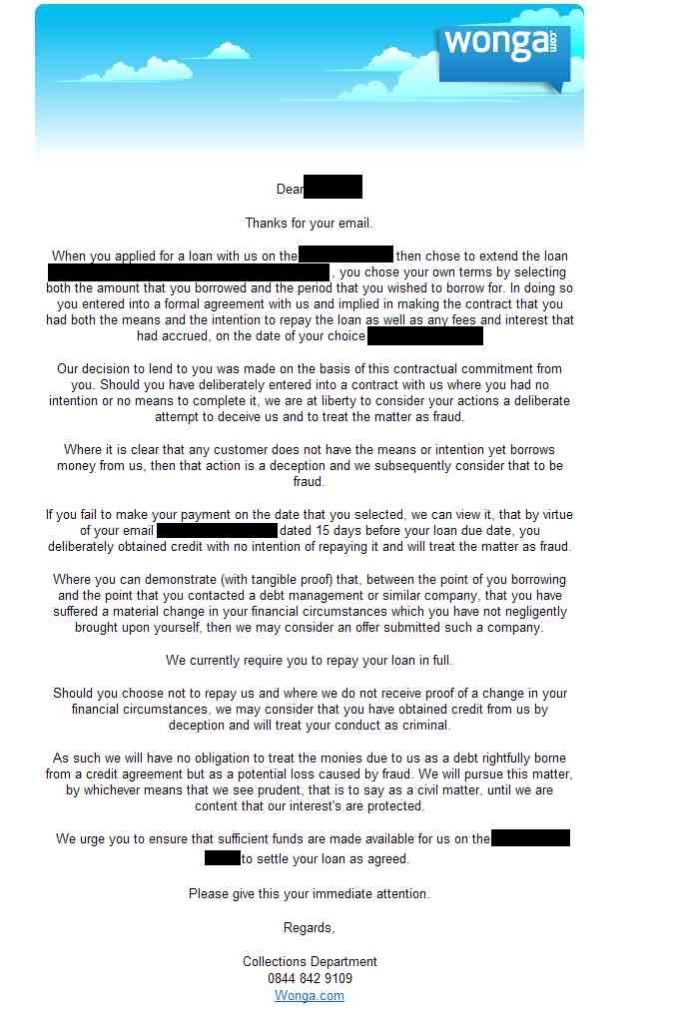

Heres a standard threat from Wonga. Notice how one minute they are threatening 'criminal' offences and the next minute it will be pursued as a 'civil matter'.

I've got one somewhere where they claim 'close links to the Metropolitan police'. I'm trying to dig it out.

Best

Crispy

Heres a standard threat from Wonga. Notice how one minute they are threatening 'criminal' offences and the next minute it will be pursued as a 'civil matter'.

I've got one somewhere where they claim 'close links to the Metropolitan police'. I'm trying to dig it out.

Best

Crispy

Comment