If you have received a County Court Claim from a creditor or debt purchaser, don’t panic !

LegalBeagles have many years of experience assisting consumers in dealing with these claims, so you are in the right place to work out what steps you should take before making a decision whether to defend the claim or negotiate a settlement. To get help you will want to start a new thread in our dedicated Court Claim forum please read First Steps and make a new thread in the forum.

You will need to register – it’s free, anonymous, and only takes a minute.

First Steps

If you receive a Claim Form from the court you NEED to take action. Do NOT ignore court papers – even if you do not believe you owe the money or have never heard of the claimant.

You must take certain steps within 14 days of receiving the form or the court may issue a ‘judgment by default’ which will appear on the register of judgments and on your credit file for six years. This will enable the claimant to bring enforcement action against you, such as sending a bailiff or obtaining a charge over your home.

So… is it a real claim ?

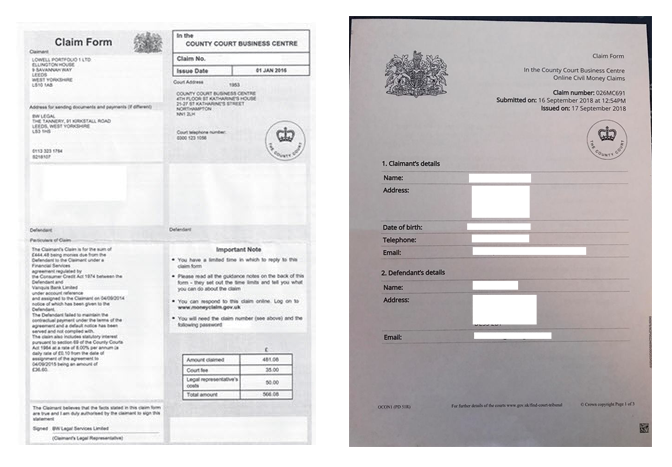

There are two types of claim form. Both are equally as valid, they have simply been issued through different online systems as the Court Service is currently trialling a new moneyclaim service online.

The claim form is sent to you directly by the court. Normally it arrives in a brown envelope and contains a response pack and instructions for response. It may look like either of these.

If you have any concerns over it’s validity then you can call the court that sent the form and give them the Claim Number to check. Alternatively you can simply try logging in to the MoneyClaim online service with the details given. If you want to check with the court directly you can find the court contact information here.

We always advise that you Acknowledge the Claim first of all. This ensures you have the full 28 days from service ( when you received the claim ) to find out more information and decide whether to defend the claim, or make an admission and offer to pay, or even to negotiate directly with the claimant to settle the debt out of court.

ACKNOWLEDGE THE CLAIM (see here)

If you do not respond

You might get a County Court Judgment (CCJ) in default if you do not respond by the date on the letter or email.

If you get a CCJ:

- bailiffs might be sent to your home or business

- you might have problems getting credit, such as a mobile phone contract, credit card or mortgage

- It may affect your job – particularly if you work in finance

Users of the forum can offer support and guidance through the rest of the process. Please feel free to post, have a rant, ask questions, discuss tactics … whatever you like, we’re HERE for you.

We now feature a number of specialist consumer credit debt solicitors on our sister site, JustBeagle.com – If your case is over £10,000 or particularly complex it may be worth a chat with a solicitor, often they will be able to help on a fixed fee or CFA (no win, no fee) basis.