Re: Medical Insurance Pre existing conditions

B]

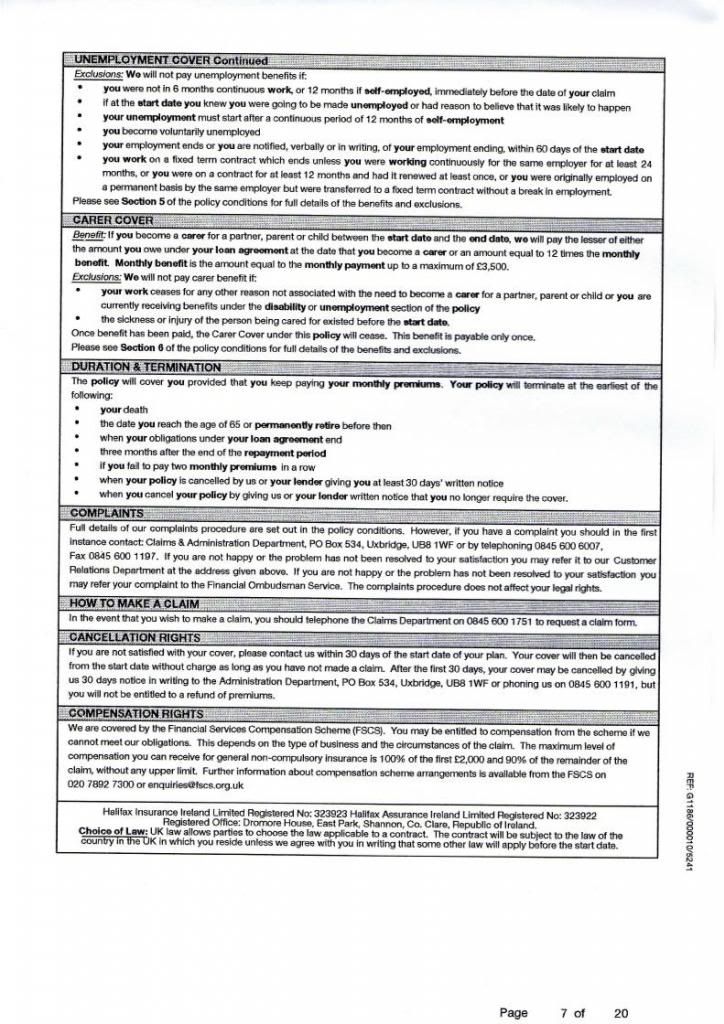

2007-Home Loan Application, Secured Loan Repayments Cover and Terms & Conditions[/B]

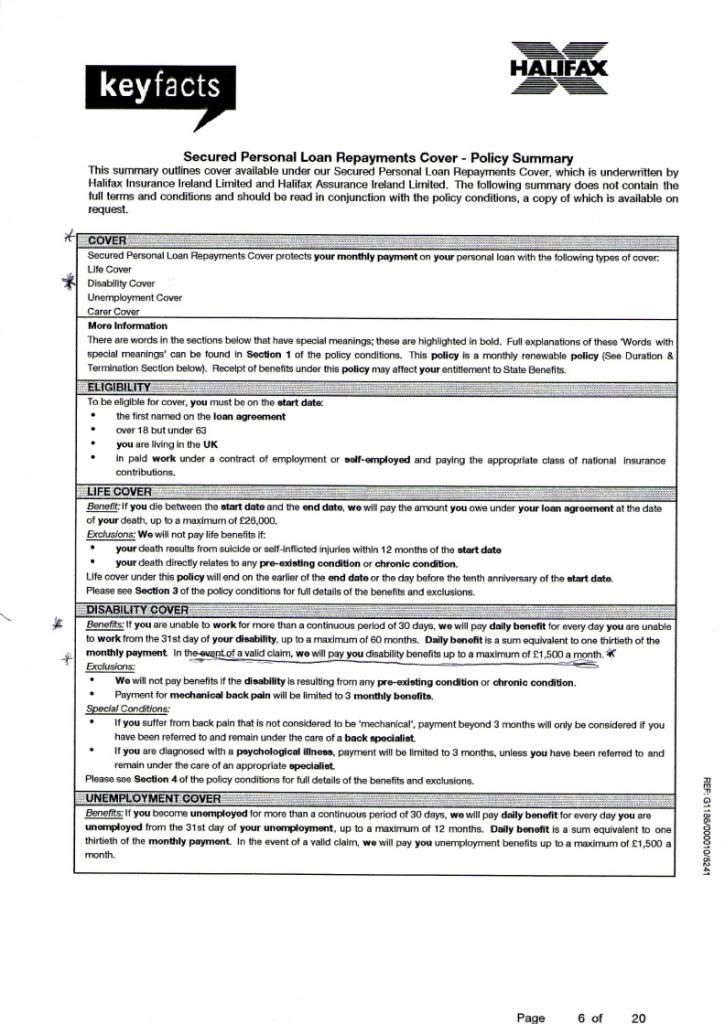

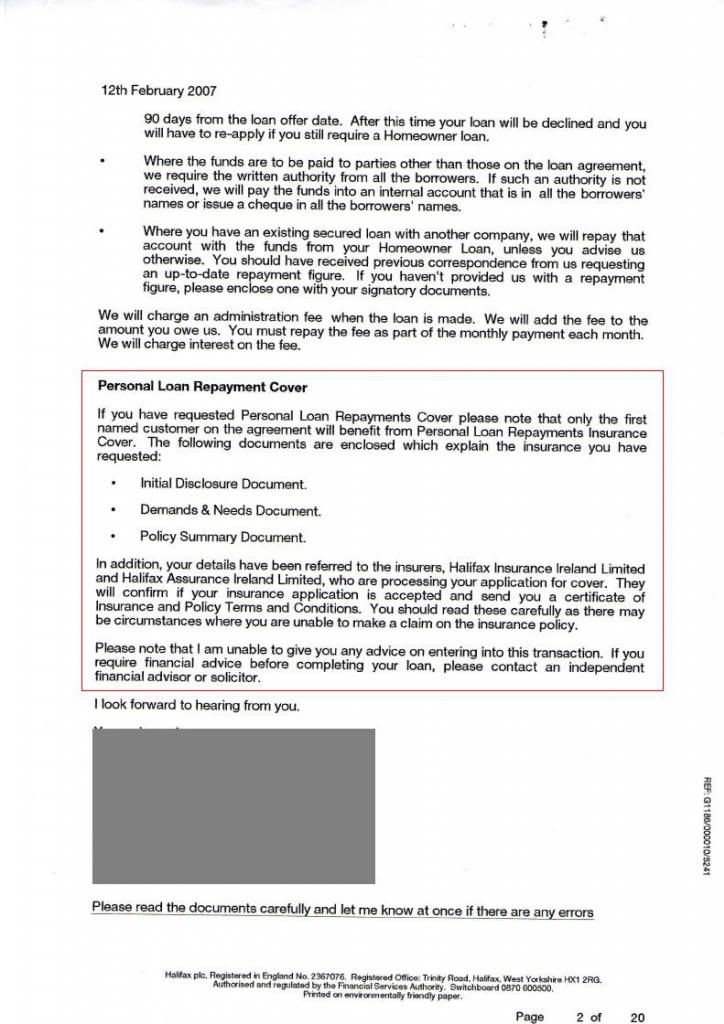

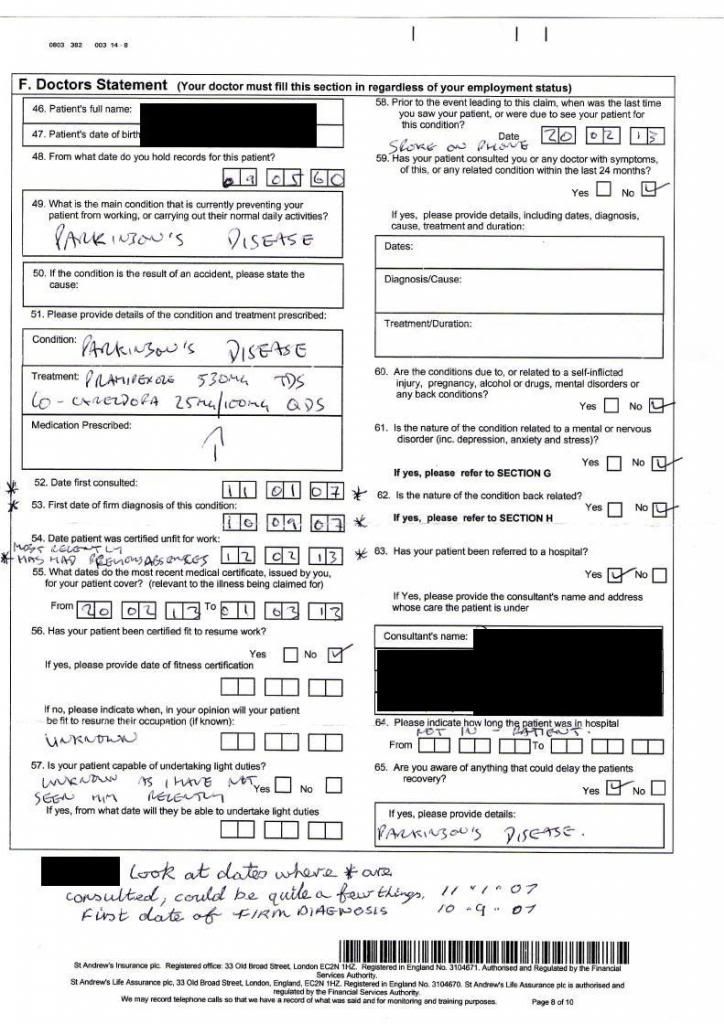

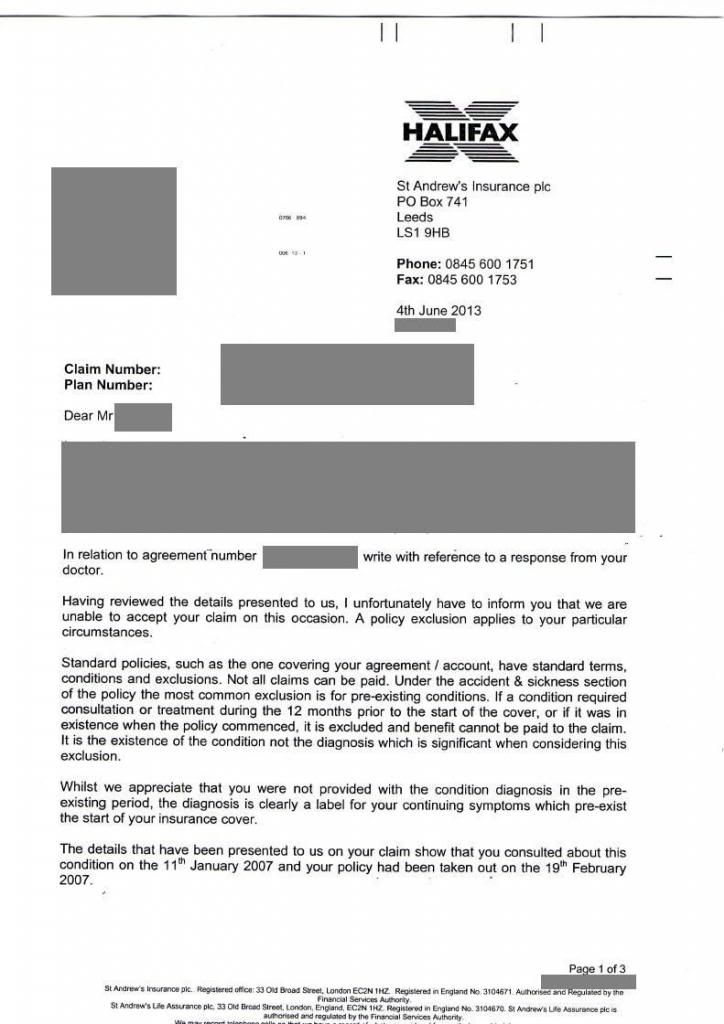

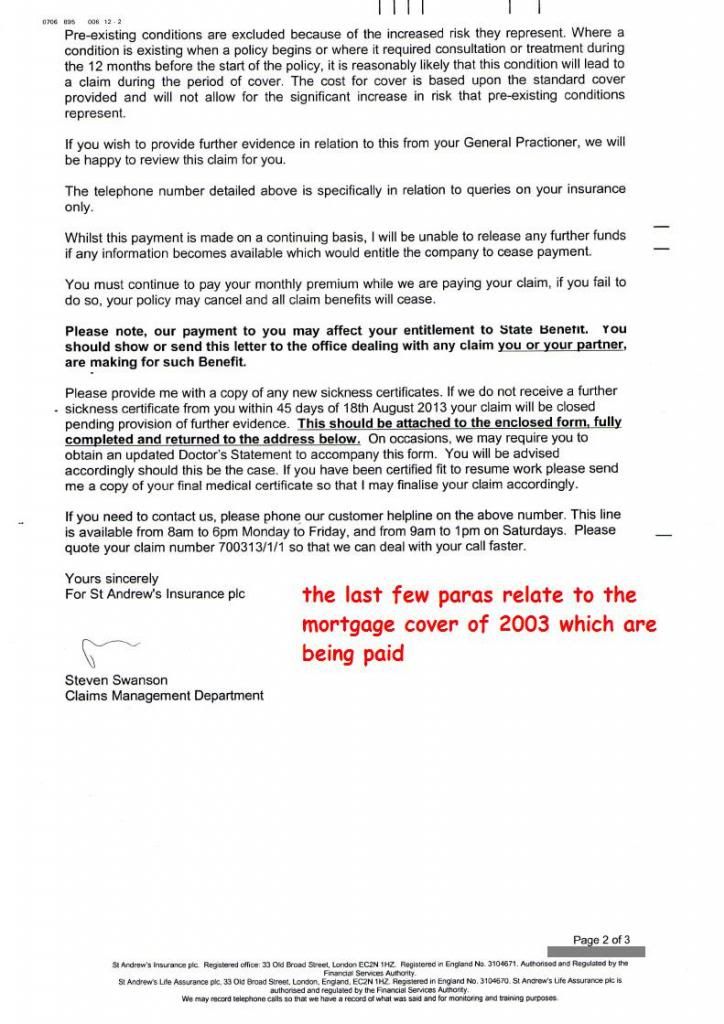

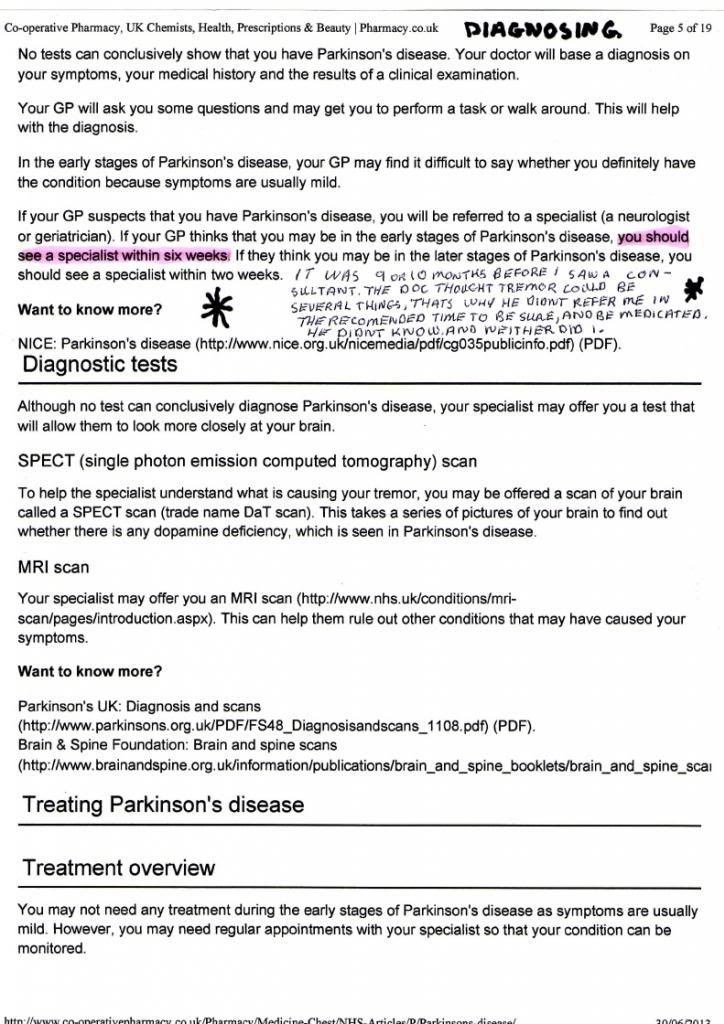

Enclosed below are pages 1,2,5,6,7,8 from the 12/02/2007 letter re Homeowner Loan Application--[2 of page 6 with Skyways annotation]

Note above page 8

This is the formal acceptance by Halifax of the Loan Application

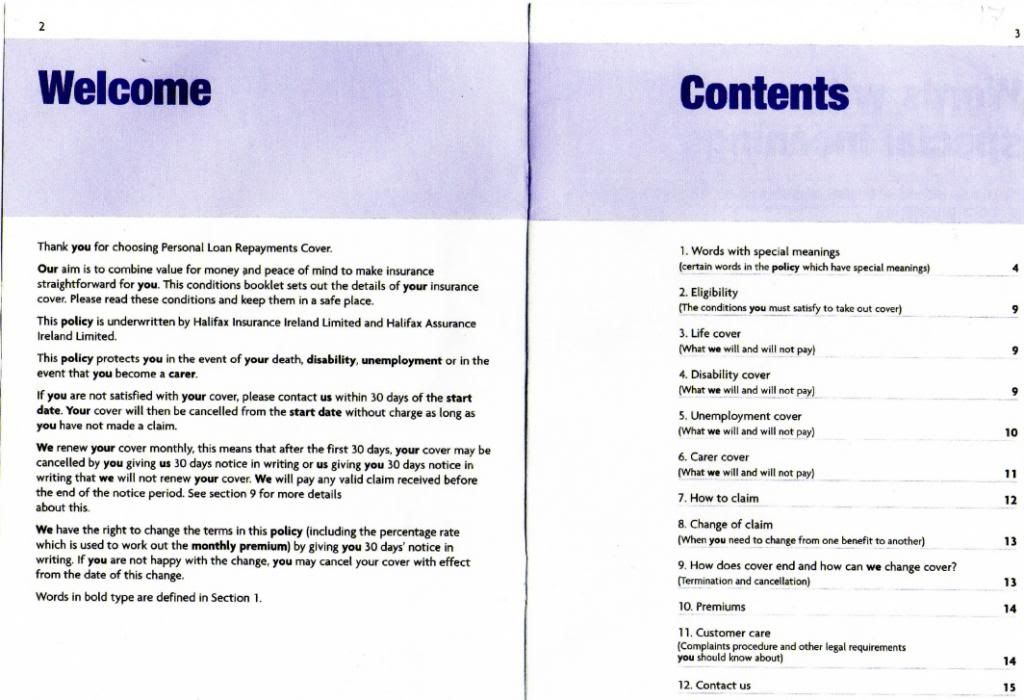

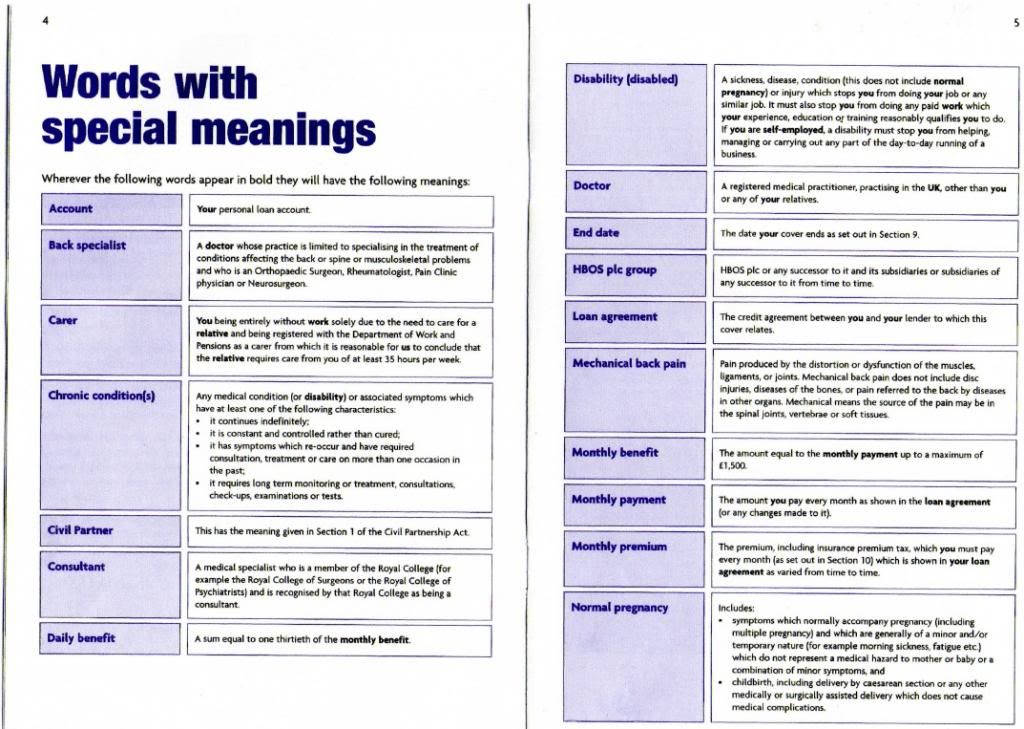

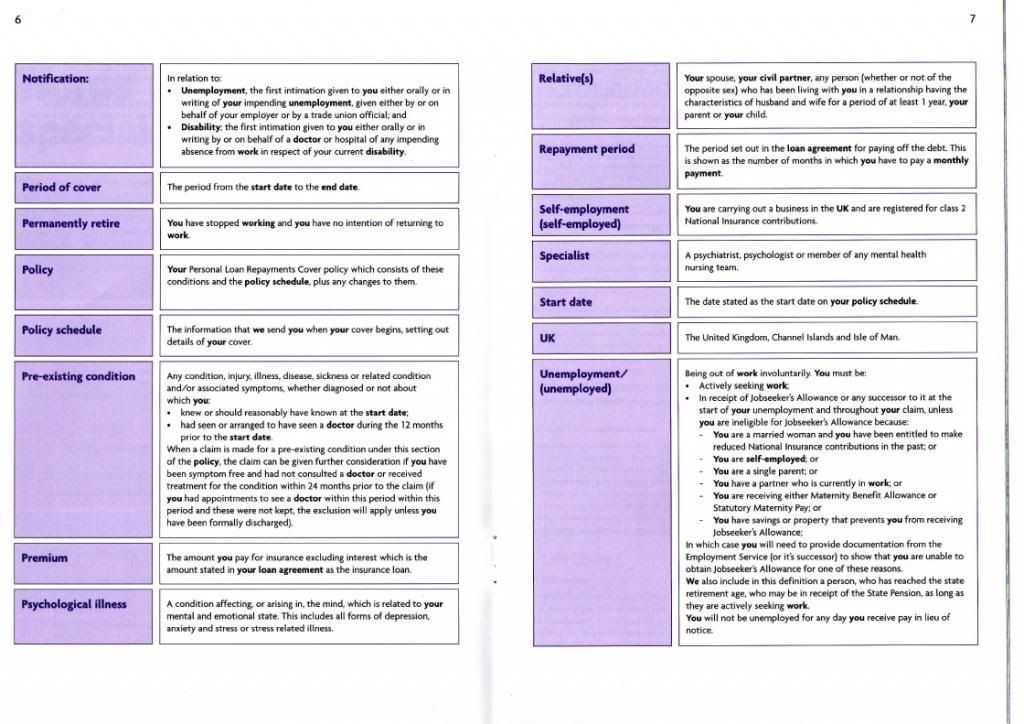

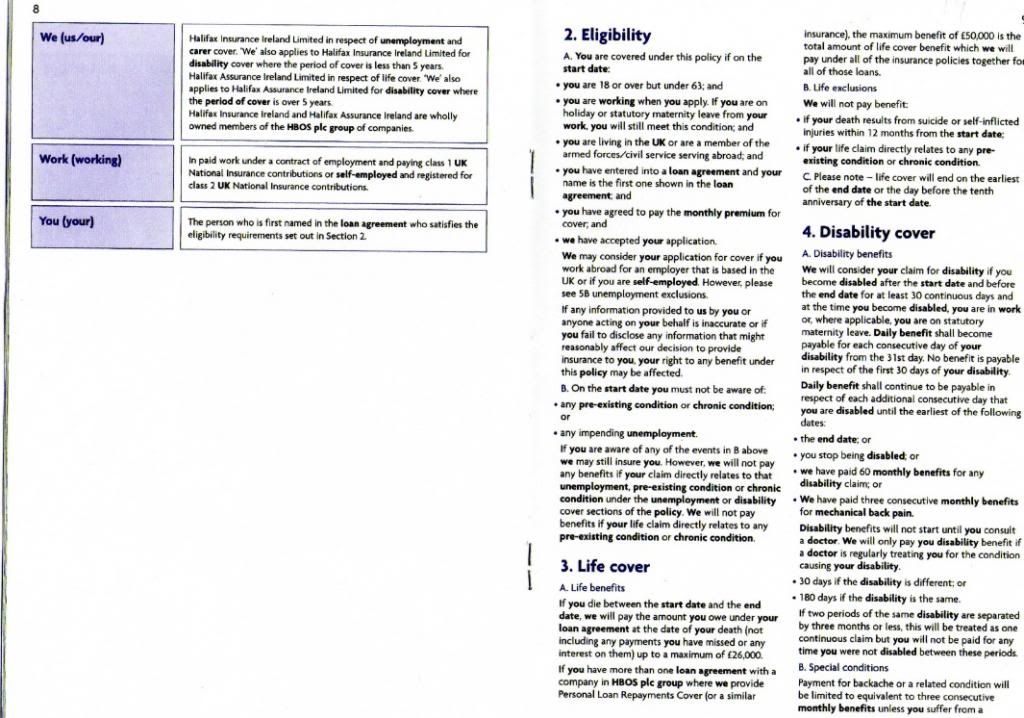

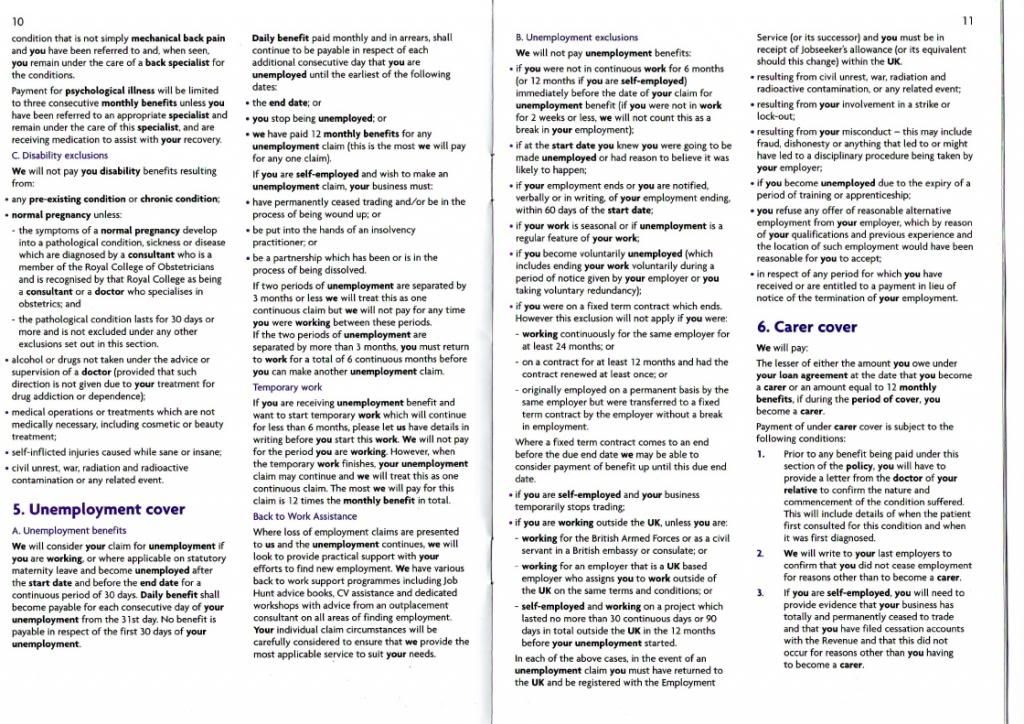

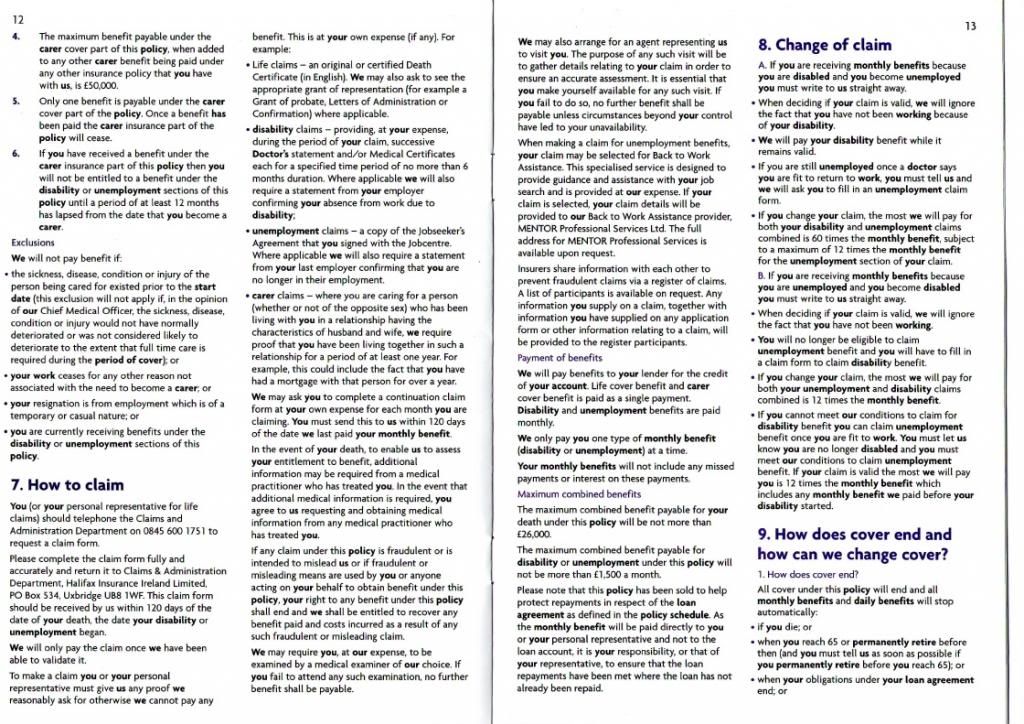

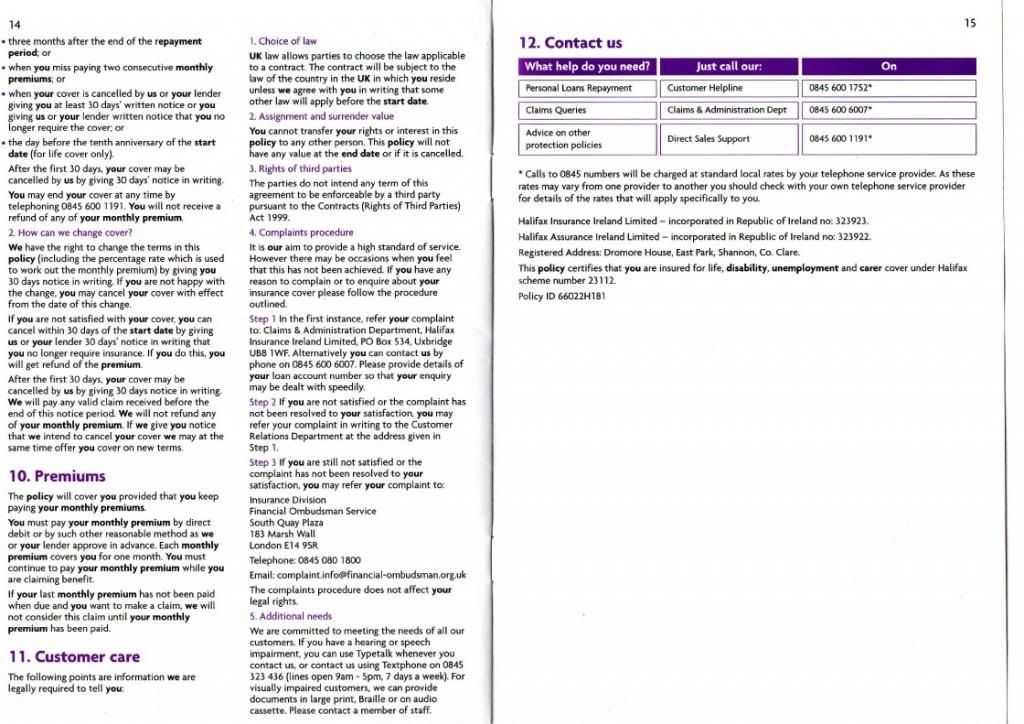

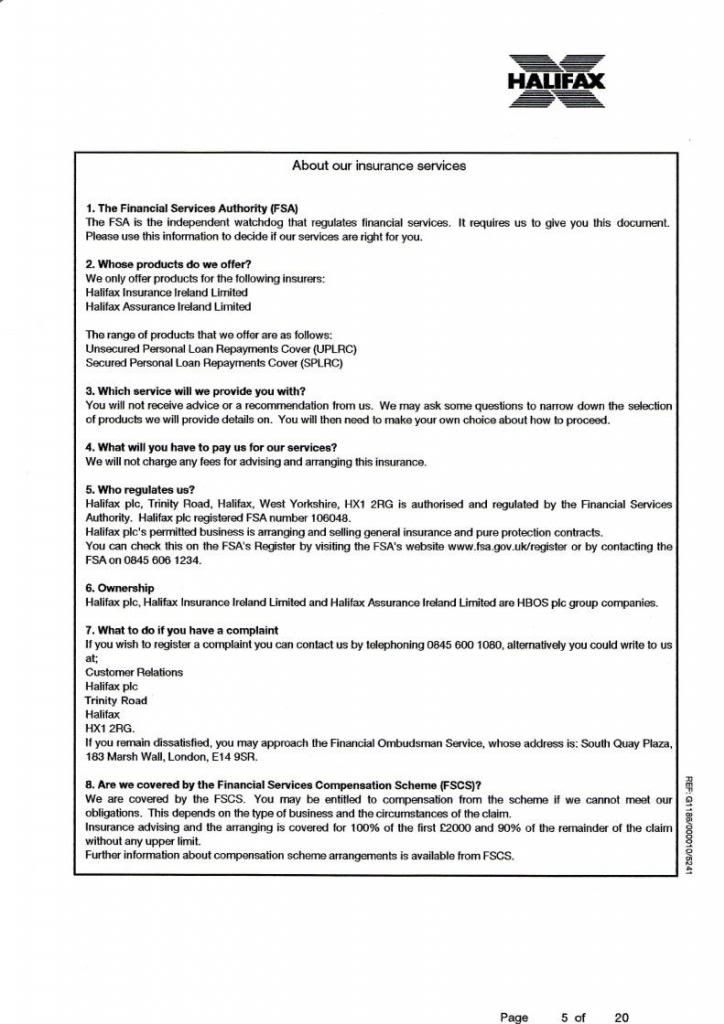

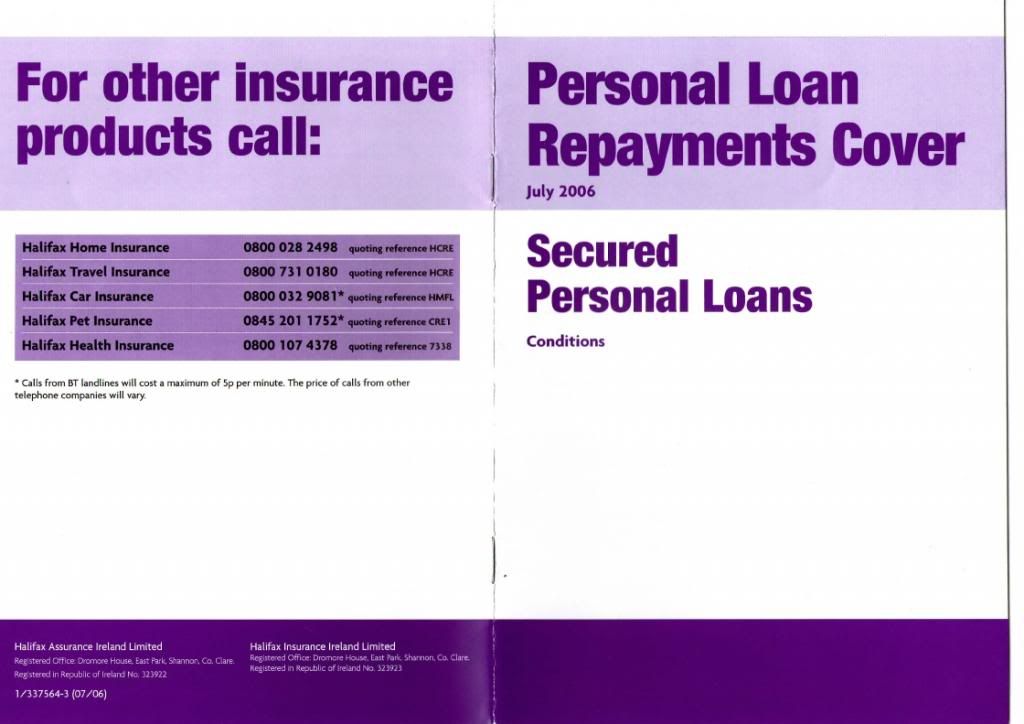

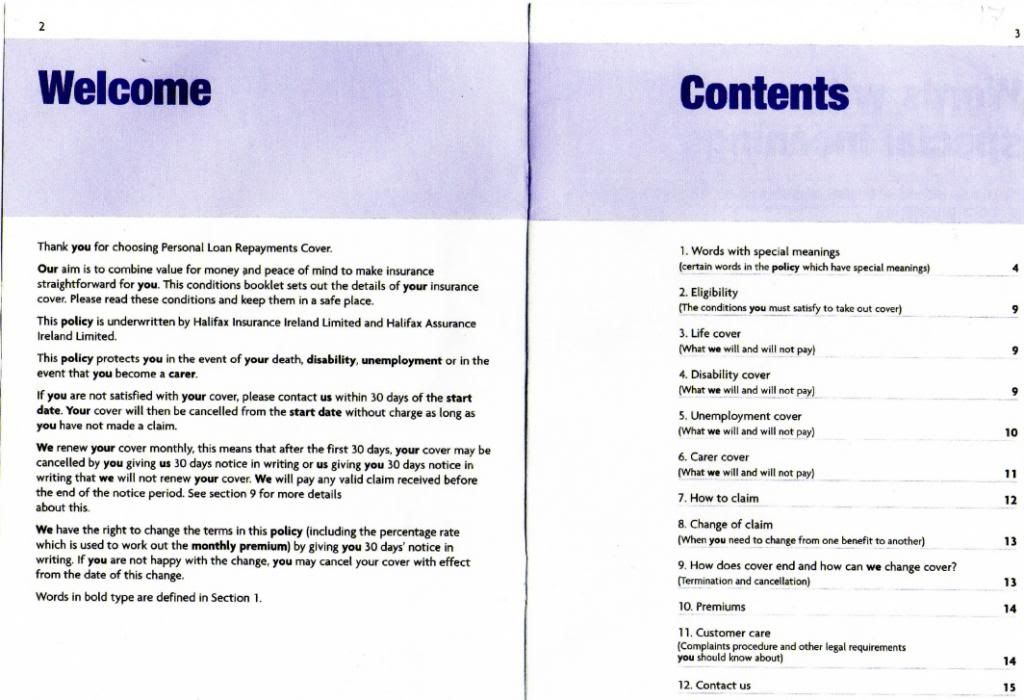

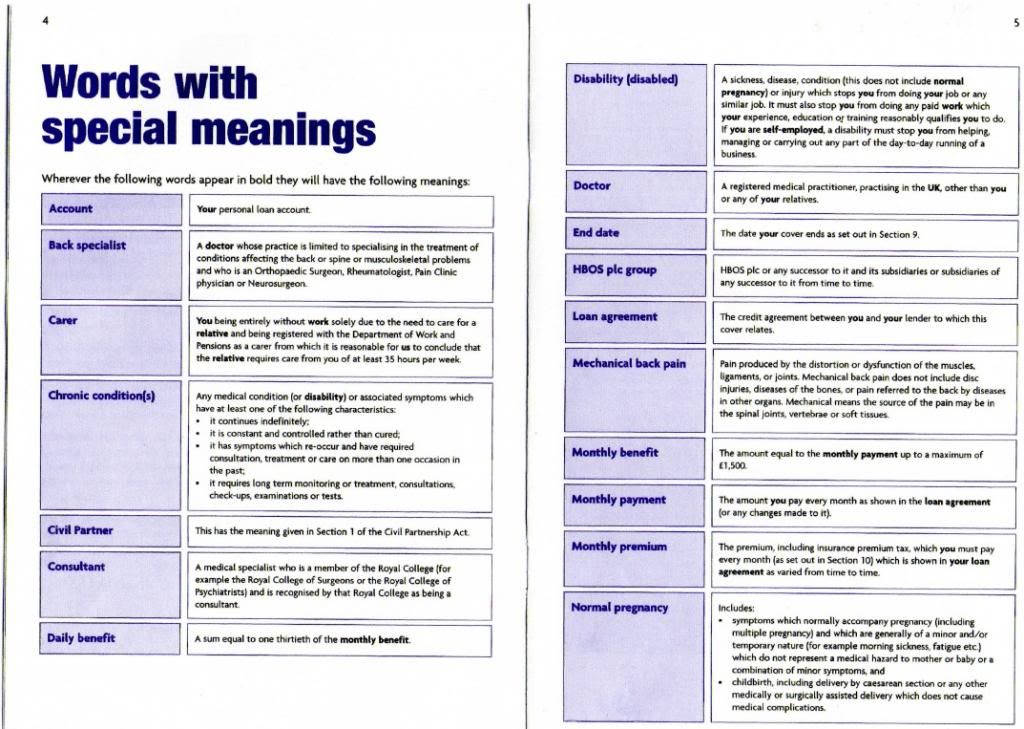

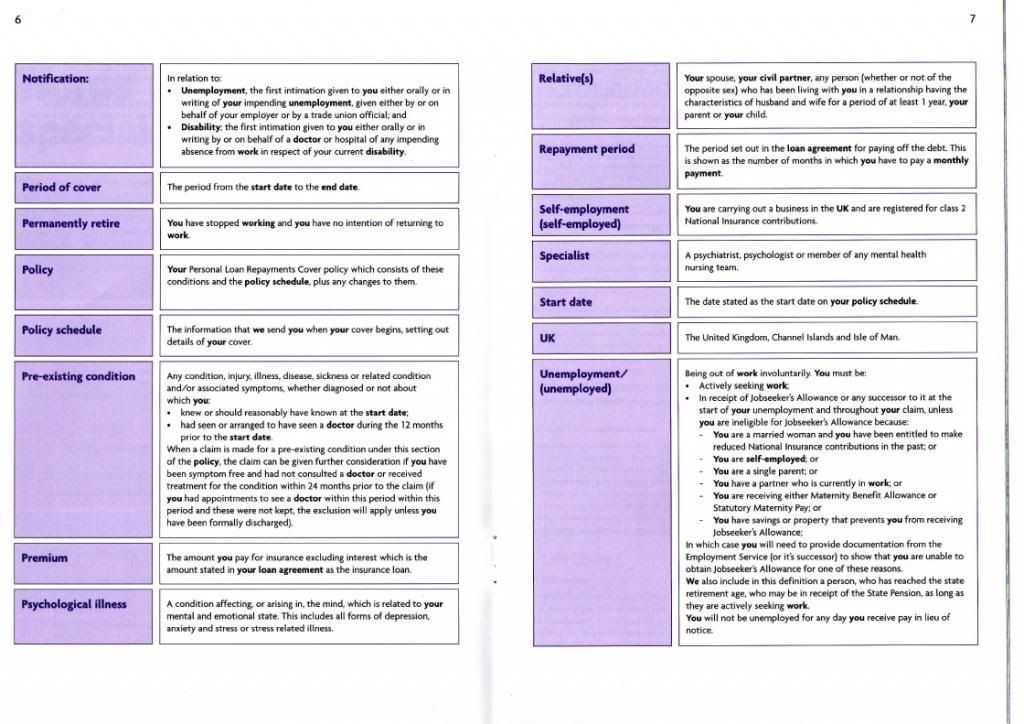

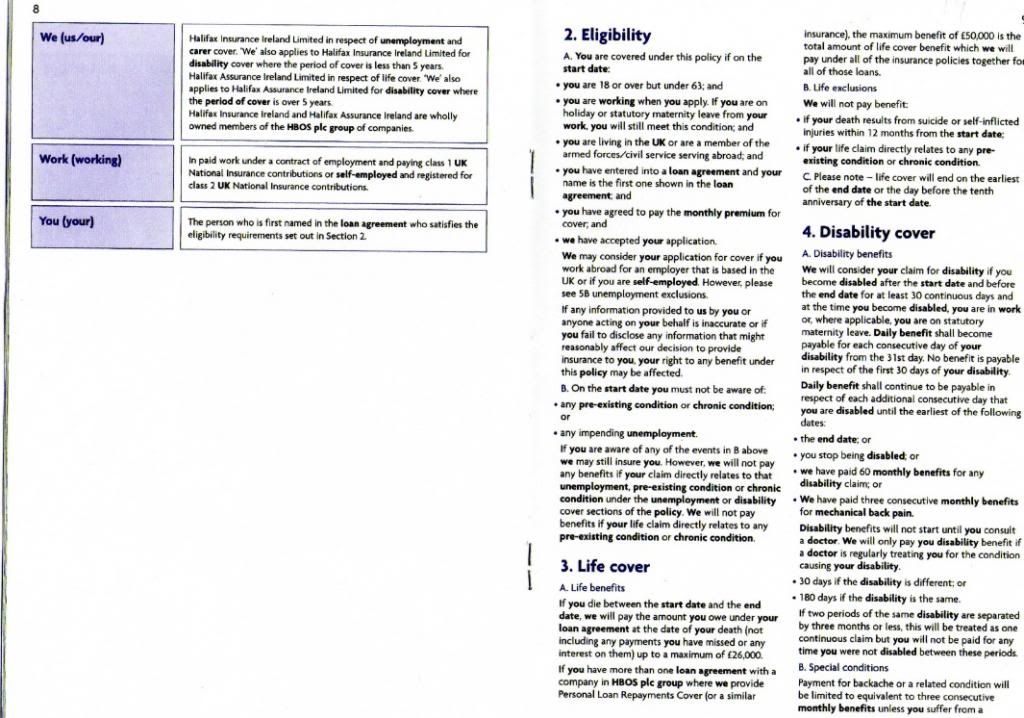

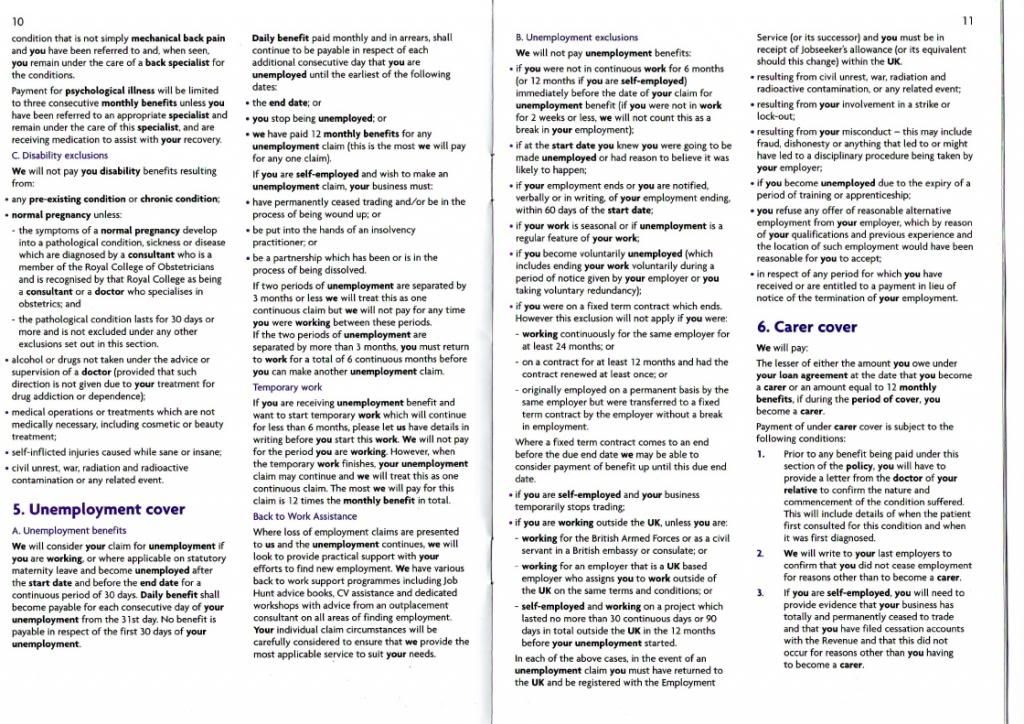

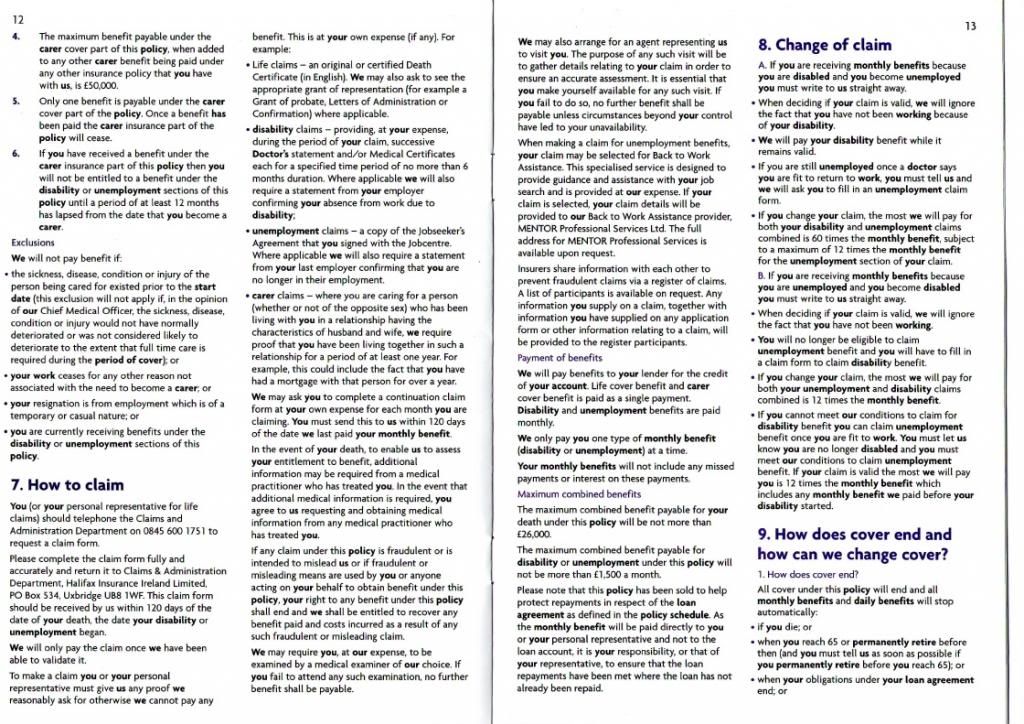

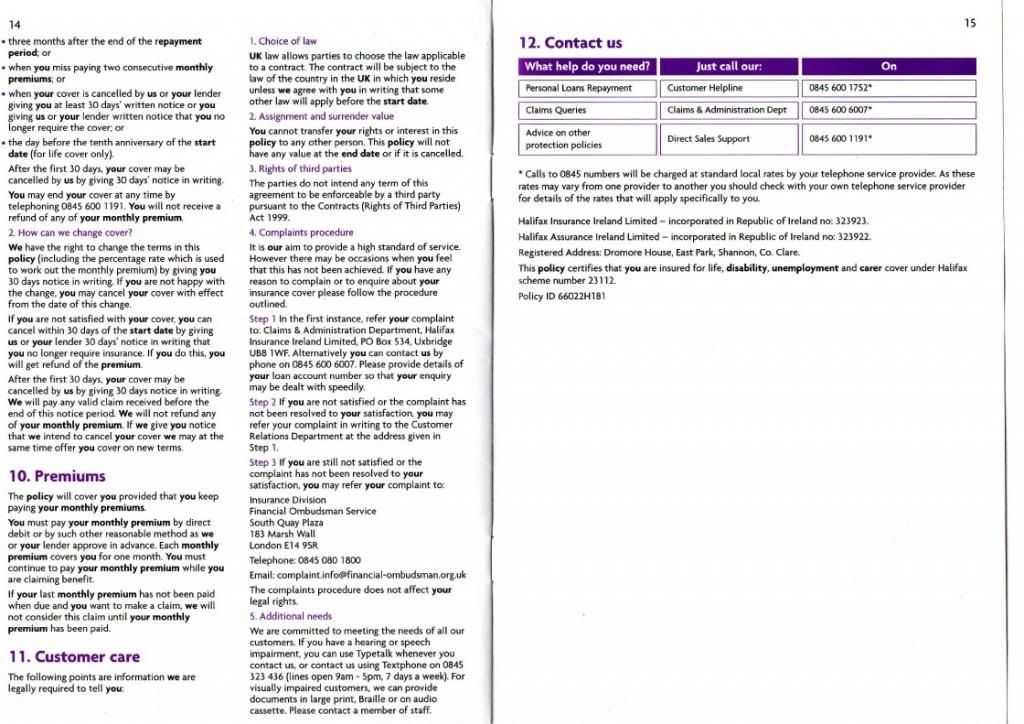

This is the Booklet for the 2007 Personal Loan Repayment Cover

-

-

-

-

-

-

-

-

-

-

-

-

-

-

B]

2007-Home Loan Application, Secured Loan Repayments Cover and Terms & Conditions[/B]

Enclosed below are pages 1,2,5,6,7,8 from the 12/02/2007 letter re Homeowner Loan Application--[2 of page 6 with Skyways annotation]

Note above page 8

This is the formal acceptance by Halifax of the Loan Application

This is the Booklet for the 2007 Personal Loan Repayment Cover

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Comment