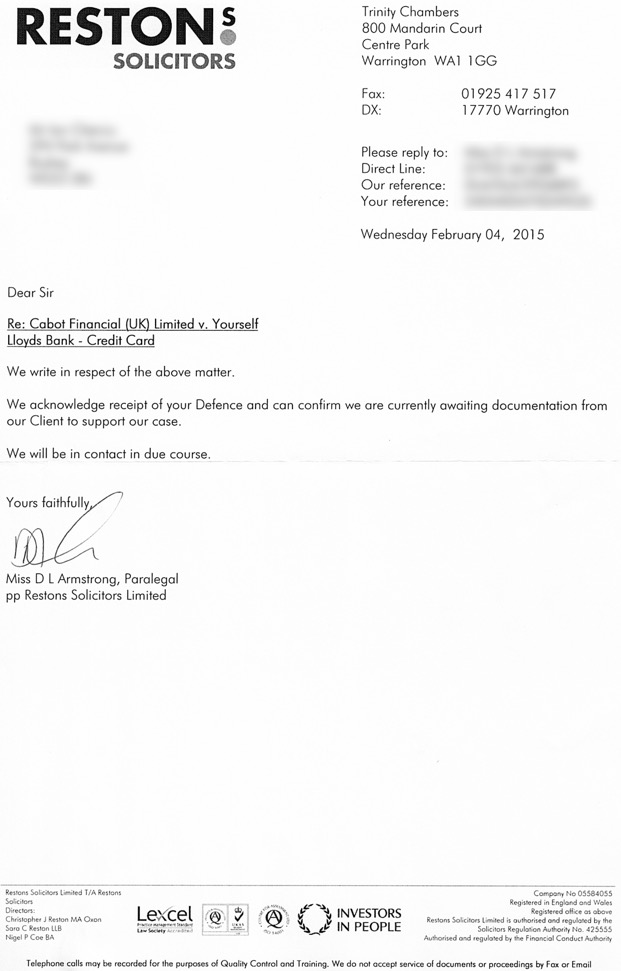

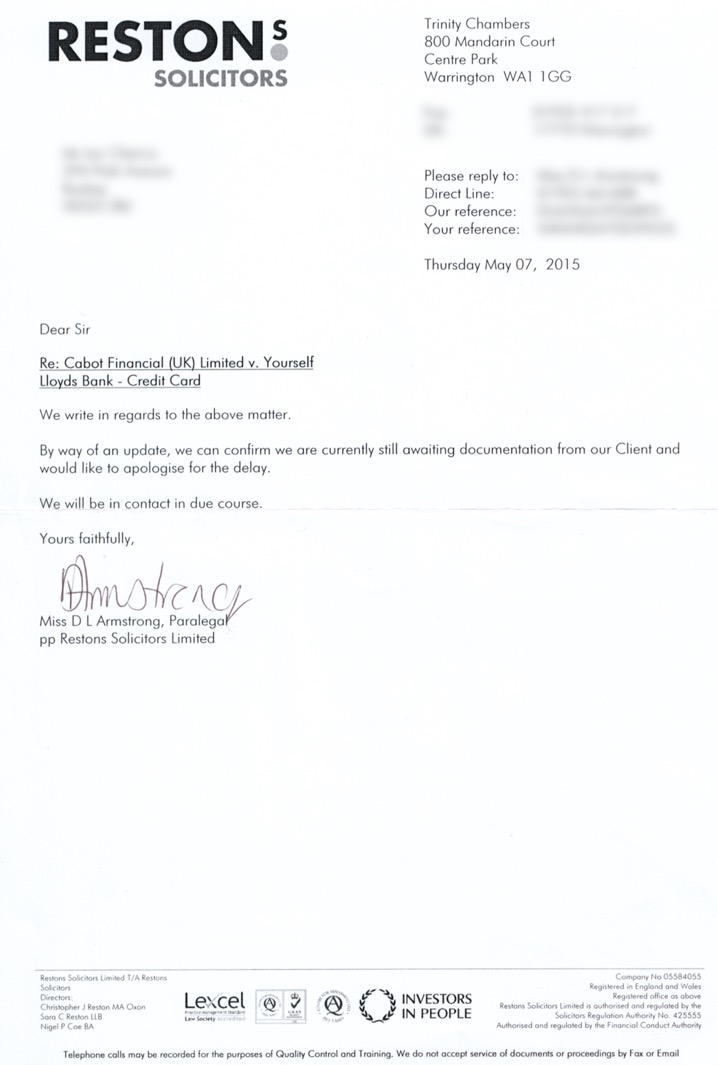

Re: Court Claim - Cabot Financial UK / Lloyds - 2-12-2014

The Consumer Credit (Prescribed Periods for Giving Information) Regulations 1983

Citation, commencement and interpretation

1.—(1) These Regulations may be cited as the Consumer Credit (Prescribed Periods for Giving Information) Regulations 1983 and shall come into operation on 19th May 1985.

(2) In these Regulations, “the Act” means the Consumer Credit Act 1974.

Prescribed period

2. The period of 12 working days is hereby prescribed for the purposes of each provision of the Act specified in Column 1 of the Schedule to these Regulations relating to the duty indicated in Column 2 in relation to regulated agreements.

SCHEDULESECTIONS OF THE ACT IN RESPECT OF WHICH A PERIOD OF 12 WORKING DAYS IS PRESCRIBED RELATING TO DUTIES IN RELATION TO REGULATED AGREEMENTS

SECTION OF THE ACT DUTY

(1) (2)

77(1) Duty to give information to debtor under fixed-sum credit agreement.

78(1) Duty to give information to debtor under running-account credit agreement.

79(1) Duty to give information to hirer under consumer hire agreement.

103(1) Duty to give debtor or hirer under a regulated agreement termination statement or serve counter-notice.

107(1) Duty to give information to surety under fixed-sum credit agreement.

108(1) Duty to give information to surety under running-account credit agreement.

109(1) Duty to give information to surety under consumer hire agreement.

110(1) Duty to give debtor or hirer copy of any security instrument executed in relation to agreement after making of agreement.

Yes, after the PRESCRIBED PERIOD that is true, so there is a time limit on when it becomes unenforceable. It CAN be remedied at any time though, which presumably is what she is talking about, but I'd still be inclined to say there are time limits and they are not 40 days.

It USED to be a criminal offence not to provide it within 12 days + 30 days. Sadly that was taken out in 2006.

Originally posted by octet

View Post

Citation, commencement and interpretation

1.—(1) These Regulations may be cited as the Consumer Credit (Prescribed Periods for Giving Information) Regulations 1983 and shall come into operation on 19th May 1985.

(2) In these Regulations, “the Act” means the Consumer Credit Act 1974.

Prescribed period

2. The period of 12 working days is hereby prescribed for the purposes of each provision of the Act specified in Column 1 of the Schedule to these Regulations relating to the duty indicated in Column 2 in relation to regulated agreements.

SCHEDULESECTIONS OF THE ACT IN RESPECT OF WHICH A PERIOD OF 12 WORKING DAYS IS PRESCRIBED RELATING TO DUTIES IN RELATION TO REGULATED AGREEMENTS

SECTION OF THE ACT DUTY

(1) (2)

77(1) Duty to give information to debtor under fixed-sum credit agreement.

78(1) Duty to give information to debtor under running-account credit agreement.

79(1) Duty to give information to hirer under consumer hire agreement.

103(1) Duty to give debtor or hirer under a regulated agreement termination statement or serve counter-notice.

107(1) Duty to give information to surety under fixed-sum credit agreement.

108(1) Duty to give information to surety under running-account credit agreement.

109(1) Duty to give information to surety under consumer hire agreement.

110(1) Duty to give debtor or hirer copy of any security instrument executed in relation to agreement after making of agreement.

However, failure to comply with the provisions means that the agreement becomes unenforceable while the failure to comply persists, and the courts have no discretion to allow enforcement.

It USED to be a criminal offence not to provide it within 12 days + 30 days. Sadly that was taken out in 2006.

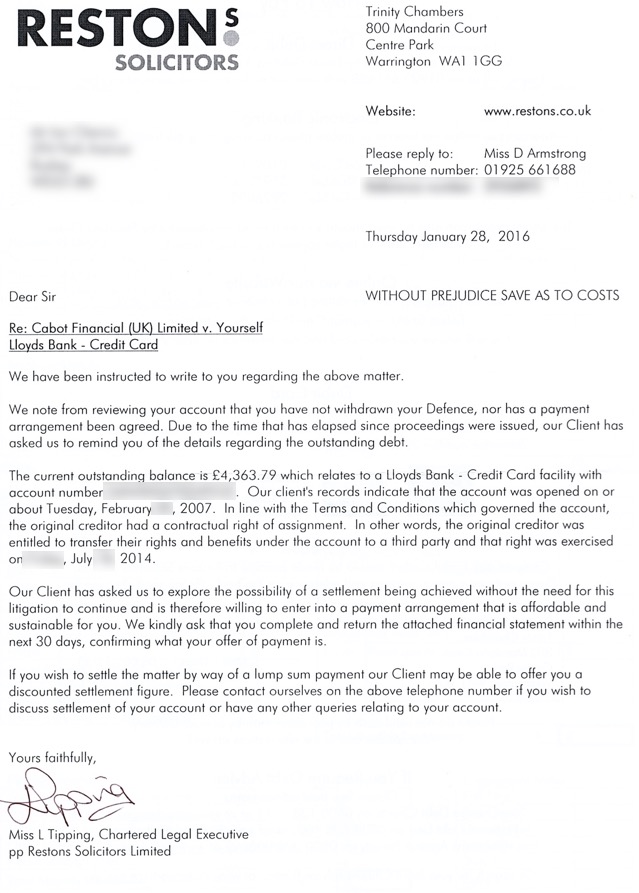

msl: That should teach them (and a lot of other firms acting for creditors), a lesson! :whoo: :whoo: :whoo:

msl: That should teach them (and a lot of other firms acting for creditors), a lesson! :whoo: :whoo: :whoo:

Comment