Re: Another court case - hearing on the 24th August..HELP!

Hi everybody,

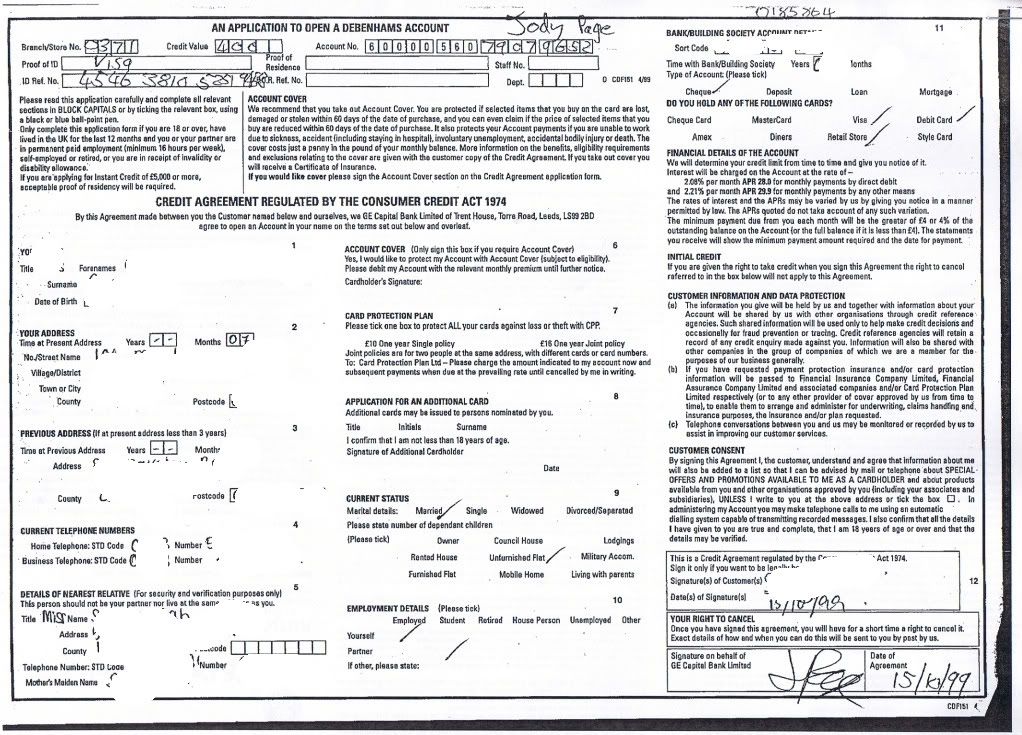

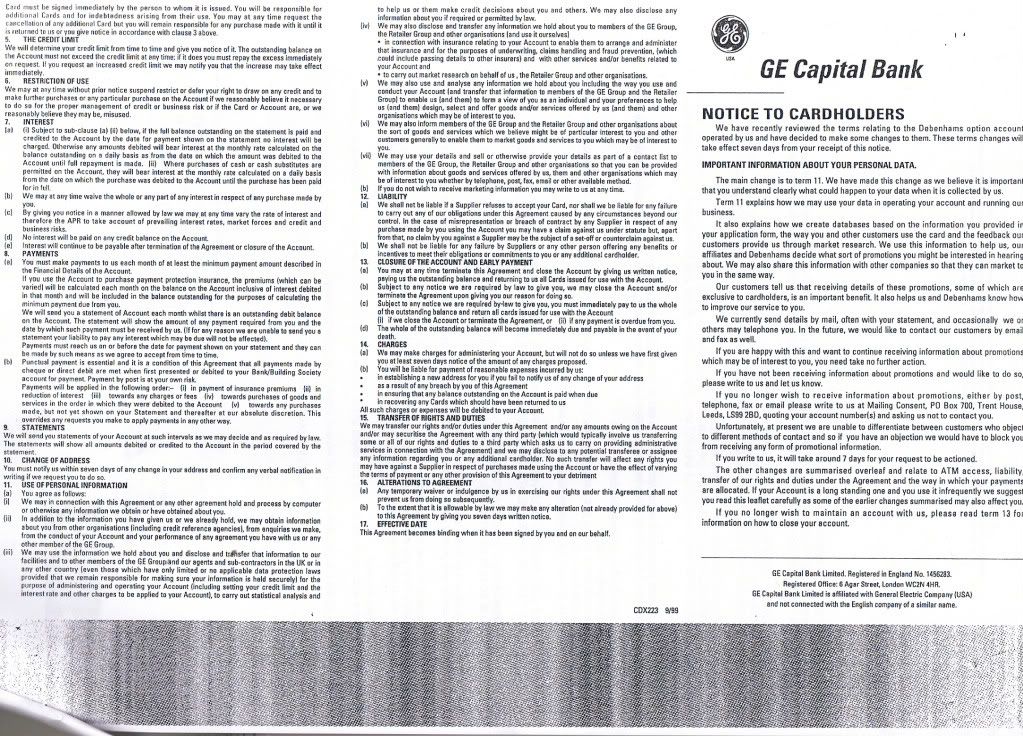

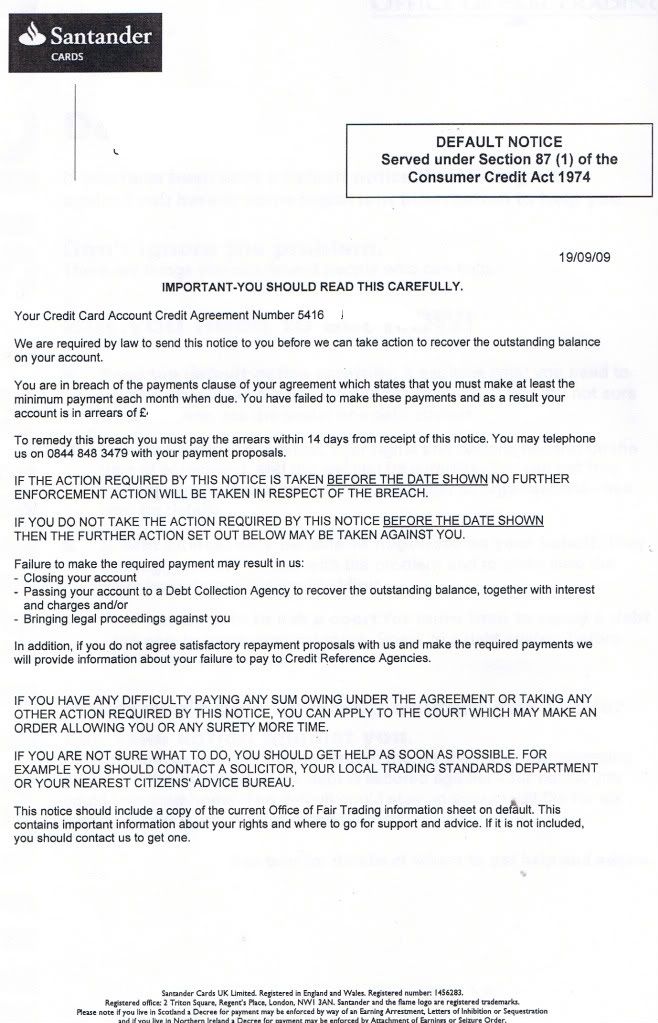

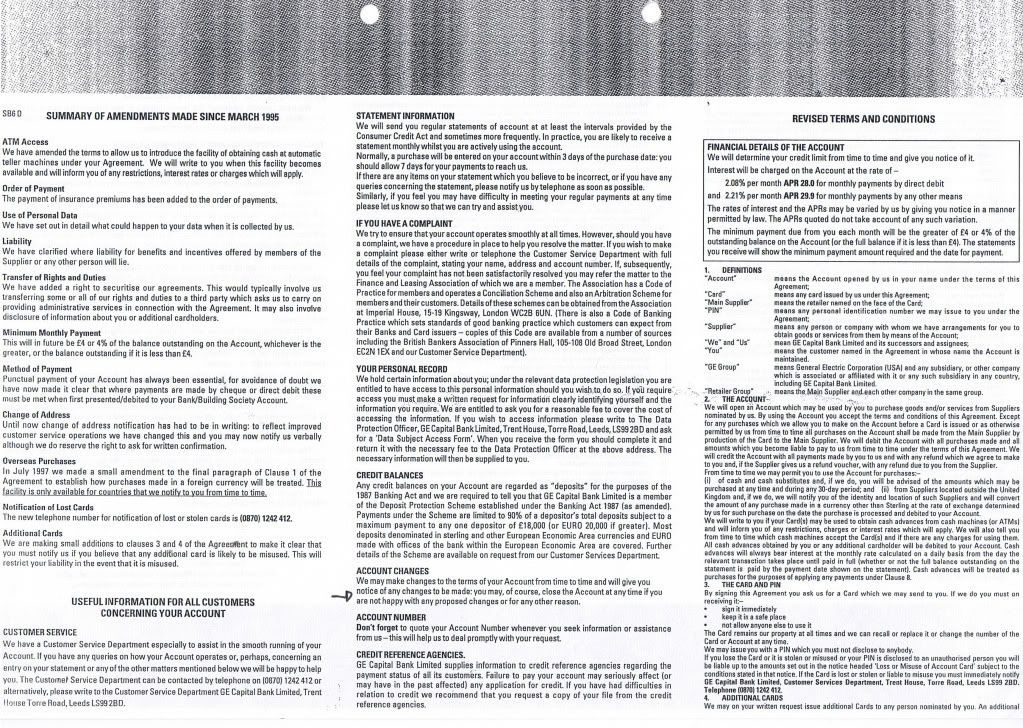

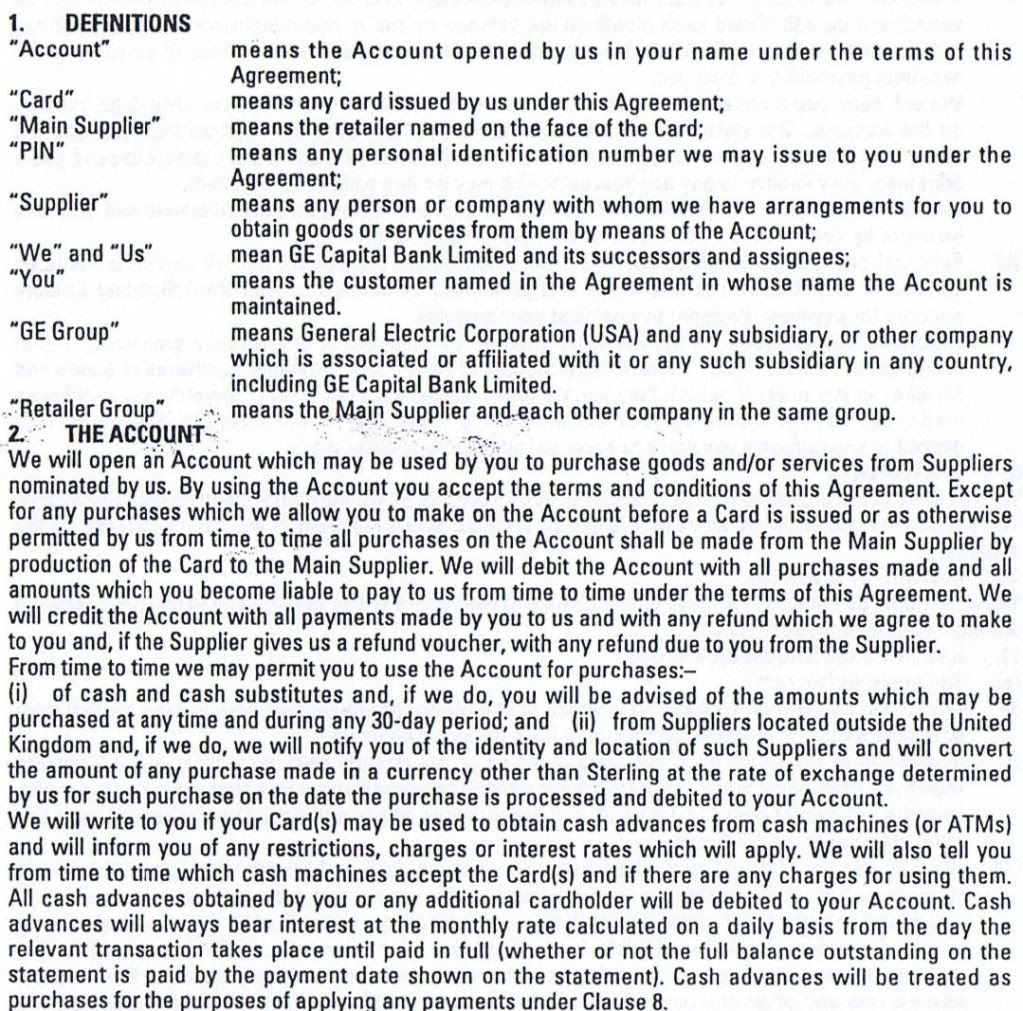

Today...is not a good day ... I was hoping today is D-day. Eiither I owe them money or not but instead I got an adjourned and I have to continue this path and do an amended defense before 7th September for them to reply by 21st September....purely due to the fact they don't bring to the court the "upgrade" T&Cs from store card to credit card.

I do believe there is an element of luck involved as who you get as your DDJ....

Gonna have a cupt tea now & will tell all about it for reference here later....

Hi everybody,

Today...is not a good day ... I was hoping today is D-day. Eiither I owe them money or not but instead I got an adjourned and I have to continue this path and do an amended defense before 7th September for them to reply by 21st September....purely due to the fact they don't bring to the court the "upgrade" T&Cs from store card to credit card.

I do believe there is an element of luck involved as who you get as your DDJ....

Gonna have a cupt tea now & will tell all about it for reference here later....

Comment