Re: CCA unenforceable+I live in Taiwan!

My pleasure Enaid. Maybe I should claim back all the money previously paid on th3 4 accounts. That's what is being advertised by Lawyers now for unenforceable CCAs, claim back every peeny you ever paid.

Mmmmmm....tempting....but that would make me be a bit like a debt collector

My pleasure Enaid. Maybe I should claim back all the money previously paid on th3 4 accounts. That's what is being advertised by Lawyers now for unenforceable CCAs, claim back every peeny you ever paid.

Mmmmmm....tempting....but that would make me be a bit like a debt collector

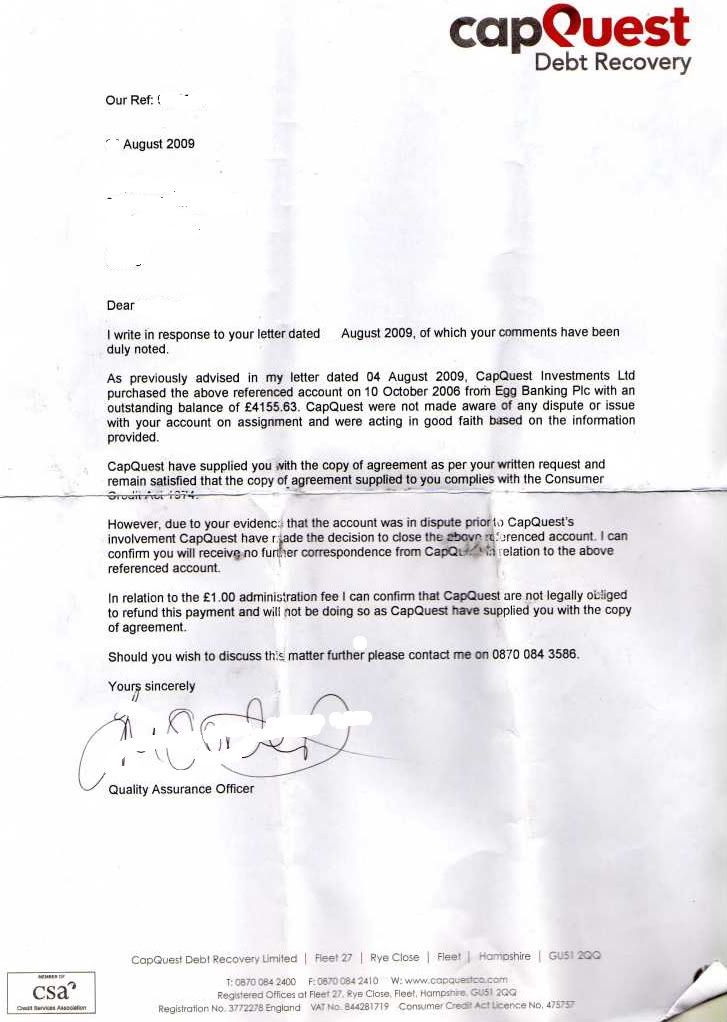

and thank you for posting up the letters and about your case, it will help others a lot.

and thank you for posting up the letters and about your case, it will help others a lot.

Comment