Re: Wonga to pay redress for unfair debt collection practices – FCA - £2.6m to 45k cu

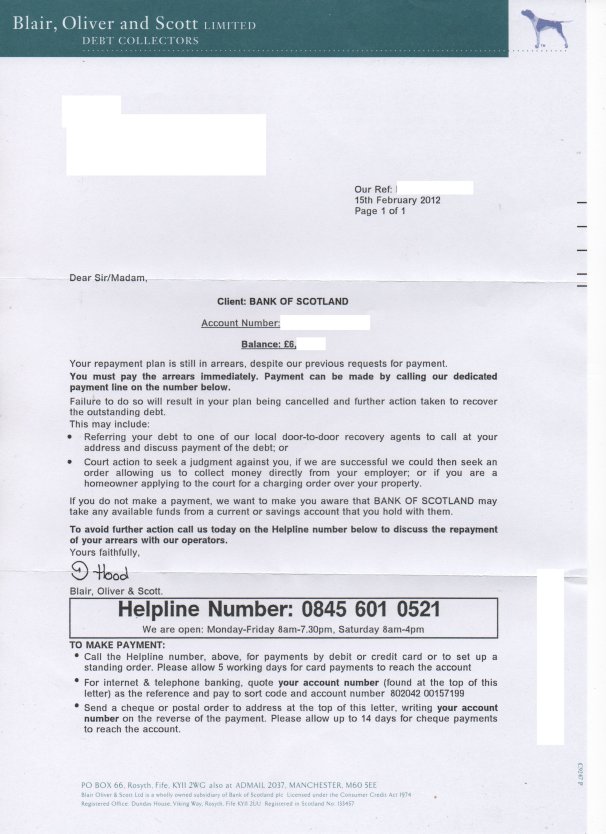

That's interesting! In similar correspondence to me in 2009 they mention court action on behalf of their 'client'!! Note, also, that there is no mention in the letter to me of Blair, Oliver & Scott being a subsidiary, as in the 2012 one above.

Originally posted by Amethyst

View Post

Comment