Hi, apologies if this is in the wrong forum? Your advice would be really appreciated.

I have somehow got myself into a mess with a sub-prime car finance lender called PCF (Private & Commercial Finance Group). I have had a poor credit rating for a couple of years due to two CCJ's that have been present on my record.

Due to this, when looking for car finance this year I used a car finance broker to get me a HP agreement for £22k on a vehicle of which he selected PCF. After 3 months I had to buy another car due to major issues wth the current one. i asked for a redemption figure and everything was in order.

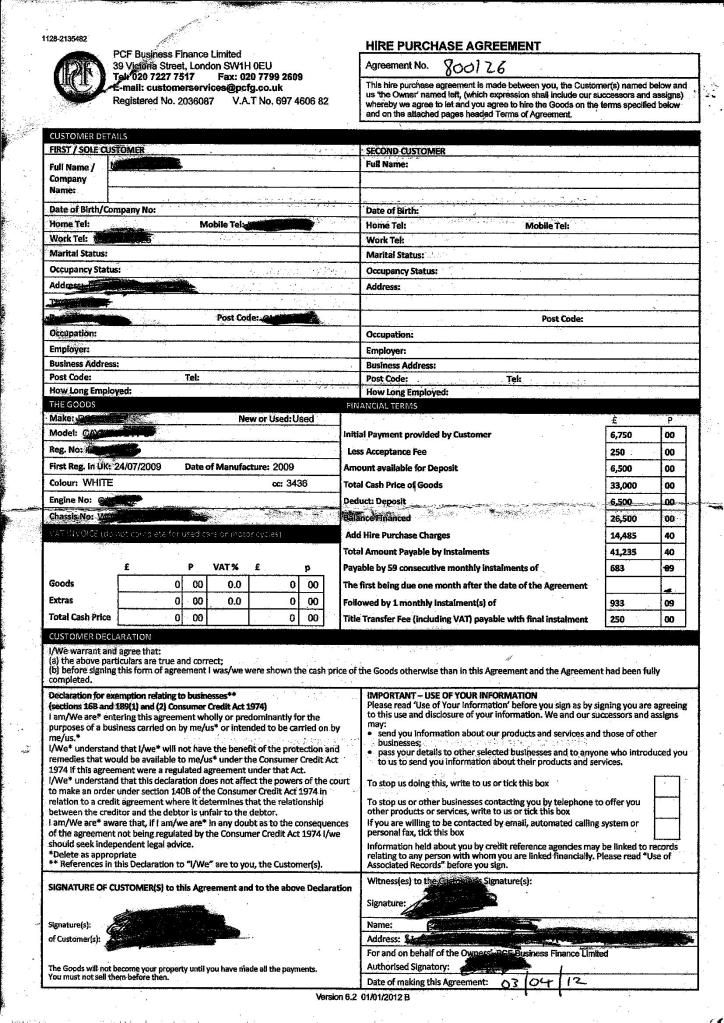

The next car I bought was also financed through them, this time on a 5 year HP agreement. Due to my circumstances the rate was high (20% APR) but I accepted that this was the best i was likely to get and agreed to it after asking the broker if there was possibilities to make overpayment's, no massive early redemption etc. It seemed just like the previous agreement I had, which had only charged me 1 months interest to get out of it early. I trade in my car, put £6k in cash down and take the HP for a further £26k.

Ok, so fast forward 6 months. The reason I mentioned the CCJ's was that I have been pursing the claimant for over two years to get them to agree to the judgments being set aside. Finally they agree and I ask the judge to make an order. The order comes through on the 20/09/12 in my favor. Set aside and case dismissed.

I speak to the broker and say look can we get off this high APR now that my credit score has been fixed? he says yes, no problem, just get a settlement figure and we can start looking at it.

I call PCF yesterday and ask for a settlement figure, they tell me that it's is £37,516.71 That's over £10,000 more than I borrowed.

I call the broker back immediately and he says don't worry there is a mistake and that he'll call them and sort it out. I get a phonecall back today saying, ''sorry! you signed an unregulated agreement and they are charging you 5 years interest''.

I am shocked, seriously just dumbfounded that this can happen? I know i am partly to blame here for not picking this up when i looked through the paperwork but it just seems illegal to be able to do this? Even If I keep the car, it's a depreciating asset so i'll be left with that £11.5k to pay on trade in??

Is there anything I can do? I feel like i've just got my life straight with the CCJ's and now this has smashed me in the face.

I have somehow got myself into a mess with a sub-prime car finance lender called PCF (Private & Commercial Finance Group). I have had a poor credit rating for a couple of years due to two CCJ's that have been present on my record.

Due to this, when looking for car finance this year I used a car finance broker to get me a HP agreement for £22k on a vehicle of which he selected PCF. After 3 months I had to buy another car due to major issues wth the current one. i asked for a redemption figure and everything was in order.

The next car I bought was also financed through them, this time on a 5 year HP agreement. Due to my circumstances the rate was high (20% APR) but I accepted that this was the best i was likely to get and agreed to it after asking the broker if there was possibilities to make overpayment's, no massive early redemption etc. It seemed just like the previous agreement I had, which had only charged me 1 months interest to get out of it early. I trade in my car, put £6k in cash down and take the HP for a further £26k.

Ok, so fast forward 6 months. The reason I mentioned the CCJ's was that I have been pursing the claimant for over two years to get them to agree to the judgments being set aside. Finally they agree and I ask the judge to make an order. The order comes through on the 20/09/12 in my favor. Set aside and case dismissed.

I speak to the broker and say look can we get off this high APR now that my credit score has been fixed? he says yes, no problem, just get a settlement figure and we can start looking at it.

I call PCF yesterday and ask for a settlement figure, they tell me that it's is £37,516.71 That's over £10,000 more than I borrowed.

I call the broker back immediately and he says don't worry there is a mistake and that he'll call them and sort it out. I get a phonecall back today saying, ''sorry! you signed an unregulated agreement and they are charging you 5 years interest''.

I am shocked, seriously just dumbfounded that this can happen? I know i am partly to blame here for not picking this up when i looked through the paperwork but it just seems illegal to be able to do this? Even If I keep the car, it's a depreciating asset so i'll be left with that £11.5k to pay on trade in??

Is there anything I can do? I feel like i've just got my life straight with the CCJ's and now this has smashed me in the face.

Comment