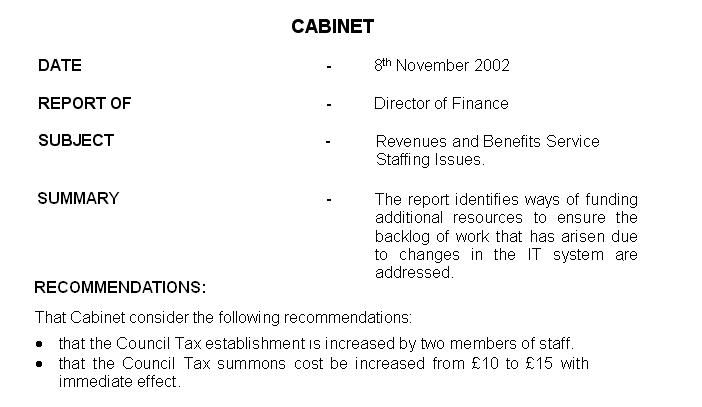

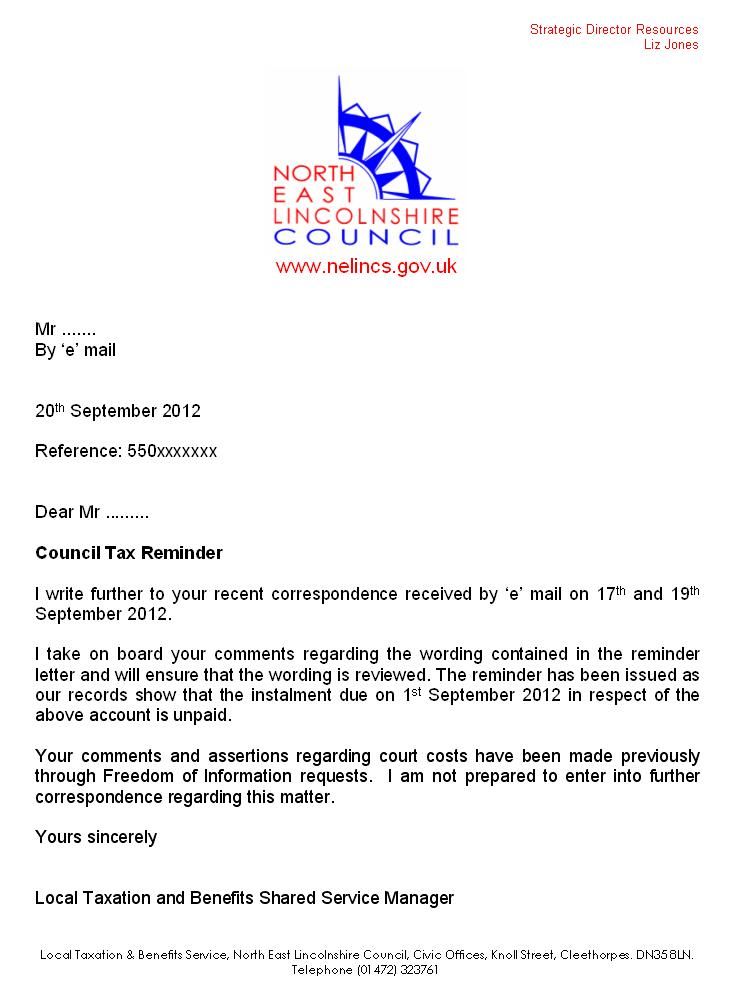

This is what the council commonly refer to as a "first reminder", or what might be considered the first stage in the recovery process leading to a Summons, then a Liability Order granted by the Magistrates' Court if no action is taken as per the instructions.

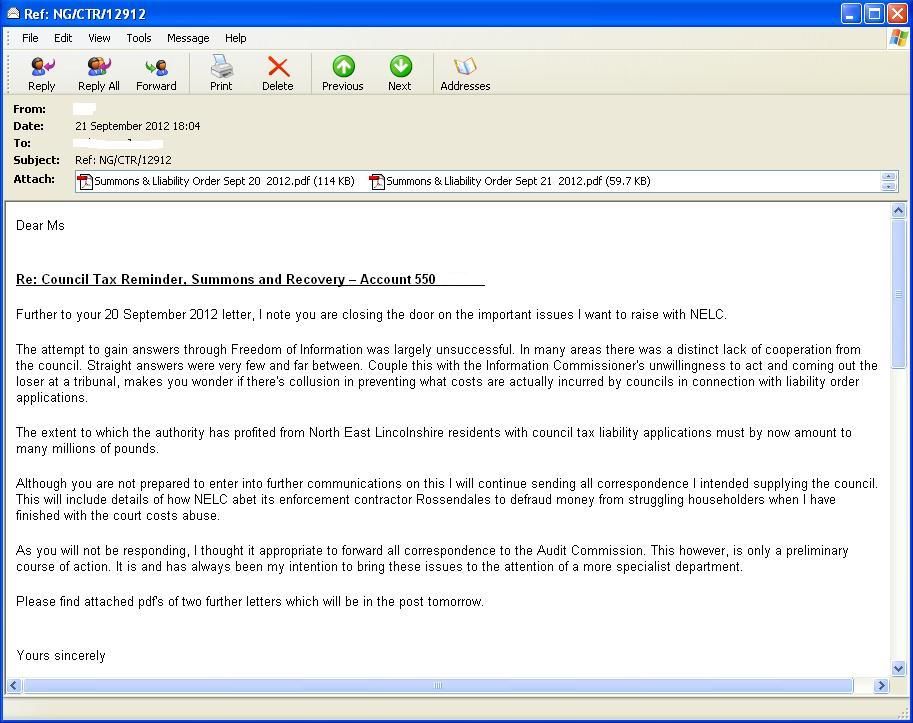

I will, as a test case, be querying this, and subsequent correspondence with the council to try and establish if their procedure, including the imposed costs, are entirely lawful.

The first two items of highlighted text show that this letter has not been dealt with by a member of staff.

It states the taxpayer's sex (Mr), initial and surname, then continues to address the account holder as "Dear Sir or Madam". It then states – third item highlighted:

"It appears from my records....."

This strikes me as an outrageous lie. There has been no member of staff, diligently going through thousands of accounts to find that a council tax instalment has been overlooked. This has been worded in such a way to give an impression that more work is going on, than actually is.

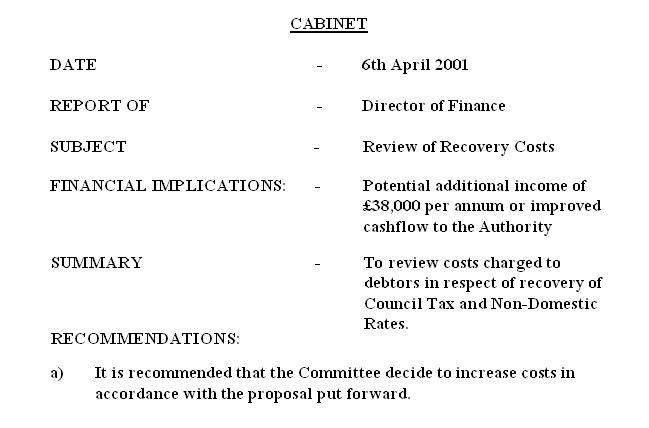

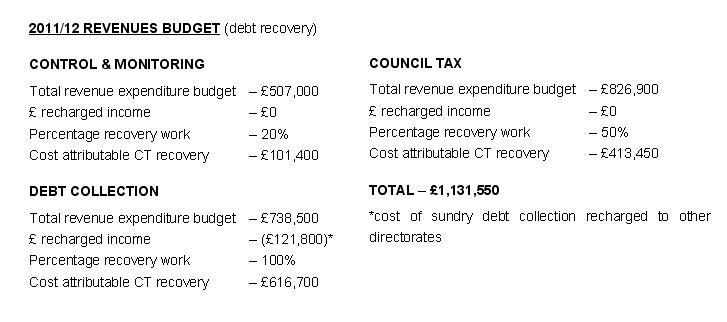

It is understandable that Councils would want to emphasise the effort required in producing these reminders, summonses etc., when "without any further notice being given to you" a summons will be issued, incurring £70 costs. However, the council would have a mammoth task on its hands, if it were ever required to prove that £180,000 or so, was reasonably incurred in respect of one bogus Magistrates' court hearing. This would be a corresponding amount of over two and a half thousand householders incurring £70 summons costs. The point being that the law only allows the authority to charge its residents costs it has reasonably incurred, not make a profit.

The considerations have to be:

These are some of the issues I'm hoping the authority will be able to verify.

I will, as a test case, be querying this, and subsequent correspondence with the council to try and establish if their procedure, including the imposed costs, are entirely lawful.

The first two items of highlighted text show that this letter has not been dealt with by a member of staff.

It states the taxpayer's sex (Mr), initial and surname, then continues to address the account holder as "Dear Sir or Madam". It then states – third item highlighted:

"It appears from my records....."

This strikes me as an outrageous lie. There has been no member of staff, diligently going through thousands of accounts to find that a council tax instalment has been overlooked. This has been worded in such a way to give an impression that more work is going on, than actually is.

It is understandable that Councils would want to emphasise the effort required in producing these reminders, summonses etc., when "without any further notice being given to you" a summons will be issued, incurring £70 costs. However, the council would have a mammoth task on its hands, if it were ever required to prove that £180,000 or so, was reasonably incurred in respect of one bogus Magistrates' court hearing. This would be a corresponding amount of over two and a half thousand householders incurring £70 summons costs. The point being that the law only allows the authority to charge its residents costs it has reasonably incurred, not make a profit.

The considerations have to be:

- Can it be possible for the council to reasonably incur costs of £70? These will be batched with thousands of others in an automated process?

- Is it lawful for a council to impose on a resident, a predetermined amount of costs, before a Magistrate has determined what level of costs should be awarded?

- The Council Tax regulations provide for costs to be added in stages. For example, penalties can be less if an account holder settles what's outstanding in-between when the summons is issued and the court hearing (liability order). This council has front loaded all the costs to the summons stage.

These are some of the issues I'm hoping the authority will be able to verify.

Comment