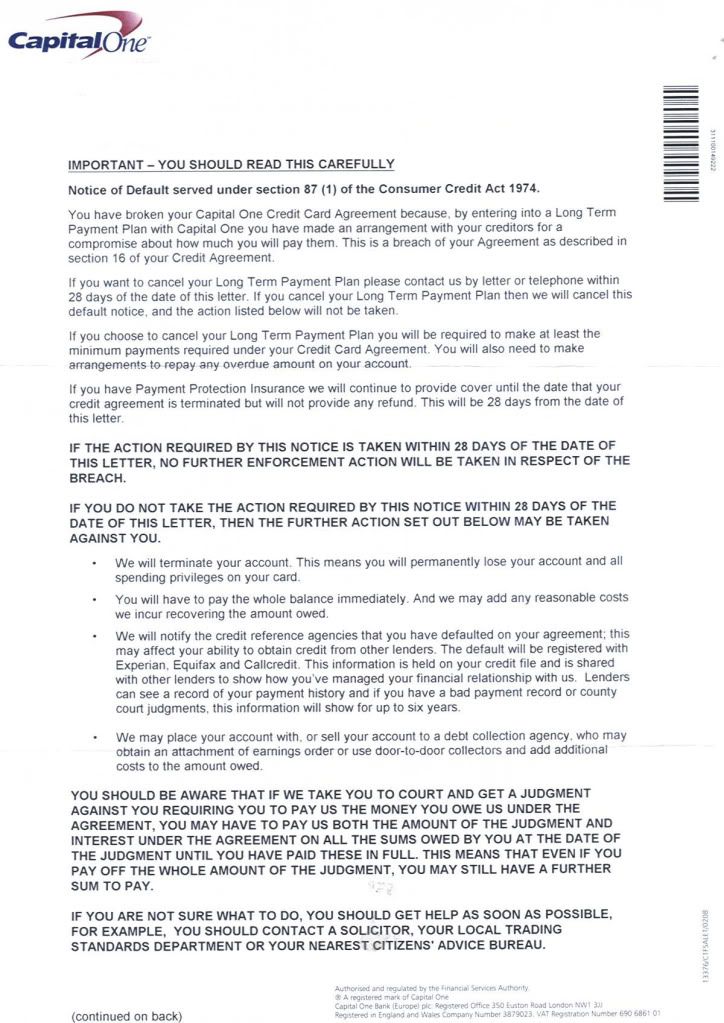

I'm in a payment plan with Cap 1. we are in dispute regarding the mis selling of PPI whch is under investigation by the FOS.

After 4 years, they've recently sent me the following, any ideas as to it legality or why Cap 1 have taken his action after so long

------------------------------- merged -------------------------------

Letter sent in response to the above

After 4 years, they've recently sent me the following, any ideas as to it legality or why Cap 1 have taken his action after so long

------------------------------- merged -------------------------------

Letter sent in response to the above

Dear Mr Banker

Thank you for you letter dated xxxxxxx the contents of which are noted. I remind you that we are in dispute regarding the legitimacy of your charging regime and the mi-selling of Payment Protection Insurance.

To provide further evidence of this dispute, Cap 1 stated in their letter, ref xxxxxxxxx dated xxxxxx that the Financial Ombudsman Service has been in contact regarding their investigation.

I am still awaiting a response from Capital One with regard to my claim of £xxxxxx, as a refund of Payment Protection Insurance.

Capital one is already reporting the status of the account inaccurately and I have asked your Ms Banker to amend this record accordingly. Any negative change to the current status will result in an immediate complaint to my local trading standards officer and the Information Commissioners Office.

Further, with regard to your default notice, you claim I am in breach of s 16 of my credit agreement, I’m afraid the T&Cs I have do not reflect your claim that I have broken my agreement with Cap 1. The s 16 in the T&Cs I have refer to lost or stolen cards and PIN, therefore the default notice you threaten is not legally binding.

If you state the T&Cs I hold are inaccurate then I will of course inform the Information Commissioners Office that you have failed to comply with my date Subject Access Request dated xxxxxxxx for all data on all systems.

Until such time as the dispute is resolved, Office of Fair Trading guidance recommends no enforcement action be taken therefore you may not place any default on my credit report. Please confirm, within 10 days, that no default will be applied to this account until such time as our dispute over Payment Protection Insurance repayments is resolved.

In closing, should you ignore this request I will, lawfully, with hold payments until such time as the Financial Ombudsman Service decides on our dispute. In that case, I would be happy for Capital to test the legality of the agreement in court and in this way we may finally resolve the issue of enforceability.

You may use the email address above to inform me of your intentions regarding your action to place a default on my record.

Yours Sincerely

Thank you for you letter dated xxxxxxx the contents of which are noted. I remind you that we are in dispute regarding the legitimacy of your charging regime and the mi-selling of Payment Protection Insurance.

To provide further evidence of this dispute, Cap 1 stated in their letter, ref xxxxxxxxx dated xxxxxx that the Financial Ombudsman Service has been in contact regarding their investigation.

I am still awaiting a response from Capital One with regard to my claim of £xxxxxx, as a refund of Payment Protection Insurance.

Capital one is already reporting the status of the account inaccurately and I have asked your Ms Banker to amend this record accordingly. Any negative change to the current status will result in an immediate complaint to my local trading standards officer and the Information Commissioners Office.

Further, with regard to your default notice, you claim I am in breach of s 16 of my credit agreement, I’m afraid the T&Cs I have do not reflect your claim that I have broken my agreement with Cap 1. The s 16 in the T&Cs I have refer to lost or stolen cards and PIN, therefore the default notice you threaten is not legally binding.

If you state the T&Cs I hold are inaccurate then I will of course inform the Information Commissioners Office that you have failed to comply with my date Subject Access Request dated xxxxxxxx for all data on all systems.

Until such time as the dispute is resolved, Office of Fair Trading guidance recommends no enforcement action be taken therefore you may not place any default on my credit report. Please confirm, within 10 days, that no default will be applied to this account until such time as our dispute over Payment Protection Insurance repayments is resolved.

In closing, should you ignore this request I will, lawfully, with hold payments until such time as the Financial Ombudsman Service decides on our dispute. In that case, I would be happy for Capital to test the legality of the agreement in court and in this way we may finally resolve the issue of enforceability.

You may use the email address above to inform me of your intentions regarding your action to place a default on my record.

Yours Sincerely

Comment