Around 2007 I had a car repossessed because I couldn't make the payment due to work and marriage problems after the car was sold in auction I received a letter telling what I owed but of course I still couldn't pay the money, 11 years down the line I received a letter from Mortimer Clarke on behave of mfs portfolio saying I was going to be taken to court no details of what for I was going on holiday and just thought they were trying it on because any debt I had in my long past would be status barred, Friday I received a county court money claims center letter so I phoned Mortimer Clarke and asked what it was about and it turned to be the car hp I played a little dumb to this them said surly this would be status barred and they then said no because be there was an order against me in 2008 first I had heard about this but from what I have heard about these people its probably false, I'm really not sure what to do now its for a big amount and my situation is better but I'm i wouldn't say I have much spare cash at the end of the month. Do these people buy debts and would I stand a chance if I appealed

Fake? - MC/MFS Attachment Earnings - 16k - old judgment

Collapse

Loading...

X

-

Re: Mortimer Clarke

First rule don't speak to them on the phone paper trail only.

second they have now issued a claim you need to concentrate and follow the court procedure.

as I said follow the guide in the green boxes as above don't listen to what they say or don't say we will put your account on hold stuff.

you will need to acknowledge the claim with the log in details on the claim for and then intend to defend in full

then exit MCOL and come back on here when you have done the above.This will give you an extra 28 days to do your defence

REMEMBER all they want is a default judgement and if it is statute barred you should have no problem.

there are lots of experienced beagles on here who will give you great advice when submitting your defence

i would take your time and read the guides above send read some concluded cases to give you a idea how it works.

Comment

-

Re: Mortimer Clarke

If they mean that there was a CCJ in 2008, then the matter is res judicataand they then said no because be there was an order against me in 2008CAVEAT LECTOR

This is only my opinion - "Opinions are made to be changed --or how is truth to be got at?" (Byron)

You and I do not see things as they are. We see things as we are.

Cohen, Herb

There is danger when a man throws his tongue into high gear before he

gets his brain a-going.

Phelps, C. C.

"They couldn't hit an elephant at this distance!"

The last words of John Sedgwick

- 1 thank

Comment

-

Re: Mortimer Clarke

I have just read the link so is it likely nothing was done in court in 2008 and is just one of there tactics in a hope I didn't do some researchOriginally posted by charitynjw View PostIf they mean that there was a CCJ in 2008, then the matter is res judicata

- 1 thank

Comment

-

Re: Mortimer Clarke

Thank you for the help. I have just registered to MCOL but I have a problem I don't have a response pack as such so no defense password all I got were a letter with the court hearing details and an expenditure form to fill in and send off. I can't get my head around what I have to do I send the form off to the court and give them my log in details to prove I have registered and state I want the 28 days because I can't go any further on MCOL without some information I don't have at presentLast edited by andrew wilson; 28th August 2016, 21:08:PM.

Comment

-

Re: Mortimer Clarke

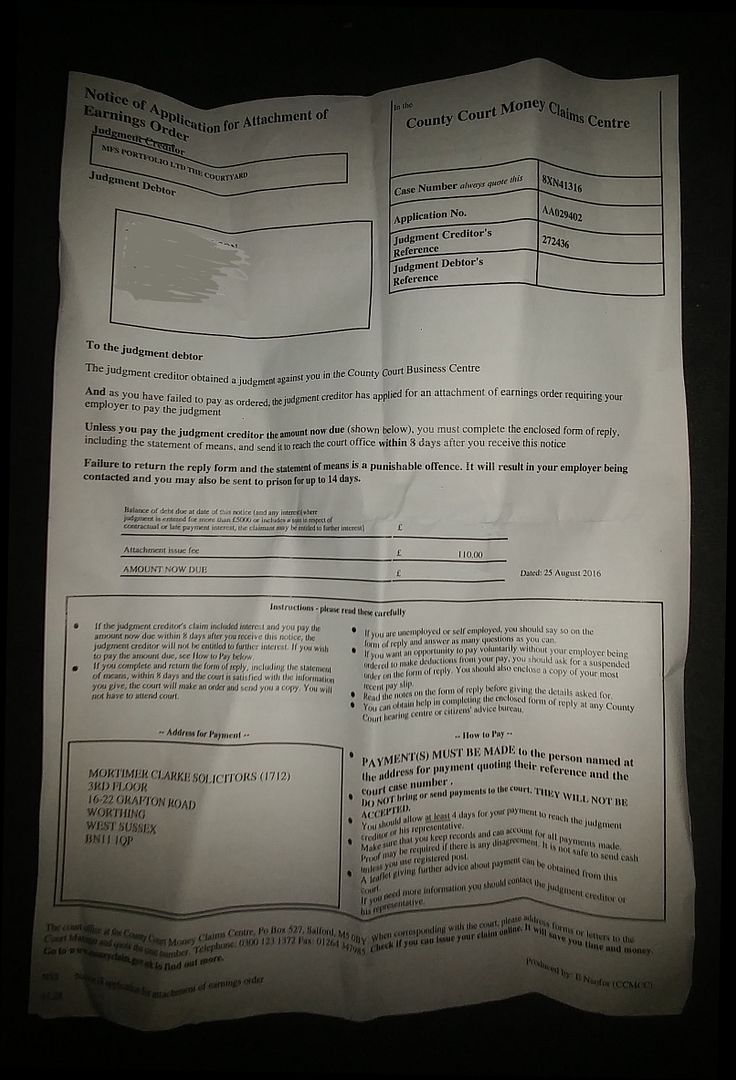

Are you you sure what you've received is a court summons/claim and not something like a court Order for an oral hearing in relation to an Attachment of Earnings for a CCJ obtained in 2008?Originally posted by andrew wilson View PostI don't have a response pack as such so no defense password all I got were a letter with the court hearing details and an expenditure form to fill in and send off.

Possibly not, but without seeing the document you received it's not possible to suggest how you should react to it.

I'm baffled as to why a hearing has been listed before you've even filed your Defence (if this were a routine claim).

Di

- 1 thank

Comment

-

Re: Mortimer Clarke

What sort of letter was that? Could you post it up?Originally posted by andrew wilson View PostAround 2007 I had a car repossessed because I couldn't make the payment due to work and marriage problems after the car was sold in auction I received a letter telling what I owed but of course I still couldn't pay the money, 11 years down the line I received a letter from Mortimer Clarke on behave of mfs portfolio saying I was going to be taken to court no details of what for I was going on holiday and just thought they were trying it on because any debt I had in my long past would be status barred, Friday I received a county court money claims center letter so I phoned Mortimer Clarke and asked what it was about and it turned to be the car hp I played a little dumb to this them said surly this would be status barred and they then said no because be there was an order against me in 2008 first I had heard about this but from what I have heard about these people its probably false, I'm really not sure what to do now its for a big amount and my situation is better but I'm i wouldn't say I have much spare cash at the end of the month. Do these people buy debts and would I stand a chance if I appealed

CCJs don't go statute barred but if the judgment creditor didn't make any attempt at enforcement during the first six years, they cannot enforce it now. A CCJ from 2008 will not be on record either.

- 1 thank

Comment

-

Re: Fake?

Looks legit to me, but best way to tell definitively is to give the court a call and give them the claim ref number ( starting 8XN ) and ask them

If you haven't had anything previously ( ie the court claim etc) then you could apply to set aside the judgment, and put this enforcement action on hold.#staysafestayhome

Any support I provide is offered without liability, if you are unsure please seek professional legal guidance.

Received a Court Claim? Read >>>>> First Steps

Comment

View our Terms and Conditions

LegalBeagles Group uses cookies to enhance your browsing experience and to create a secure and effective website. By using this website, you are consenting to such use.To find out more and learn how to manage cookies please read our Cookie and Privacy Policy.

If you would like to opt in, or out, of receiving news and marketing from LegalBeagles Group Ltd you can amend your settings at any time here.

If you would like to cancel your registration please Contact Us. We will delete your user details on request, however, any previously posted user content will remain on the site with your username removed and 'Guest' inserted.

Announcement

Collapse

1 of 2

<

>

SHORTCUTS

First Steps

Check dates

Income/Expenditure

Acknowledge Claim

CCA Request

CPR 31.14 Request

Subject Access Request Letter

Example Defence

Set Aside Application

Directions Questionnaire

If you received a court claim and would like some help and support dealing with it, please read the first steps and make a new thread in the forum with as much information as you can.

NOTE: If you receive a court claim note these dates in your calendar ...

Acknowledge Claim - within 14 days from Service

Defend Claim - within 28 days from Service (IF you acknowledged in time)

If you fail to Acknowledge the claim you may have a default judgment awarded against you, likewise, if you fail to enter your defence within 28 days from Service.

We now feature a number of specialist consumer credit debt solicitors on our sister site, JustBeagle.com

If your case is over £10,000 or particularly complex it may be worth a chat with a solicitor, often they will be able to help on a fixed fee or CFA (no win, no fee) basis.

2 of 2

<

>

Support LegalBeagles

See more

See less

Court Claim ?

Guides and LettersSHORTCUTS

Pre-Action Letters

First Steps

Check dates

Income/Expenditure

Acknowledge Claim

CCA Request

CPR 31.14 Request

Subject Access Request Letter

Example Defence

Set Aside Application

Witness Statements

Directions Questionnaire

Statute Barred Letter

Voluntary Termination: Letter Templates

A guide to voluntary termination: Your rights

Loading...

Loading...

Comment