Thanks to everybody for their friendship and support

Hello,

I have received a court summons from hfc today. I am in a state of shock and don't know what to do

I was just about to send a letter of complaint to hfc regarding the harrassment calls.

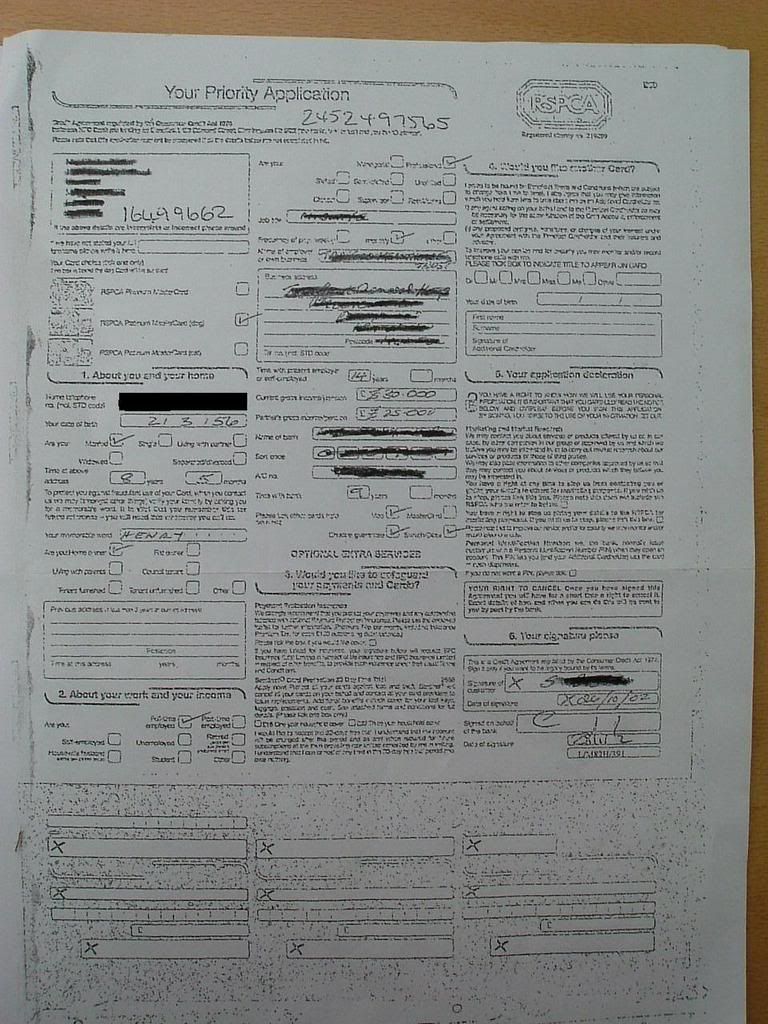

They have sent me a copy of a credit application form which I cannot read as it is so blurred. Can't see if it contains all of the prescibed terms etc.

The have also defaulted on the S.A.R - (Subject Access Request).

Who do I now write to regarding these. hfc or restons or both. I do feel that they are not going to be helpful now.

Please advise, I am truely at a loss

Hello,

I have received a court summons from hfc today. I am in a state of shock and don't know what to do

I was just about to send a letter of complaint to hfc regarding the harrassment calls.

They have sent me a copy of a credit application form which I cannot read as it is so blurred. Can't see if it contains all of the prescibed terms etc.

The have also defaulted on the S.A.R - (Subject Access Request).

Who do I now write to regarding these. hfc or restons or both. I do feel that they are not going to be helpful now.

Please advise, I am truely at a loss

, and where the contractual term is that permits them to apply it and at what rate, how is that justified in relation to their costs etc etc. I would also include in the letter reference to the CCA request not being fulfilled.

, and where the contractual term is that permits them to apply it and at what rate, how is that justified in relation to their costs etc etc. I would also include in the letter reference to the CCA request not being fulfilled. So I go mcol and enter that I will be defending the case. Then do I have 28days to put in my defence to the court?

So I go mcol and enter that I will be defending the case. Then do I have 28days to put in my defence to the court?

Comment