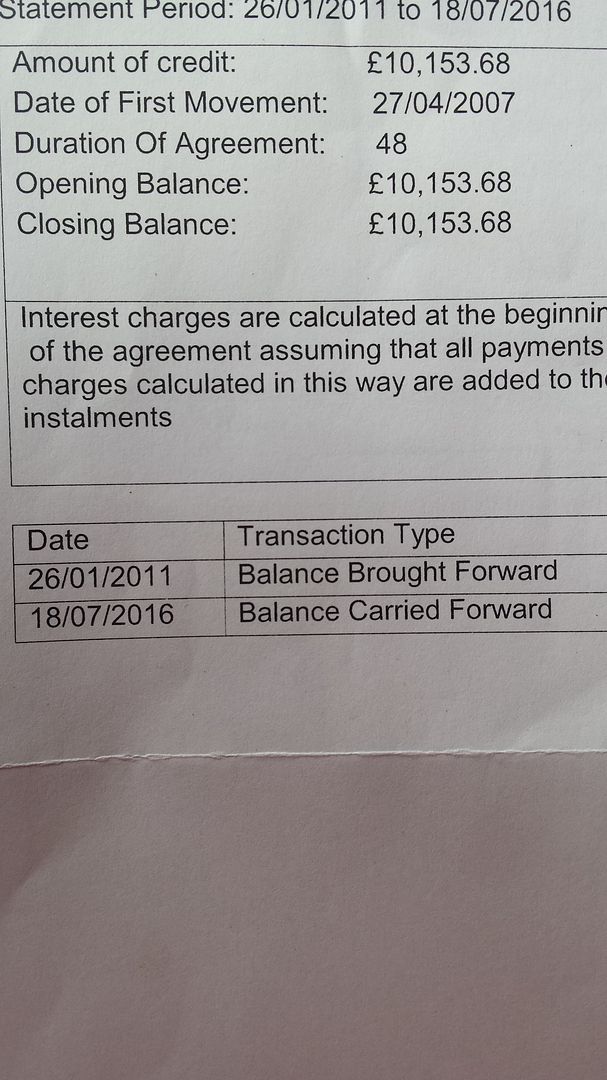

In 2007 we ran into some financial difficulty and defaulted on payments for a car. The car was returned to the dealer but resulted in a debt. Think we had a letter about it shortly after the car went back but nothing after.

We moved house in 2013 and had never had or even acknowledged the debt.

Today we received a letter at our new address about the debt.

So, my question is should this be statute barred and what should I do about it. We have only recently started to claw our way back up on our credit score.

Thanks in advance

We moved house in 2013 and had never had or even acknowledged the debt.

Today we received a letter at our new address about the debt.

So, my question is should this be statute barred and what should I do about it. We have only recently started to claw our way back up on our credit score.

Thanks in advance

Comment