Hi All,

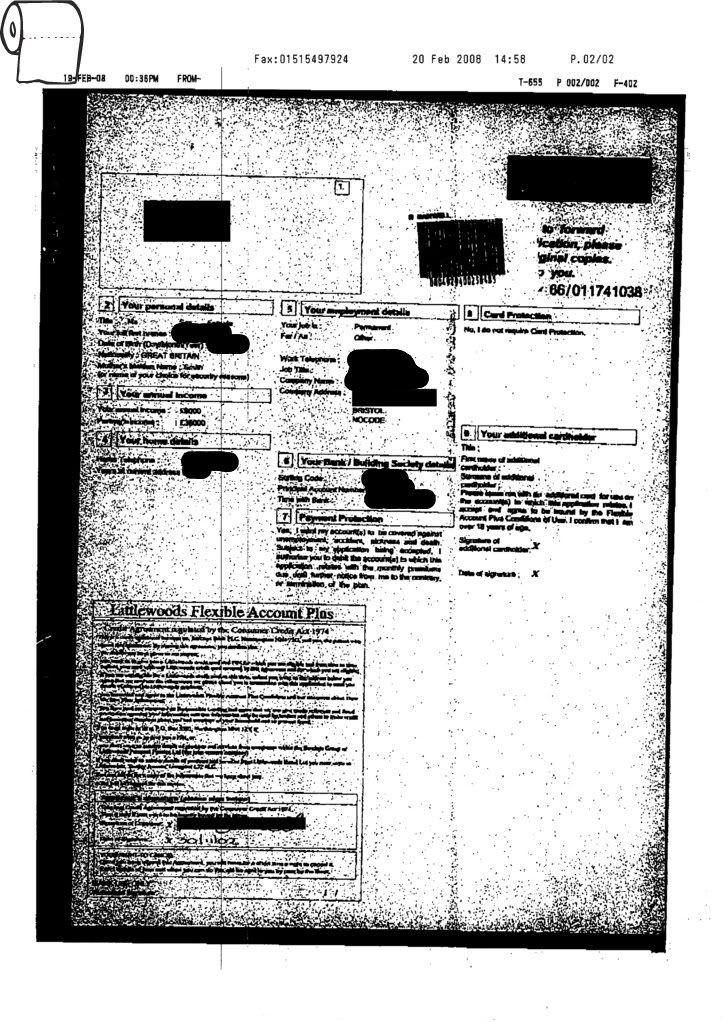

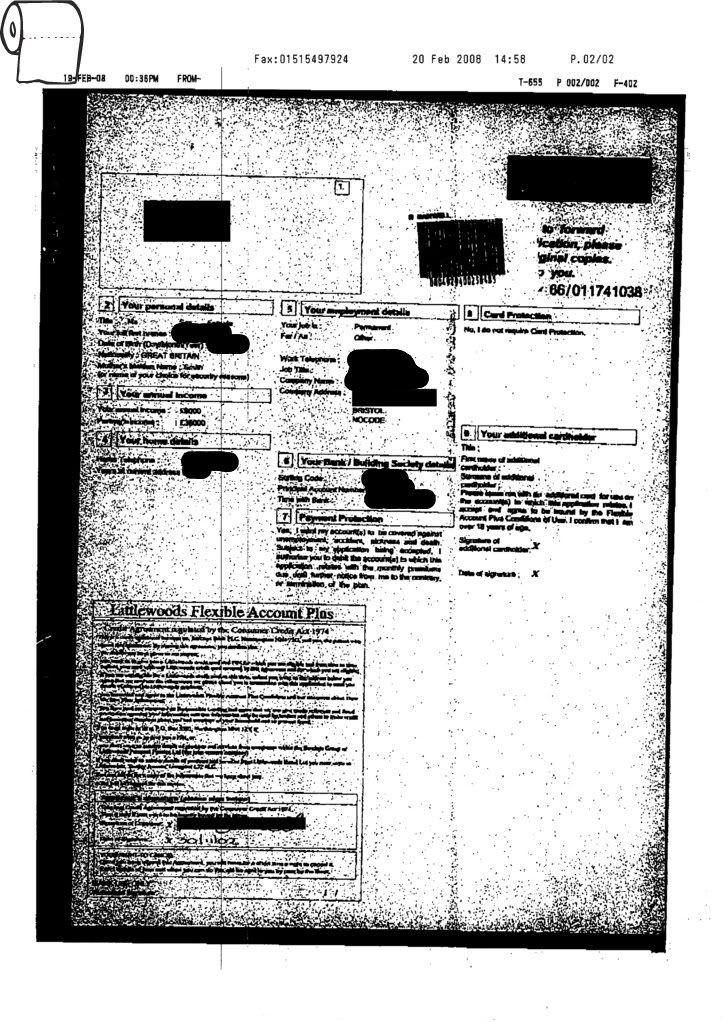

I have been dealing with cabot for a few months now and they have been CCA'd etc. They have sent me an application form and some T&C's:

I responded to these with this:

Account In Dispute

Dear Emma Robertson

Thank you for your letter of 07/03/2008, the contents of which have been noted.

You have failed to respond to my legal request to supply me a true copy of the original Consumer Credit Agreement for the above account.

On 22/06/2007 I made a formal request for a true signed agreement for the alleged account under consumer credit Act 1974 s77/8. A copy of which is enclosed for your perusal and ease of reference.

Mercers have failed to comply with my request, and as such the account entered default on 12/08/2007.

The document that you are obliged to send me is a true copy of the executed agreement that contained all of the prescribed terms, all other required terms and statutory notices and was signed by both Littlewoods and myself as defined in section 61(1) of CCA 74 and subsequent Statutory Instruments. If the executed agreement contained any reference to any other document, you are also obliged to send me a copy of that document. In addition a full statement of this account should have been sent to me detailing all debits and credits to the account.

Furthermore

You are aware that the Consumer Credit Act allows 12 working days for a request for a true copy of a credit agreement to be carried out before your client enters into a default situation.

If that request is not satisfied after a further 30 calendar days your client commits a summary criminal offence.

These limits have expired.

As you are no doubt aware section 77(6) states:

If the creditor fails to comply with Subsection (1)

(a) He is not entitled , while the default continues, to enforce the agreement.

And

(b) If the default continues for one month he commits an offence.

Therefore this account has become unenforceable at law.

As you have Failed to comply with a lawful request for a true, signed copy of the said agreement and other relevant documents mentioned in it, Failed to send a full statement of the account and Failed to provide any of the documentation requested.

Consequentially any legal action you pursue will be averred as both UNLAWFUL and VEXATIOUS.

Furthermore I shall counterclaim that any such action constitutes unlawful harassment.

Please note you may also consider this letter as a statutory notice under section 10 of the Data Protection Act to cease processing any data in relation to this account with immediate effect.

This means you must remove all information regarding this account from your own internal records and from my records with any credit reference agencies.

Should you refuse to comply, you must within 21 days provide me with a detailed breakdown of your reasoning behind continuing to process my data.

It is not sufficient to simply state that you have a ‘legal right’; You must outline your reasoning in this matter and state upon which legislation this reasoning depends.

Should you not respond within 14 days I expect that this means you agree to remove all such data.

Furthermore you should be aware that a creditor is not permitted to take ANY

Action against an account whilst it remains in dispute.

The lack of a credit agreement is a very clear dispute and as such the following applies.

* You may not demand any payment on the account, nor am I obliged to offer any payment to you.

* You may not add further interest or any charges to the account.

* You may not pass the account to a third party.

* You may not register any information in respect of the account with any credit reference agency.

* You may not issue a default notice related to the account.

I reserve the right to report your actions to any such regulatory authorities as I see fit.

You have 14 days from receiving this letter to contact me with your intentions to resolve this matter which is now a formal complaint.

I would appreciate your due diligence in this matter.

I look forward to hearing from you in writing.

Yours faithfully

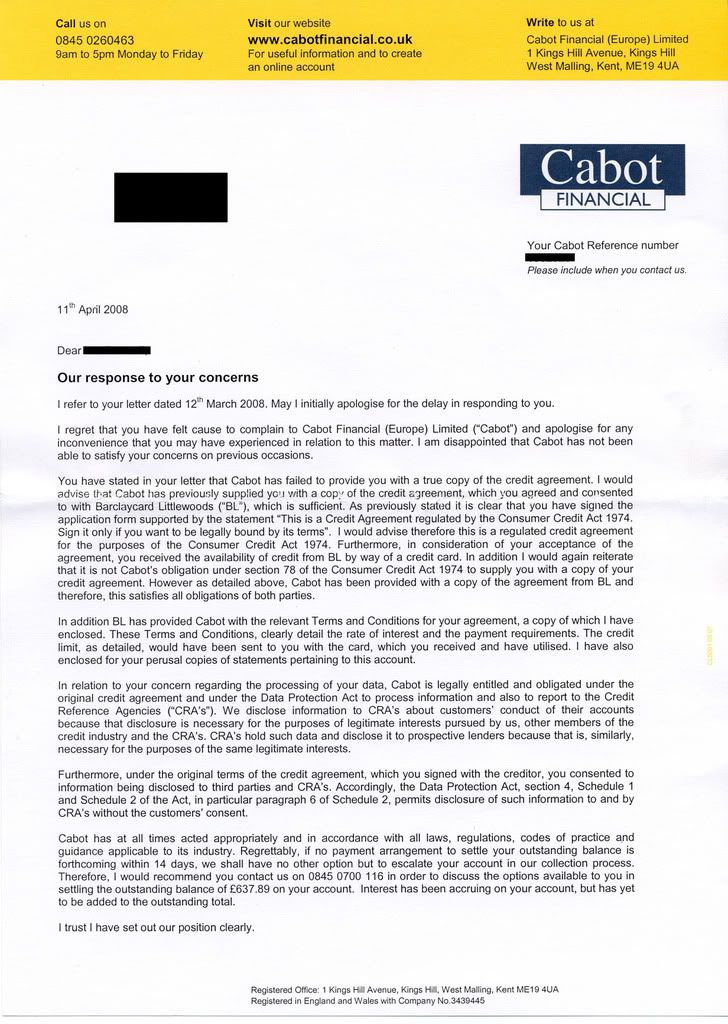

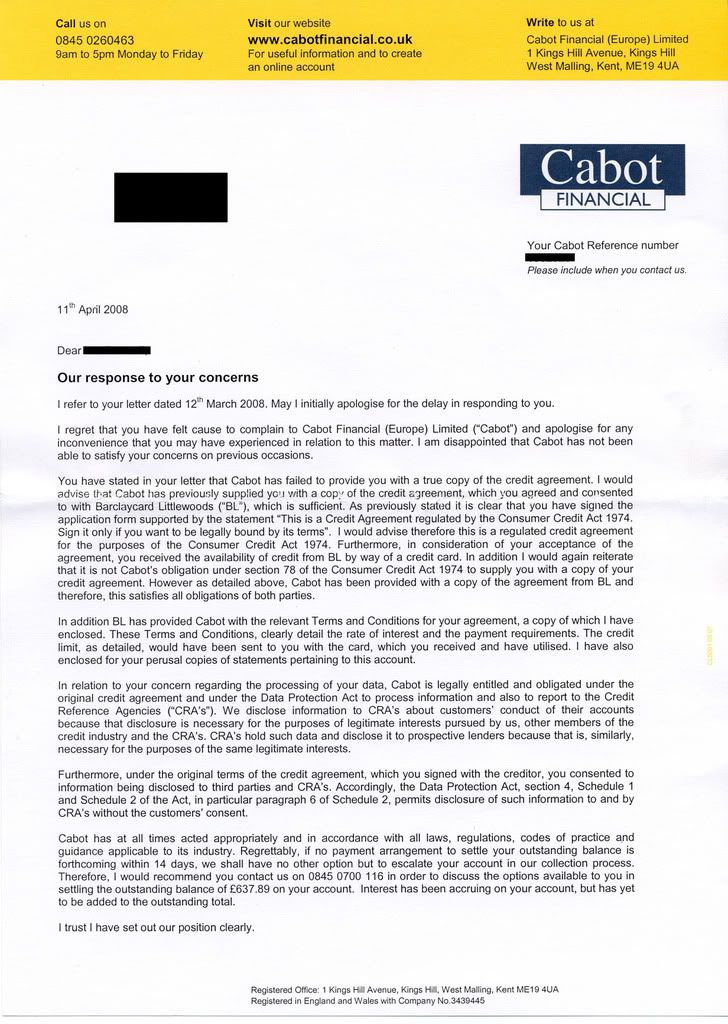

They have now sent the following and I was hoping to find some help replying.

Kind Regards

Bigandy

I have been dealing with cabot for a few months now and they have been CCA'd etc. They have sent me an application form and some T&C's:

I responded to these with this:

Account In Dispute

Dear Emma Robertson

Thank you for your letter of 07/03/2008, the contents of which have been noted.

You have failed to respond to my legal request to supply me a true copy of the original Consumer Credit Agreement for the above account.

On 22/06/2007 I made a formal request for a true signed agreement for the alleged account under consumer credit Act 1974 s77/8. A copy of which is enclosed for your perusal and ease of reference.

Mercers have failed to comply with my request, and as such the account entered default on 12/08/2007.

The document that you are obliged to send me is a true copy of the executed agreement that contained all of the prescribed terms, all other required terms and statutory notices and was signed by both Littlewoods and myself as defined in section 61(1) of CCA 74 and subsequent Statutory Instruments. If the executed agreement contained any reference to any other document, you are also obliged to send me a copy of that document. In addition a full statement of this account should have been sent to me detailing all debits and credits to the account.

Furthermore

You are aware that the Consumer Credit Act allows 12 working days for a request for a true copy of a credit agreement to be carried out before your client enters into a default situation.

If that request is not satisfied after a further 30 calendar days your client commits a summary criminal offence.

These limits have expired.

As you are no doubt aware section 77(6) states:

If the creditor fails to comply with Subsection (1)

(a) He is not entitled , while the default continues, to enforce the agreement.

And

(b) If the default continues for one month he commits an offence.

Therefore this account has become unenforceable at law.

As you have Failed to comply with a lawful request for a true, signed copy of the said agreement and other relevant documents mentioned in it, Failed to send a full statement of the account and Failed to provide any of the documentation requested.

Consequentially any legal action you pursue will be averred as both UNLAWFUL and VEXATIOUS.

Furthermore I shall counterclaim that any such action constitutes unlawful harassment.

Please note you may also consider this letter as a statutory notice under section 10 of the Data Protection Act to cease processing any data in relation to this account with immediate effect.

This means you must remove all information regarding this account from your own internal records and from my records with any credit reference agencies.

Should you refuse to comply, you must within 21 days provide me with a detailed breakdown of your reasoning behind continuing to process my data.

It is not sufficient to simply state that you have a ‘legal right’; You must outline your reasoning in this matter and state upon which legislation this reasoning depends.

Should you not respond within 14 days I expect that this means you agree to remove all such data.

Furthermore you should be aware that a creditor is not permitted to take ANY

Action against an account whilst it remains in dispute.

The lack of a credit agreement is a very clear dispute and as such the following applies.

* You may not demand any payment on the account, nor am I obliged to offer any payment to you.

* You may not add further interest or any charges to the account.

* You may not pass the account to a third party.

* You may not register any information in respect of the account with any credit reference agency.

* You may not issue a default notice related to the account.

I reserve the right to report your actions to any such regulatory authorities as I see fit.

You have 14 days from receiving this letter to contact me with your intentions to resolve this matter which is now a formal complaint.

I would appreciate your due diligence in this matter.

I look forward to hearing from you in writing.

Yours faithfully

They have now sent the following and I was hoping to find some help replying.

Kind Regards

Bigandy

or mine is really bad. I have edited the cca now although none of the details that you could see are current.

or mine is really bad. I have edited the cca now although none of the details that you could see are current.

Comment