Hello.

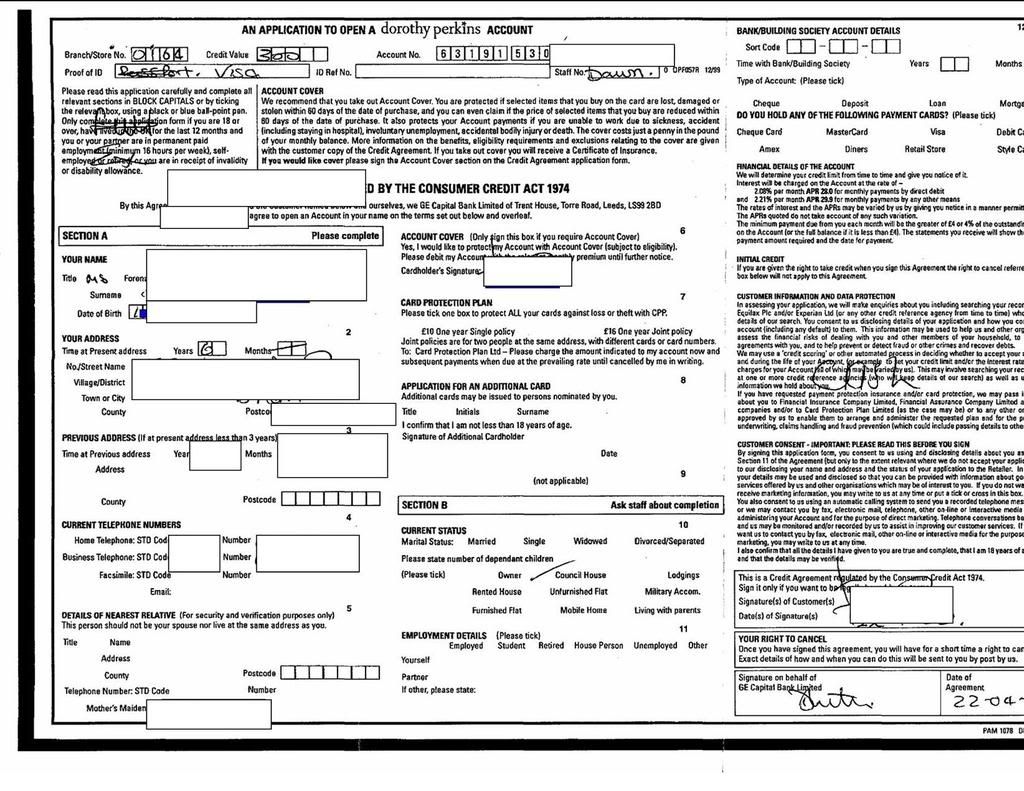

On to my next "problem", This was a store card with Dorothy Perkins.

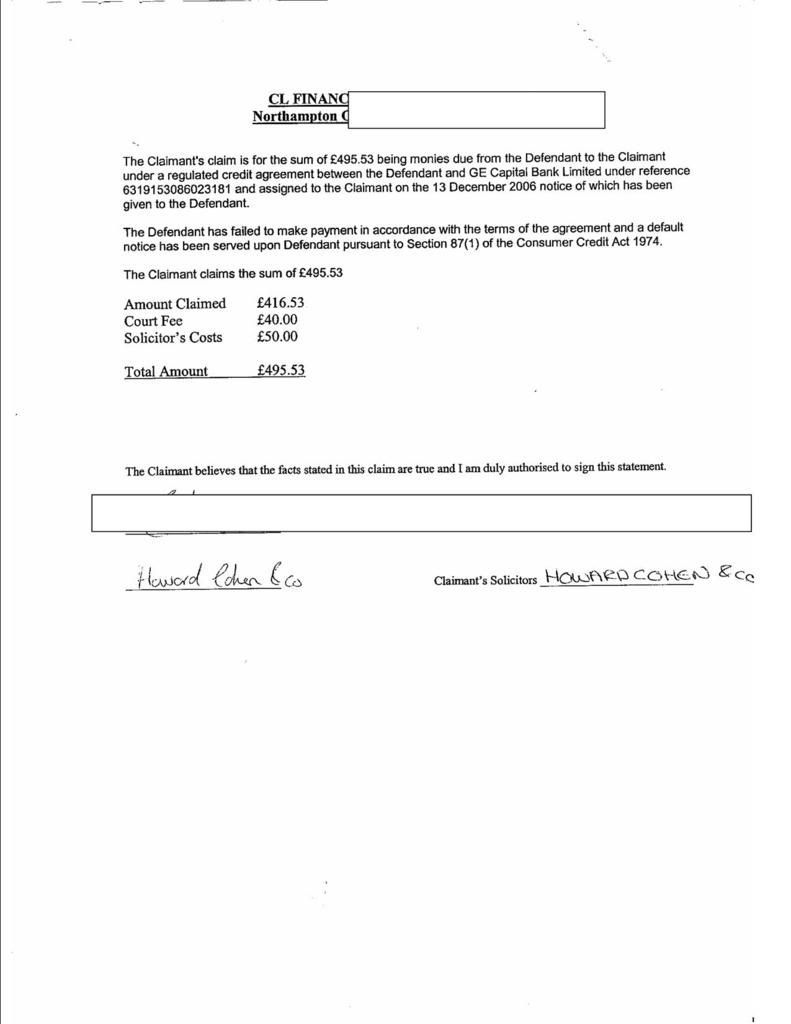

I had been paying £5 pm direct to GE Money and got right down to £400 when it was transferred to CL Finance/Howard Cohen.

I queried the credit agreement as it looked more like an application/agreement.

C L Finance wouldn't budge and issued a court claim. I argued that it contained a couple of late payment charges making their claim wrong.

As it stands at the moment, I had a statement of truth come through yesterday (I gather thats their response to my defence?) So it looks like they are forging ahead with a hearing. Just waiting for a date now I presume.

So, in light of all this, shall I concede and go for offering them £5.00 pm as in my battle with Restons?

Advice/guidance much appreciated as ever

Sara

On to my next "problem", This was a store card with Dorothy Perkins.

I had been paying £5 pm direct to GE Money and got right down to £400 when it was transferred to CL Finance/Howard Cohen.

I queried the credit agreement as it looked more like an application/agreement.

C L Finance wouldn't budge and issued a court claim. I argued that it contained a couple of late payment charges making their claim wrong.

As it stands at the moment, I had a statement of truth come through yesterday (I gather thats their response to my defence?) So it looks like they are forging ahead with a hearing. Just waiting for a date now I presume.

So, in light of all this, shall I concede and go for offering them £5.00 pm as in my battle with Restons?

Advice/guidance much appreciated as ever

Sara

Comment