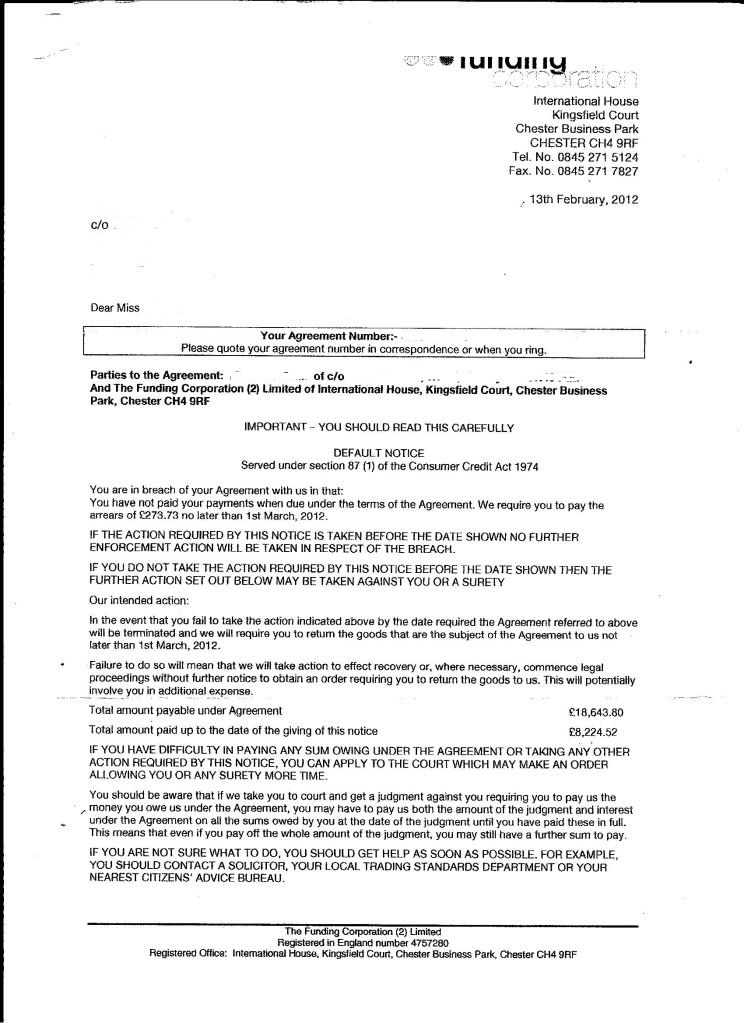

Re: funding corporation

Sorry, I missed that post, Maggott, and just did my calcs entirely separately - so I think we arrived at the same answer by different routes - which is a good 'double-check.'

No, I don't think so, as the £1500 deposit is not included in the TAP - it is not part of the £7000 loan advance itself. But I agree that this could be penalty charges.

I was hoping you and Labman might see some mileage in that. As Labman suggests, unenforceability itself can be a bit of a booby prize, but unlawful repo might give this some legs.

Originally posted by maggott

View Post

No, I don't think so, as the £1500 deposit is not included in the TAP - it is not part of the £7000 loan advance itself. But I agree that this could be penalty charges.

Originally posted by miliitant

View Post

Comment