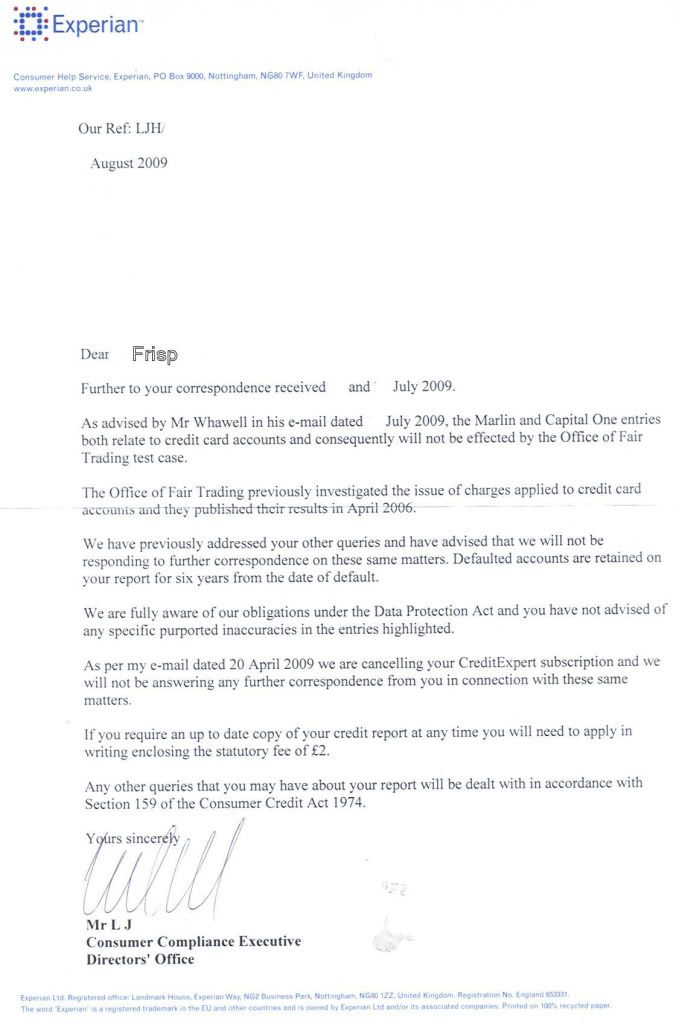

Asked E xperian to remove some inaccurate data on my CR here's their response

Asked them to remove a settled account

With regards to the entry C7, we keep defaulted accounts on your report for six years from the date of default. This is true whether or not the debt has been fully repaid.

Asked them to remove accounts that were not being maintained by the originator

Just because a lender has not updated an account for some time, this does not mean that they are no longer maintaining the account and that it can be removed from your report. It generally means that there simply hasn't been any further payments made towards the outstanding debt and so they have not had to update the account information they send us. If you believe the balances are incorrect on C3 and C15, then please confirm this and I will be happy to contact the lender on your behalf.

Asked them to remove this data as the amounts contained unfair charges set @ c£30, not what has been agreed as the limit for credit cards & potentially what will be decided in the test case

I note your comments about the Marlin and Capital One accounts. However, I would advise that the OFT test case currently in the courts only applies to current accounts and these are both credit card debts.

Any comments on these ludicrous statements welcome

Asked them to remove a settled account

With regards to the entry C7, we keep defaulted accounts on your report for six years from the date of default. This is true whether or not the debt has been fully repaid.

Asked them to remove accounts that were not being maintained by the originator

Just because a lender has not updated an account for some time, this does not mean that they are no longer maintaining the account and that it can be removed from your report. It generally means that there simply hasn't been any further payments made towards the outstanding debt and so they have not had to update the account information they send us. If you believe the balances are incorrect on C3 and C15, then please confirm this and I will be happy to contact the lender on your behalf.

Asked them to remove this data as the amounts contained unfair charges set @ c£30, not what has been agreed as the limit for credit cards & potentially what will be decided in the test case

I note your comments about the Marlin and Capital One accounts. However, I would advise that the OFT test case currently in the courts only applies to current accounts and these are both credit card debts.

Comment