Re: Default Notices: time to remedy

Hi AME,

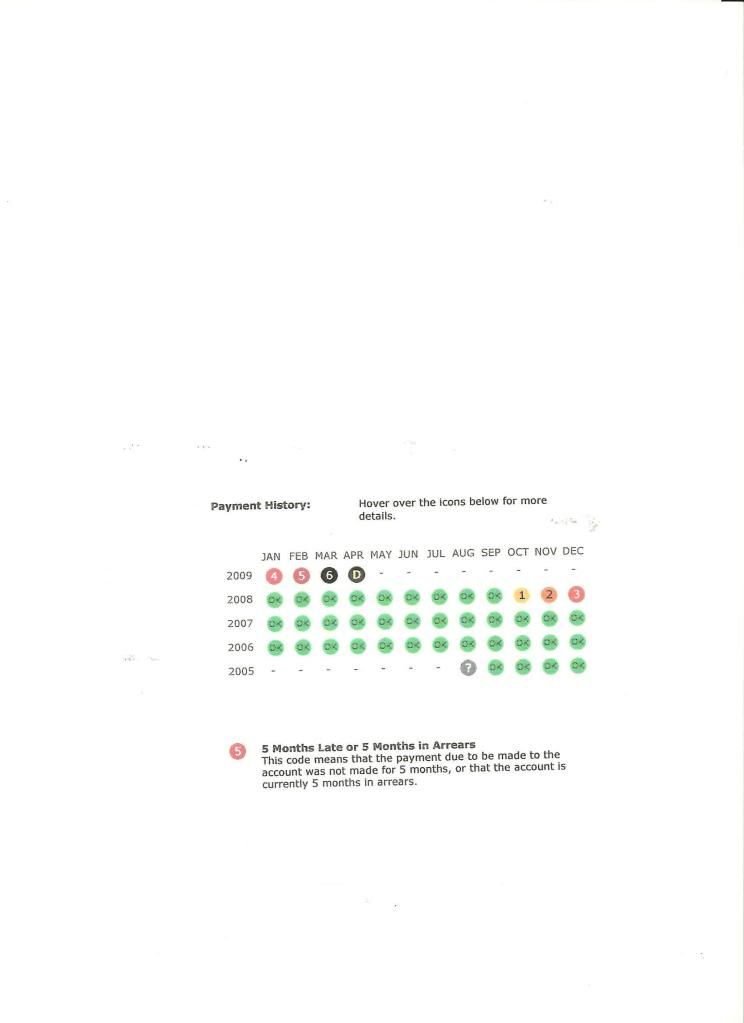

Statements started from Feb 06, as that is what they sent me and this information is only according to them not me. This is for the same account. When I opened my account I was sent a credit card numbers ending in 1234, then in 08 I lost my card for this account and they sent me a new card for the same account but numbers ending in 5678.......see where I am going?

Sig is mine on the recon, but no way was it opened the date it says on the agreement

Originally posted by Amethyst

View Post

Hi AME,

Statements started from Feb 06, as that is what they sent me and this information is only according to them not me. This is for the same account. When I opened my account I was sent a credit card numbers ending in 1234, then in 08 I lost my card for this account and they sent me a new card for the same account but numbers ending in 5678.......see where I am going?

Sig is mine on the recon, but no way was it opened the date it says on the agreement

Comment