Hi all, after some advice - hope this is in the right place!

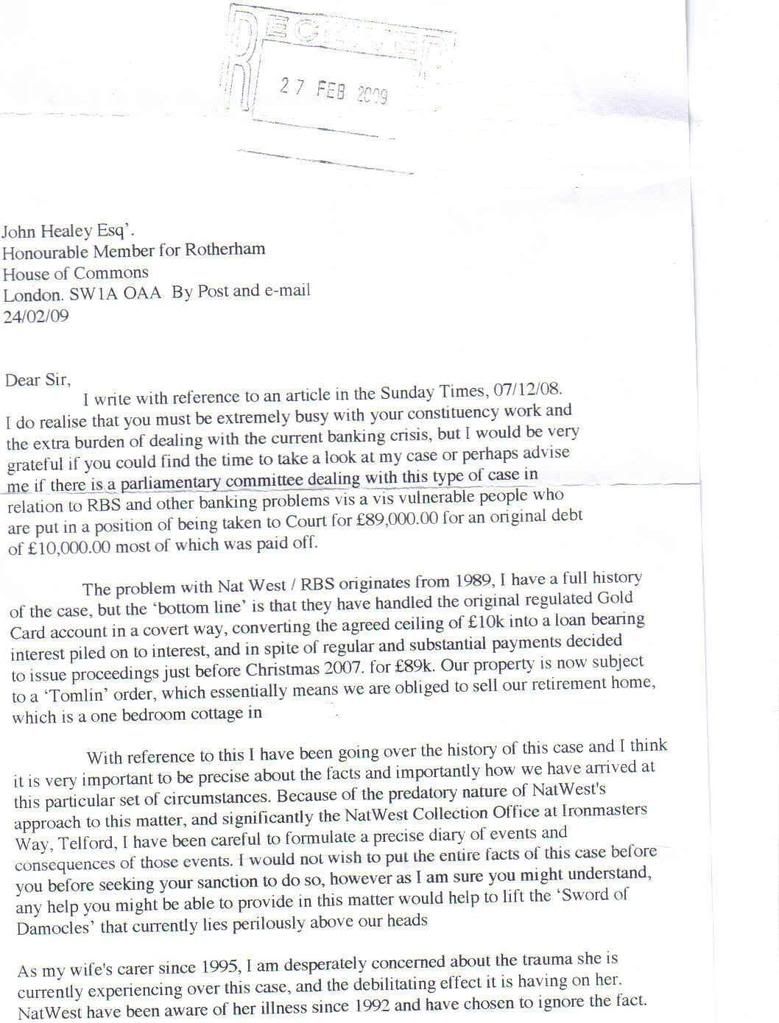

To cut a long story short, years ago I had a gold account with Natwest with a £10k overdraft facility.

Things got tough at the end of the 80's and Natwest decided to transfer the overdraft to a loan, although I was under the overdraft limit. I remember being very angry about it but alot of the ensuing detail eludes me now.

What I do know is that they got a default judgement CCJ against me (my application to have it set aside failed) so for the past 10 years plus, I've been paying £20 a month. The figure at Court was around £14,500.

I have never had any statements, but I seem to remember the debt showing on my credit report files in 2007 at around £25,000.

Really think it's time to extract my head from the sand - I am struggling to find the £20 per month as a (now) single disabled parent with 4 children.

Any help or advice welcome, thanks.

To cut a long story short, years ago I had a gold account with Natwest with a £10k overdraft facility.

Things got tough at the end of the 80's and Natwest decided to transfer the overdraft to a loan, although I was under the overdraft limit. I remember being very angry about it but alot of the ensuing detail eludes me now.

What I do know is that they got a default judgement CCJ against me (my application to have it set aside failed) so for the past 10 years plus, I've been paying £20 a month. The figure at Court was around £14,500.

I have never had any statements, but I seem to remember the debt showing on my credit report files in 2007 at around £25,000.

Really think it's time to extract my head from the sand - I am struggling to find the £20 per month as a (now) single disabled parent with 4 children.

Any help or advice welcome, thanks.

Comment