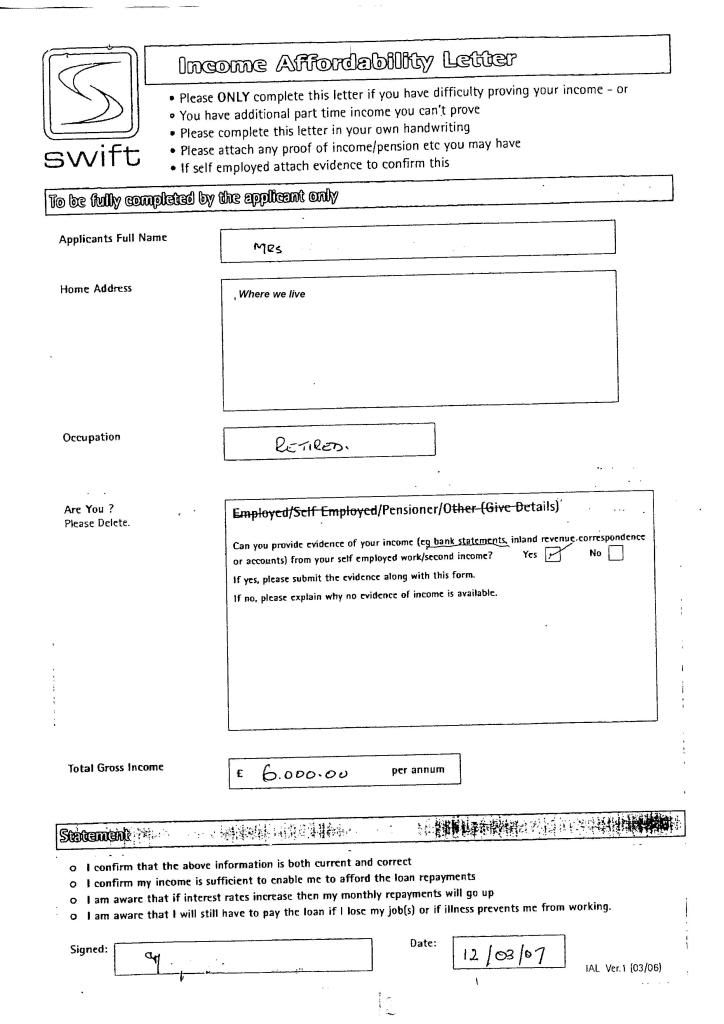

Re: Swift Advances Plc?

I post this for folks to obtain proper legal opinion on with regard to Swift Group Legal Services

Recognised Bodies Regulations

means the SRA Recognised Bodies Regulations updated 2009;

recognised body

means a partnership, company or LLP for the time being recognised by the Solicitors Regulation Authority under section 9 of the Administration of Justice Act 1985 and the Recognised Bodies Regulations

Swift Group Legal Services are not recognised by anyone, ...................and in my opinion any solicitor or barrister who accepts instructions from them involves themselves in a criminal offence in contravention of the Solicitors Code of Conduct and the Bar Code by which Barristers are regulated.

It is agreed that each of the solicitors employed by Swift Group Legal Services hold practicing certificates in their own right but this only covers them to act as a law firm ..........sole practitioners.................. a partnership .....................or an LLP

They are registered with the Law Socity as an "Organisation," I personally would welcome a response and view from any legal "guest" that views this thread ....please register and comment.

Sparkie

This is my personal opinion and belief and proper legal opinion shoud be sought if considering to use this in Defences of repossession proceedings

I post this for folks to obtain proper legal opinion on with regard to Swift Group Legal Services

Recognised Bodies Regulations

means the SRA Recognised Bodies Regulations updated 2009;

recognised body

means a partnership, company or LLP for the time being recognised by the Solicitors Regulation Authority under section 9 of the Administration of Justice Act 1985 and the Recognised Bodies Regulations

Swift Group Legal Services are not recognised by anyone, ...................and in my opinion any solicitor or barrister who accepts instructions from them involves themselves in a criminal offence in contravention of the Solicitors Code of Conduct and the Bar Code by which Barristers are regulated.

It is agreed that each of the solicitors employed by Swift Group Legal Services hold practicing certificates in their own right but this only covers them to act as a law firm ..........sole practitioners.................. a partnership .....................or an LLP

They are registered with the Law Socity as an "Organisation," I personally would welcome a response and view from any legal "guest" that views this thread ....please register and comment.

Sparkie

This is my personal opinion and belief and proper legal opinion shoud be sought if considering to use this in Defences of repossession proceedings

Comment