Re: Swift Advances Plc?

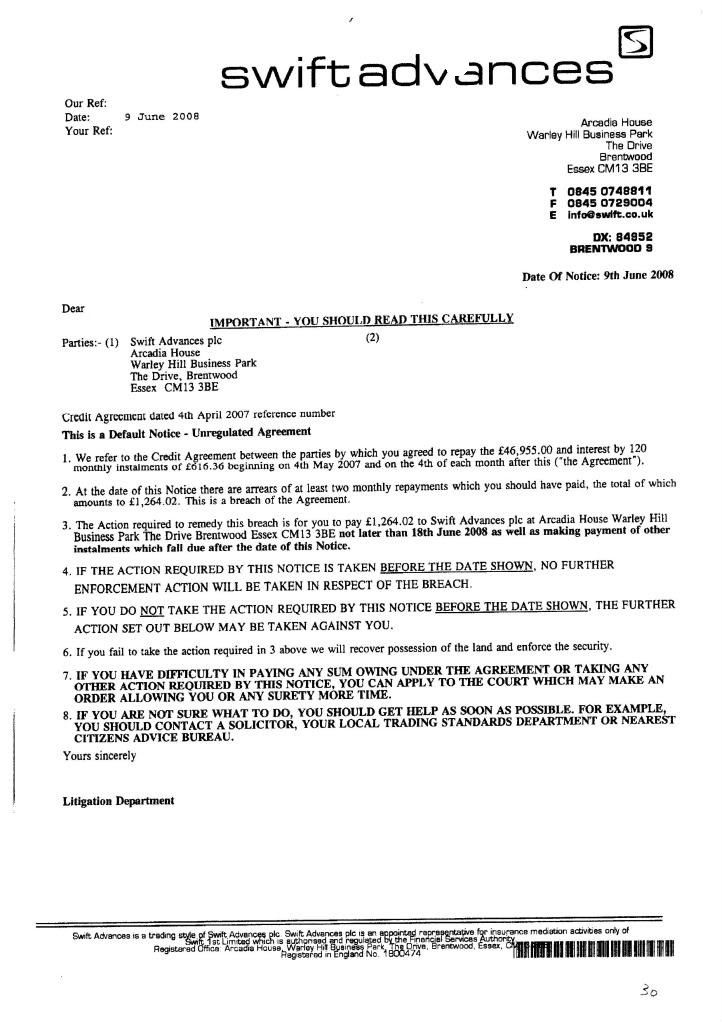

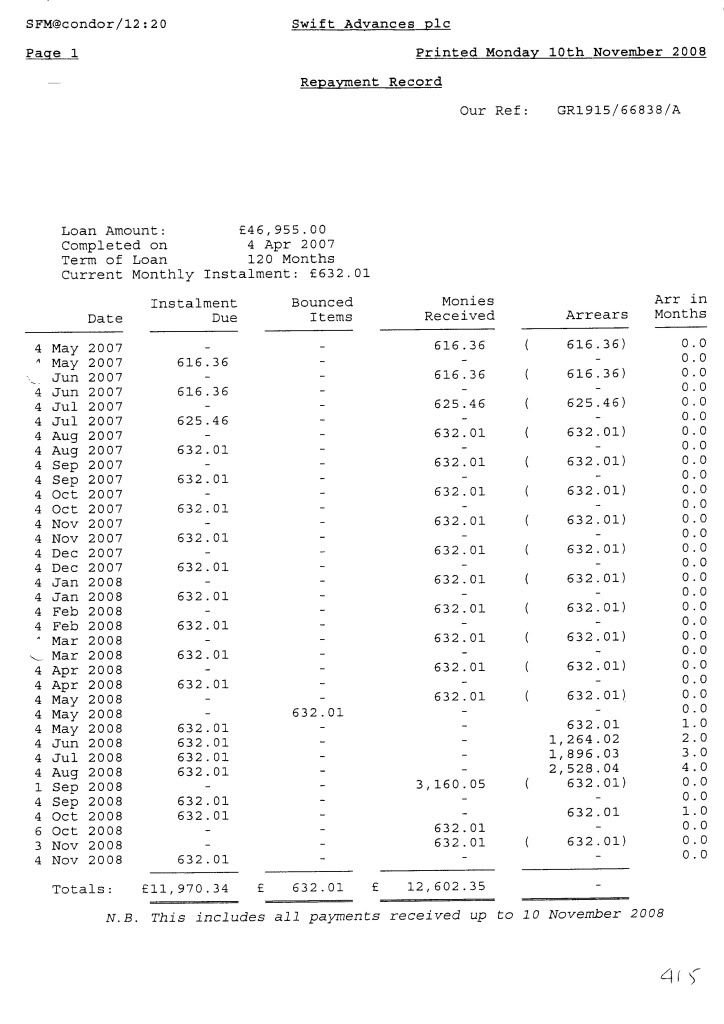

I have been thinking of my options and I have reached the conclusion is the way forward for me is to mount a Unfair Relationship claim under section 140......this way I can use all the evidence I have to support my claim.

So I will be working on that over the next coming weeks, there is a section in it that says;

"Anythingthe creditor has done before the agreement was made during the agreement and EVEN after the agreement has ended"........that part in the favourite words of Swift Advances plc is "irrellevant"..........That way I can include as many statutes as I think would apply within that Unfair Relationship claim.

Another section says inas much "Anything the debtor alleges it is up to the creditor to prove him wrong"

For instacee

Refusing to supply information I am legally entitled to under sectrion 3 of the New FRaud Act is Unfair

They would have to prove it was not unfair

Comments anyone please

Sparkie

I have been thinking of my options and I have reached the conclusion is the way forward for me is to mount a Unfair Relationship claim under section 140......this way I can use all the evidence I have to support my claim.

So I will be working on that over the next coming weeks, there is a section in it that says;

"Anythingthe creditor has done before the agreement was made during the agreement and EVEN after the agreement has ended"........that part in the favourite words of Swift Advances plc is "irrellevant"..........That way I can include as many statutes as I think would apply within that Unfair Relationship claim.

Another section says inas much "Anything the debtor alleges it is up to the creditor to prove him wrong"

For instacee

Refusing to supply information I am legally entitled to under sectrion 3 of the New FRaud Act is Unfair

They would have to prove it was not unfair

Comments anyone please

Sparkie

Comment