Hi all

I took out a secured loan with Welcome Finance in 2005. Soon after i lost my business and got into difficulties. I ended up with CCCS for some unsecured loans and credit cards. I moved into rented accommodation and put my house on the market. However the house didn't sell for 6 months and i had to drop the price. In the end the house sold for more than the mortgage but not enough to pay off the secured loan as well. As i was then in areas with my mortgage the Halifax wanted to sell and it went through. After the Halifax had taken my areas and early payment fees they gave £1750 to Welcome.

This is where the problems started. I tried to continue paying Them my payment but they kept saying they couldnt find my details as my account was being sent from the branch to head office and was in the middle somewhere so was not showing on either system. This went on for months every time i tried to make a payment. Eventually they started phoning my father who i had not used as a garantuor but only as a reference. He didnt give them any infomation as he thought it might be a scam but when i tried they could not find any record of me.

Eventually someone rang me and thought my house had been repossessed. I told them we had sold it and he said the loan was now an unsecured loan. We added it to CCCS and paid them £90 a month. This has been going along fine until this month. We have stopped using CCCS as they were paying some payments late and it is easier for us to pay the creditors direct. We agreed with them all that we could pay the same amount but we would pay direct.

Now Welcome are saying they want the original paymet of £280 a month hich we cannot afford. They have also told me that my account

balance is £19500. We only borrowed £15000 and we were paying £280 a month before the problems started. Then they had £1750 from

the house sale and £90 a month for 18 months. We owe £4500 than we originally borrowed.

They also said we do not have an unsecured agreeement with them at the moment and we need to sign one. Im not sure if i should and

would be grateful for any advice.

I would like to just carry on paying them £90 a month and pay the balance down but it has actually been going up for the last 3 years.

I would appreciate any advice on this matter and would like to know where i stand legally now the secured asset has been sold and

i dont have a credit agreement.

I sent the SAR letter off to Welcome along with a postal order which they received on the 30/10/08.

On the 14/11/08 i received a short statement of my account from the beginning. However this just shows money as a credit or debit. There are £10 debits going out all over the place. Also every time i paid £97 through CCCS they have added £285 in interest. At this rate i am just owing more and more. They have not sent me a copy of my agreement or anything else.

They do however keep asking me to sign a new loan agreement every time i ring to make a payment.

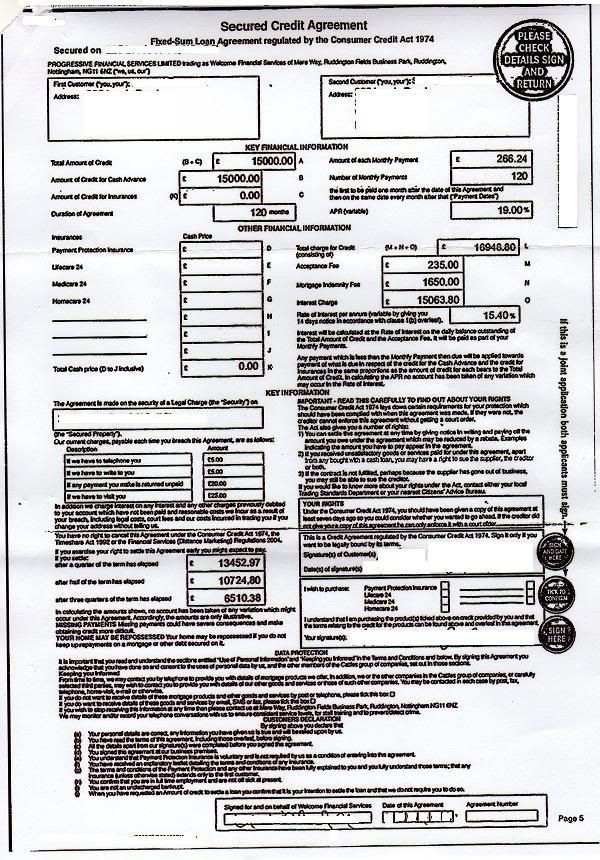

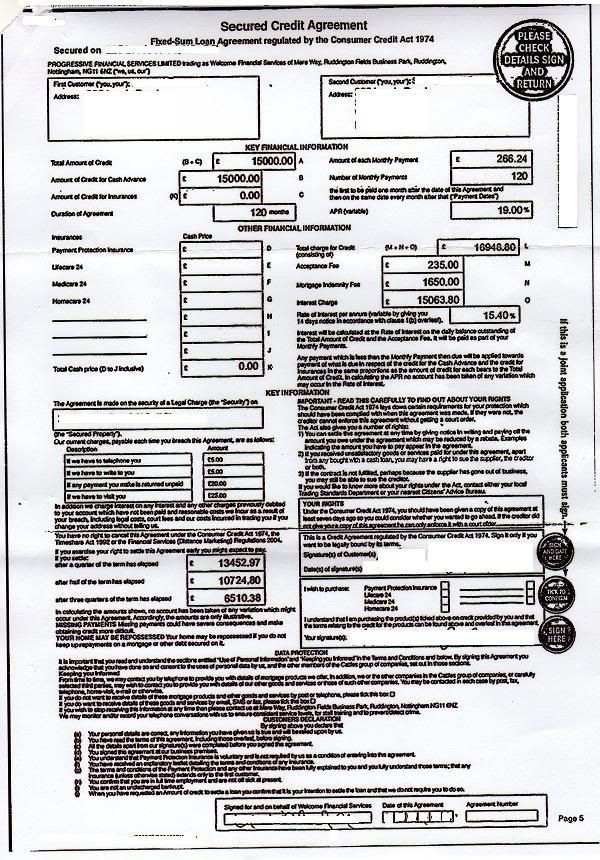

Then i received my agreement

Could someone tell me if this is enforceable? This is all they sent me though despite this sheet saying it is sheet 5. It was in response to an SAR so surely i should have got more. There are numerous charges on my statement so shouldnt i have been sent copies of all letters sent to me in the past?

As i have said this loan has now become unsecured as the property has been sold. I would like to know what my legal situation is as this is a secured agreement and i have not seen anything that tells me the new terms and conditions.

Regards

Felix

I took out a secured loan with Welcome Finance in 2005. Soon after i lost my business and got into difficulties. I ended up with CCCS for some unsecured loans and credit cards. I moved into rented accommodation and put my house on the market. However the house didn't sell for 6 months and i had to drop the price. In the end the house sold for more than the mortgage but not enough to pay off the secured loan as well. As i was then in areas with my mortgage the Halifax wanted to sell and it went through. After the Halifax had taken my areas and early payment fees they gave £1750 to Welcome.

This is where the problems started. I tried to continue paying Them my payment but they kept saying they couldnt find my details as my account was being sent from the branch to head office and was in the middle somewhere so was not showing on either system. This went on for months every time i tried to make a payment. Eventually they started phoning my father who i had not used as a garantuor but only as a reference. He didnt give them any infomation as he thought it might be a scam but when i tried they could not find any record of me.

Eventually someone rang me and thought my house had been repossessed. I told them we had sold it and he said the loan was now an unsecured loan. We added it to CCCS and paid them £90 a month. This has been going along fine until this month. We have stopped using CCCS as they were paying some payments late and it is easier for us to pay the creditors direct. We agreed with them all that we could pay the same amount but we would pay direct.

Now Welcome are saying they want the original paymet of £280 a month hich we cannot afford. They have also told me that my account

balance is £19500. We only borrowed £15000 and we were paying £280 a month before the problems started. Then they had £1750 from

the house sale and £90 a month for 18 months. We owe £4500 than we originally borrowed.

They also said we do not have an unsecured agreeement with them at the moment and we need to sign one. Im not sure if i should and

would be grateful for any advice.

I would like to just carry on paying them £90 a month and pay the balance down but it has actually been going up for the last 3 years.

I would appreciate any advice on this matter and would like to know where i stand legally now the secured asset has been sold and

i dont have a credit agreement.

I sent the SAR letter off to Welcome along with a postal order which they received on the 30/10/08.

On the 14/11/08 i received a short statement of my account from the beginning. However this just shows money as a credit or debit. There are £10 debits going out all over the place. Also every time i paid £97 through CCCS they have added £285 in interest. At this rate i am just owing more and more. They have not sent me a copy of my agreement or anything else.

They do however keep asking me to sign a new loan agreement every time i ring to make a payment.

Then i received my agreement

Could someone tell me if this is enforceable? This is all they sent me though despite this sheet saying it is sheet 5. It was in response to an SAR so surely i should have got more. There are numerous charges on my statement so shouldnt i have been sent copies of all letters sent to me in the past?

As i have said this loan has now become unsecured as the property has been sold. I would like to know what my legal situation is as this is a secured agreement and i have not seen anything that tells me the new terms and conditions.

Regards

Felix

Comment