Hi

I am hoping my situation is sorted out, but I am just looking for help incase it isn't

So back at the beginning of the year we had some financial issues and my Grandmother was also very ill and I forgot/couldn't make payments on my CT.

I received a letter some months ago telling me the council were taking me to court, I wasn't able to attend as I was unable to get there ( they had not used my local court which is 10miles away from me but one that is nearly 55miles!)and I had no childcare for my toddler, who doesn't travel well let alone for 55miles.

I contacted the court and they said I didn't have to attend and they would send me a letter with the decision.

Received a letter saying a liability order had been issued for the full amount of £815.

I then had visits from Rossendales, I turned them away as I didn't wish to deal with them (didn't and wont let them in ) I relented and sent a letter in an attempt to sort it with Rossendales and offered them £50 per month to be paid on the 15th of every month or nearest business day (my partner gets paid on the 15th and it is when all our bills are paid) which they basically refused unless they could come into my home and levy goods (which I told their agent wouldn't be happening)

During this time my Grandmother was progressively getting worse and was permanently in hospital,October 3rd she passed away which has been very hard to cope with.

I recently made a last ditch attempt with the council, I explained my situation,told them I was willing to pay but Rossendales had refused my offer and asked them to take back the debt as I didn't need the distress of dealing with bailiffs. They pretty much refused and told me I had had a chance to sort it with them, apparently there was a form with the summons or liability letter to set up installments etc, I can 100% say there wasn't a form!I would've filled it in and sent it back asap had there been.

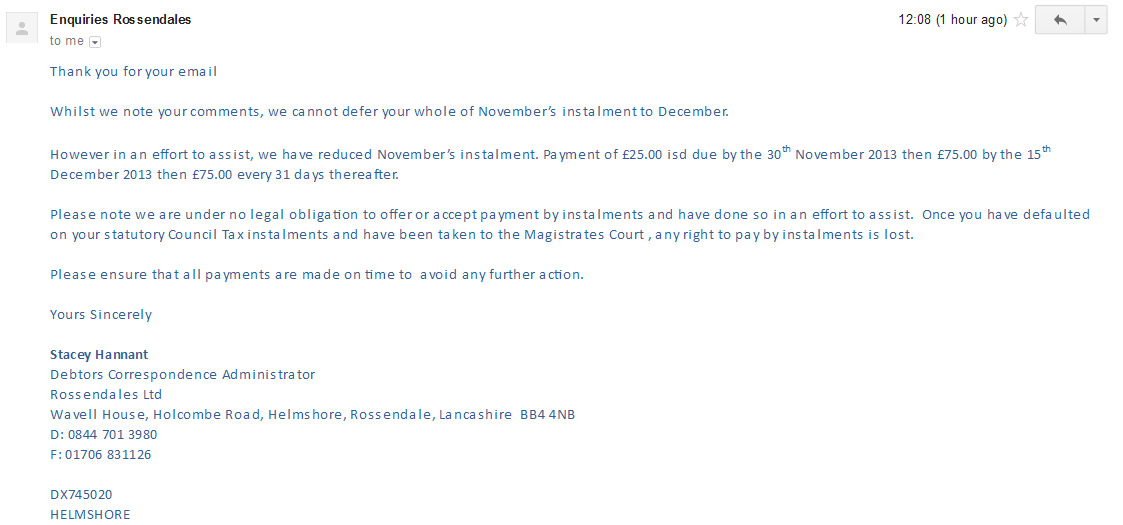

So anyway they must have contacted Rossendales as I received a letter yesterday (23rd) saying they had accepted my installments and I had to make a payment on or before 26th November!So 3 days notice to make payment! I have emailed Rossendales and asked them to move the date to the 15th and have offered to pay more than I originally offered as I have finished paying of an HP, I explained its to short notice and I asked to make payments on the 15th of each month and requested a payment card.

What do I do if they say no and start visiting again?

Hope that makes sense thank you

I am hoping my situation is sorted out, but I am just looking for help incase it isn't

So back at the beginning of the year we had some financial issues and my Grandmother was also very ill and I forgot/couldn't make payments on my CT.

I received a letter some months ago telling me the council were taking me to court, I wasn't able to attend as I was unable to get there ( they had not used my local court which is 10miles away from me but one that is nearly 55miles!)and I had no childcare for my toddler, who doesn't travel well let alone for 55miles.

I contacted the court and they said I didn't have to attend and they would send me a letter with the decision.

Received a letter saying a liability order had been issued for the full amount of £815.

I then had visits from Rossendales, I turned them away as I didn't wish to deal with them (didn't and wont let them in ) I relented and sent a letter in an attempt to sort it with Rossendales and offered them £50 per month to be paid on the 15th of every month or nearest business day (my partner gets paid on the 15th and it is when all our bills are paid) which they basically refused unless they could come into my home and levy goods (which I told their agent wouldn't be happening)

During this time my Grandmother was progressively getting worse and was permanently in hospital,October 3rd she passed away which has been very hard to cope with.

I recently made a last ditch attempt with the council, I explained my situation,told them I was willing to pay but Rossendales had refused my offer and asked them to take back the debt as I didn't need the distress of dealing with bailiffs. They pretty much refused and told me I had had a chance to sort it with them, apparently there was a form with the summons or liability letter to set up installments etc, I can 100% say there wasn't a form!I would've filled it in and sent it back asap had there been.

So anyway they must have contacted Rossendales as I received a letter yesterday (23rd) saying they had accepted my installments and I had to make a payment on or before 26th November!So 3 days notice to make payment! I have emailed Rossendales and asked them to move the date to the 15th and have offered to pay more than I originally offered as I have finished paying of an HP, I explained its to short notice and I asked to make payments on the 15th of each month and requested a payment card.

What do I do if they say no and start visiting again?

Hope that makes sense thank you

Comment