Hello all,

I am very very late to the party here - probably too late for my situation but here goes...

Last August I received a CCJ court form from Howard Cohen/Lowell. At the time (and until this weekend) I wasn't 100% sure what it was related to but suspected an old loan I had defaulted on. The bit that made me unsure was the amount was different to what had been on my credit report.

I looked online for advice when I got the form but stupidly didn't start my own thread and get my own advice. I sent off CPR31.14 request asking for more information. The court papers didn't say who the original company were or have an account number or anything. I didn't hear back from HC within the 7 days so I called them and they said they were gathering it. I didn't realise then that I should have got them to agree to extension. I didn't hear back from them by the date I had to submit my defence so I submitted an embarrassed defence that I'd found online. About a week after the deadline I received a letter from HC saying they were looking for it and agreeing to give me more time once they had found them.

This is where I've really messed up. A directions questionnaire came from the court straight after HC letter and I didn't send it back because I thought it was all on hold. I then received another letter from the court (because obviously it wasn't on hold like I naively thought) ordering me to return the form within 7 days. I had been staying with a friend at the time so by the time I got it I'd missed the deadline by 2 days. I emailed it straight over to the court within an explanation but they awarded the CCJ because I hadn't answered the form.

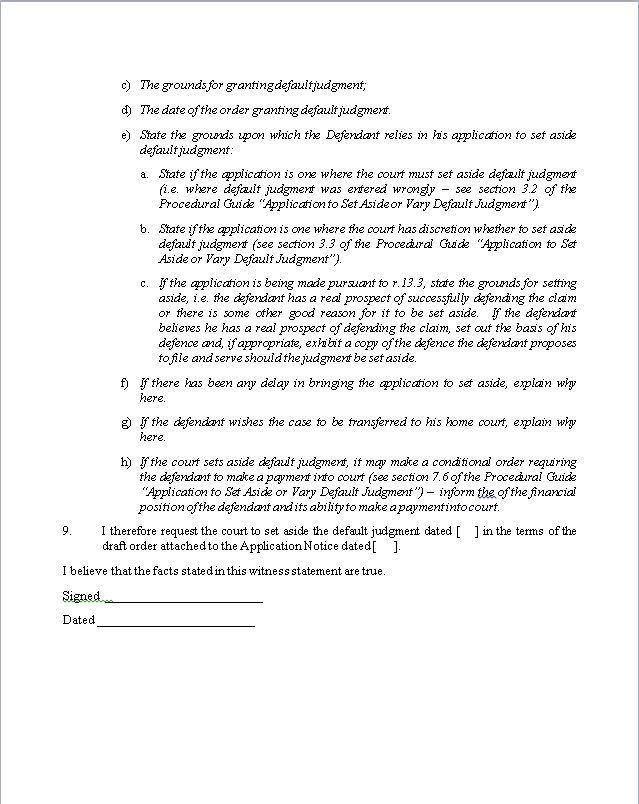

I applied to have it set aside and gave my reason as explained above. I was hoping to use the fact they still hadn't sent documents and me being clueless to help explain. Then yesterday a recorded delivery envelope came for me from HC saying they would be there in court to oppose my application. Included in the bundle was miraculously the default notice I've been asking for since last August (although a pretty grainy copy) and two letters which to be honest I think they've typed up themselves to put in the pack! There's a letter from 'HFC' informing me they've assigned the debt to Lowell - typed up with no letterhead or anything? And I'm sure the font on the signature is different to the rest of the letter! And there's a letter from Lowell telling me they've bought the debt. I'm pretty sure (although I have no paperwork anymore other than bank statements) that I was paying Capquest for a while after it had defaulted. Does this mean that Capquest must have bought it from HFC and Lowell from Capquest?? So confusing?

So now I really don't know what I should say in court tomorrow! The pack clearly shows it's my default notice for the debt so I think I'm a bit screwed. They've purposely waited until the last minute to give me the documents - although they haven't given all I asked for (no initial agreement). If they had sent this at the beginning I probably would've tried to make a deal with them if possible. This is the last negative thing on my credit report (and the default date is more than 6 years ago so it shouldn't be on there). I'm trying to save up for a mortgage so cannot have a CCJ on my file.

Is the judge likely to just say it stands as you have no valid defence? Will I get another month to pay up and get it removed from the Register? I know this hearing isn't to look at my actual defence but I'm assuming the judge will ask about it before deciding on set aside?

So scared about it. Any words of wisdom will be hugely appreciated!

I am very very late to the party here - probably too late for my situation but here goes...

Last August I received a CCJ court form from Howard Cohen/Lowell. At the time (and until this weekend) I wasn't 100% sure what it was related to but suspected an old loan I had defaulted on. The bit that made me unsure was the amount was different to what had been on my credit report.

I looked online for advice when I got the form but stupidly didn't start my own thread and get my own advice. I sent off CPR31.14 request asking for more information. The court papers didn't say who the original company were or have an account number or anything. I didn't hear back from HC within the 7 days so I called them and they said they were gathering it. I didn't realise then that I should have got them to agree to extension. I didn't hear back from them by the date I had to submit my defence so I submitted an embarrassed defence that I'd found online. About a week after the deadline I received a letter from HC saying they were looking for it and agreeing to give me more time once they had found them.

This is where I've really messed up. A directions questionnaire came from the court straight after HC letter and I didn't send it back because I thought it was all on hold. I then received another letter from the court (because obviously it wasn't on hold like I naively thought) ordering me to return the form within 7 days. I had been staying with a friend at the time so by the time I got it I'd missed the deadline by 2 days. I emailed it straight over to the court within an explanation but they awarded the CCJ because I hadn't answered the form.

I applied to have it set aside and gave my reason as explained above. I was hoping to use the fact they still hadn't sent documents and me being clueless to help explain. Then yesterday a recorded delivery envelope came for me from HC saying they would be there in court to oppose my application. Included in the bundle was miraculously the default notice I've been asking for since last August (although a pretty grainy copy) and two letters which to be honest I think they've typed up themselves to put in the pack! There's a letter from 'HFC' informing me they've assigned the debt to Lowell - typed up with no letterhead or anything? And I'm sure the font on the signature is different to the rest of the letter! And there's a letter from Lowell telling me they've bought the debt. I'm pretty sure (although I have no paperwork anymore other than bank statements) that I was paying Capquest for a while after it had defaulted. Does this mean that Capquest must have bought it from HFC and Lowell from Capquest?? So confusing?

So now I really don't know what I should say in court tomorrow! The pack clearly shows it's my default notice for the debt so I think I'm a bit screwed. They've purposely waited until the last minute to give me the documents - although they haven't given all I asked for (no initial agreement). If they had sent this at the beginning I probably would've tried to make a deal with them if possible. This is the last negative thing on my credit report (and the default date is more than 6 years ago so it shouldn't be on there). I'm trying to save up for a mortgage so cannot have a CCJ on my file.

Is the judge likely to just say it stands as you have no valid defence? Will I get another month to pay up and get it removed from the Register? I know this hearing isn't to look at my actual defence but I'm assuming the judge will ask about it before deciding on set aside?

So scared about it. Any words of wisdom will be hugely appreciated!

Comment