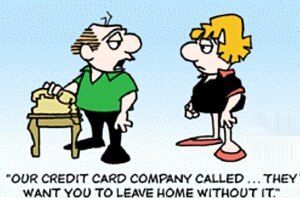

Unrequested credit card limit increases are making debt problems worse for thousands of people and must be stopped, says StepChange Debt Charity. The charity is calling on the Financial Conduct Authority to ban the practice and make credit limit increases something that people must opt-in to. The charity also says…

Read More -> Unrequested credit limit increases pushing people further into debt

More...

Read More -> Unrequested credit limit increases pushing people further into debt

More...

Comment