Re: Ebay & Gumtree Vehicle / Car Scams

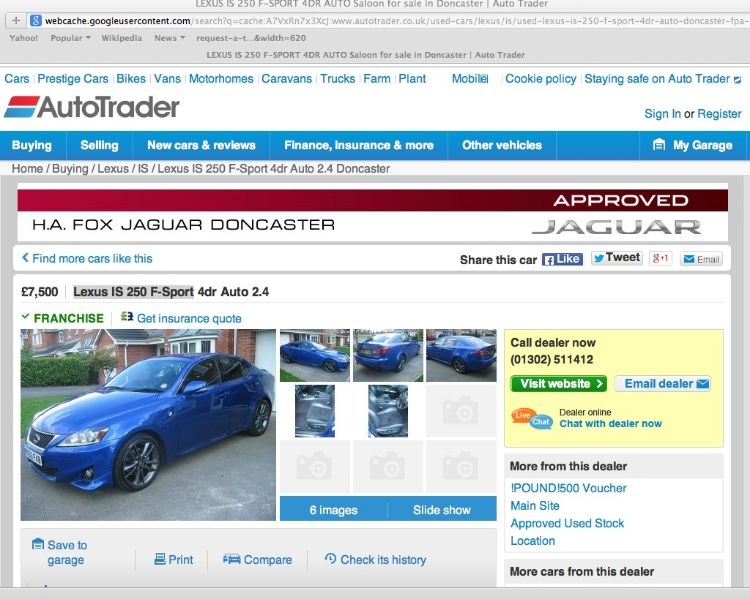

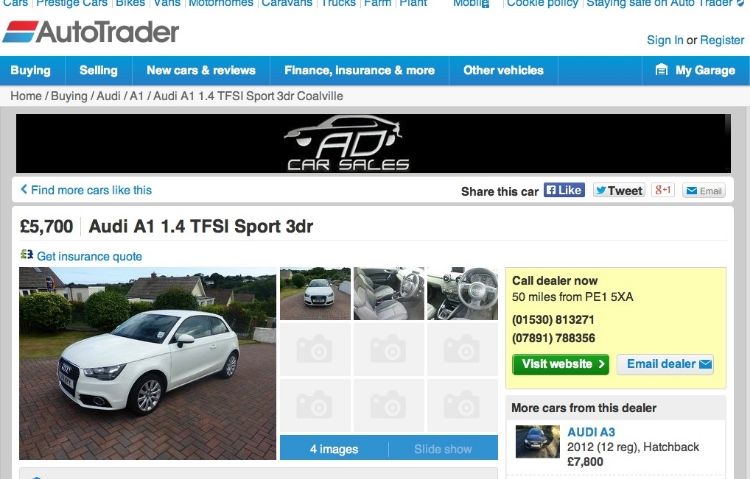

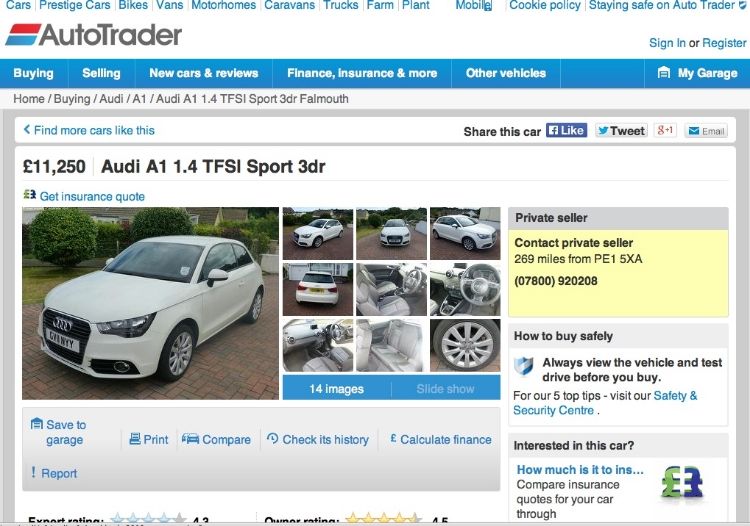

Autotrader UK are hot again tonight taking down the fraudulent adverts. I acknowledge that it's a pain and expensive to do it but the criminals are attacking the site and will do so beyond the point at which the site becomes unusable.

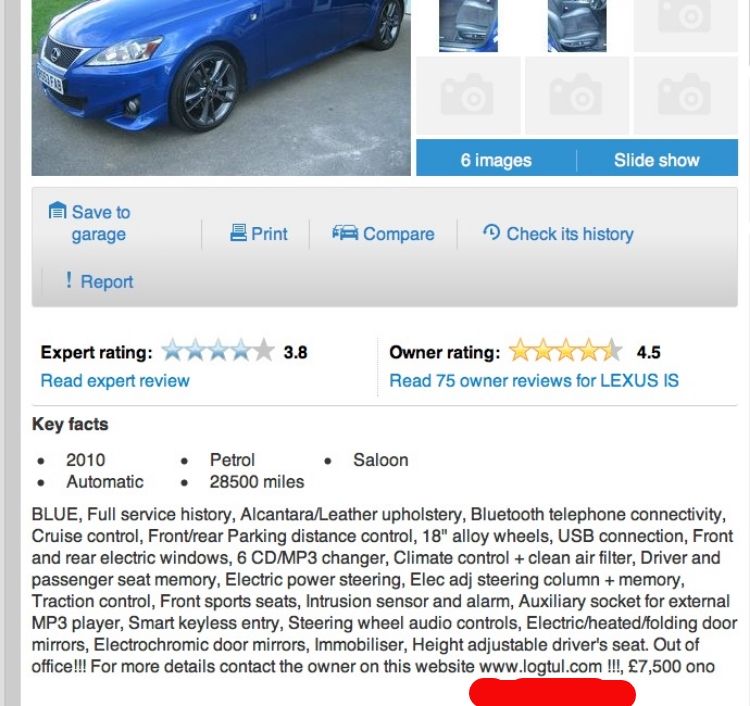

Curiously I have noted recently several instances where the scammers apparently hack some dealer pages with no email contact by which potential victims could contact them (or phone number). Alternatively perhaps AT UK are partially correcting the pages or, maybe the scammers want to make their fraudulent adverts at ridiculous prices appear reasonable and less easy to detect. I'll keep an eye on it, but if there are no contact details there's no need for me to post them as scams.

Autotrader UK are hot again tonight taking down the fraudulent adverts. I acknowledge that it's a pain and expensive to do it but the criminals are attacking the site and will do so beyond the point at which the site becomes unusable.

Curiously I have noted recently several instances where the scammers apparently hack some dealer pages with no email contact by which potential victims could contact them (or phone number). Alternatively perhaps AT UK are partially correcting the pages or, maybe the scammers want to make their fraudulent adverts at ridiculous prices appear reasonable and less easy to detect. I'll keep an eye on it, but if there are no contact details there's no need for me to post them as scams.

Being a Lexus LS400 owner myself I have to say anyone who falls for that price really must dumb

Being a Lexus LS400 owner myself I have to say anyone who falls for that price really must dumb

Comment