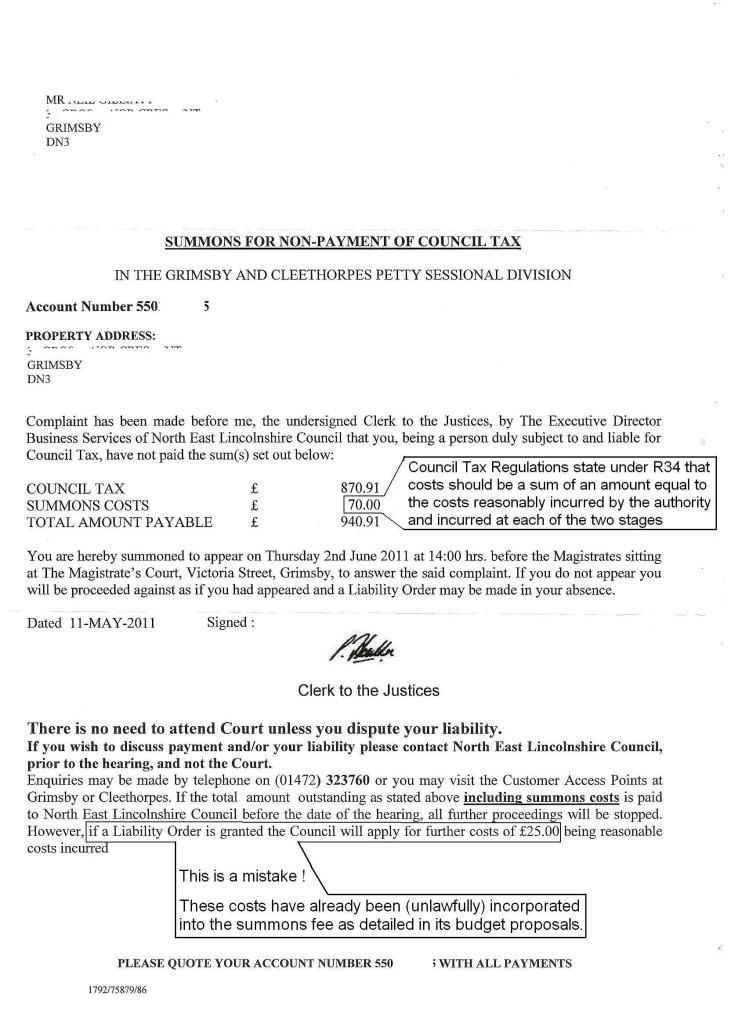

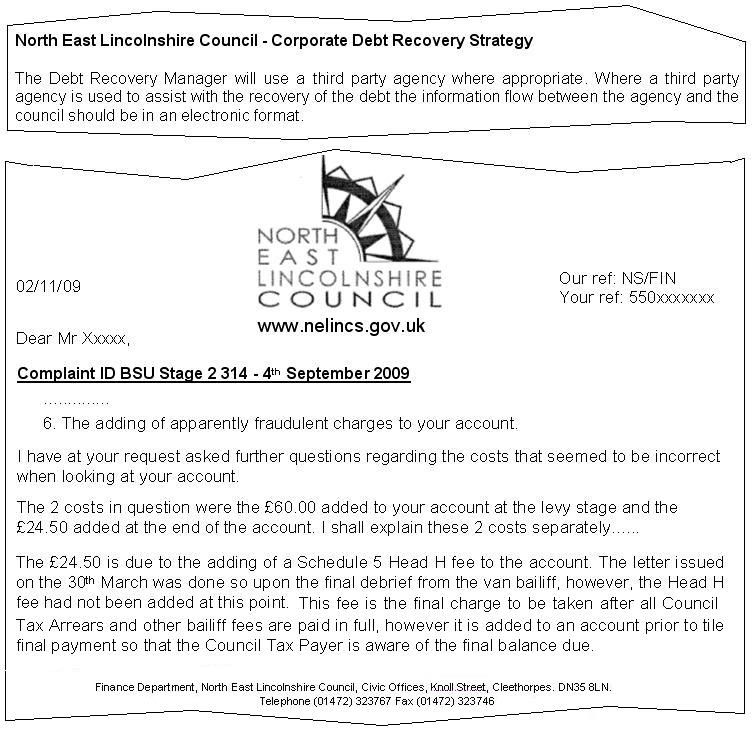

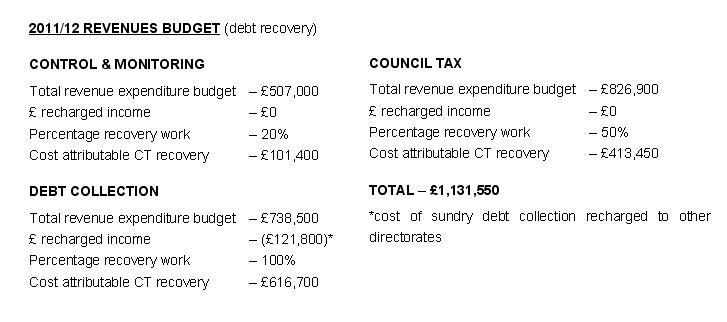

Many councils are charging liability order costs at the same time as those incurred at the summons stage of recovery. This action is effectively catching out a larger proportion of those residents who will become liable for both of these penalties.

However, the Council Tax (Administration and Enforcement) Regulations 1992 state under Regulation 34 that these fees must be incurred independently when the summons is issued and when the liability order is granted. It also states in Regulations R34(5)(b) and (7)(b), that the costs should be reasonably incurred by the authority.

Councils are therefore unlawfully collecting penalties from debtors settling their accounts prior to any court action. This procedure is not in accordance with Regulation 34(5) of the Council Tax Regulations, which requires that the authority shall not proceed with the application if the aggregate of the outstanding debt and costs reasonably incurred by the authority is paid or tendered to it.

Essentially authorities are not lawfully permitted to charge debtors the liability order costs detailed in Regulation 34(7)(b) in such circumstances, however, by charging these costs prematurely at the summons stage, they are doing exactly this.

This was covered in the Sunday Telegraph: We shouldn't let our Councils Cheat us out of 25 Billion a Year

Does this mean many of our local authorities could be open to criminal investigations?

However, the Council Tax (Administration and Enforcement) Regulations 1992 state under Regulation 34 that these fees must be incurred independently when the summons is issued and when the liability order is granted. It also states in Regulations R34(5)(b) and (7)(b), that the costs should be reasonably incurred by the authority.

Application for liability order

34.–(5) If, after a summons has been issued in accordance with paragraph (2) but before the application is heard, there is paid or tendered to the authority an amount equal to the aggregate of—

(6) The court shall make the order if it is satisfied that the sum has become payable by the defendant and has not been paid.

(7) An order made pursuant to paragraph (6) shall be made in respect of an amount equal to the aggregate of—

34.–(5) If, after a summons has been issued in accordance with paragraph (2) but before the application is heard, there is paid or tendered to the authority an amount equal to the aggregate of—

(a) the sum specified in the summons as the sum outstanding or so much of it as remains outstanding (as the case may be); and

(b) a sum of an amount equal to the costs reasonably incurred by the authority in connection with the application up to the time of the payment or tender,

the authority shall accept the amount and the application shall not be proceeded with.(b) a sum of an amount equal to the costs reasonably incurred by the authority in connection with the application up to the time of the payment or tender,

(6) The court shall make the order if it is satisfied that the sum has become payable by the defendant and has not been paid.

(7) An order made pursuant to paragraph (6) shall be made in respect of an amount equal to the aggregate of—

(a) the sum payable, and

(b) a sum of an amount equal to the costs reasonably incurred by the applicant in obtaining the order.

(b) a sum of an amount equal to the costs reasonably incurred by the applicant in obtaining the order.

Essentially authorities are not lawfully permitted to charge debtors the liability order costs detailed in Regulation 34(7)(b) in such circumstances, however, by charging these costs prematurely at the summons stage, they are doing exactly this.

This was covered in the Sunday Telegraph: We shouldn't let our Councils Cheat us out of 25 Billion a Year

Does this mean many of our local authorities could be open to criminal investigations?

Comment