I've just had a court claim from mortimer clarke regarding an old vodafone account . From small claims mcol in Northampton.

The claim details are as follows: By an agreement between vodafone ltd ("VDF") and the defendant dated 05/03/2008 VDF agreed to issue the defendant with credit relating to mobile telephone upon the terms & conditions set out therein . In breah of the the agreement the defendant failed to make the minimum payments and the agreement was terminated . The agreement was assigned to the claimant on 01/06/2011. The claimant has complied sections III & IV of Pratice direction- Pre- - Action. Conduct

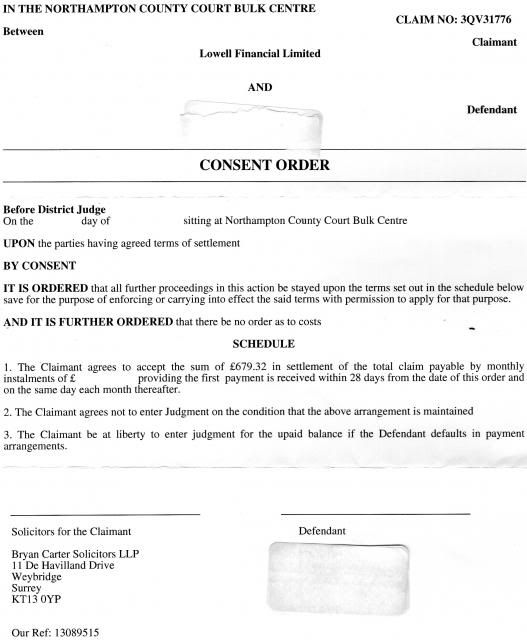

The Claimant therefore claims £XXXX (less than £1000).

I've not had a letter headed "Letter before Action" i am willing to offer payment to avoid ccj but what should my next step be?

The claim details are as follows: By an agreement between vodafone ltd ("VDF") and the defendant dated 05/03/2008 VDF agreed to issue the defendant with credit relating to mobile telephone upon the terms & conditions set out therein . In breah of the the agreement the defendant failed to make the minimum payments and the agreement was terminated . The agreement was assigned to the claimant on 01/06/2011. The claimant has complied sections III & IV of Pratice direction- Pre- - Action. Conduct

The Claimant therefore claims £XXXX (less than £1000).

I've not had a letter headed "Letter before Action" i am willing to offer payment to avoid ccj but what should my next step be?

Comment