Quite often in consumer credit debt cases you will be able to negotiate a settlement agreement with the claimants that will keep you from having a CCJ ( county court judgment ) entered against you.

Most often these will be offered by the claimant when they have a weakened position - for example after you have entered your defence and while they are unable to provide you with documents, but sometimes you can instigate the order if you wish to just get the claim settled at any point. Every case is different and you should always post on your thread on the forum for help from others who are experienced dealing with these types of claims.

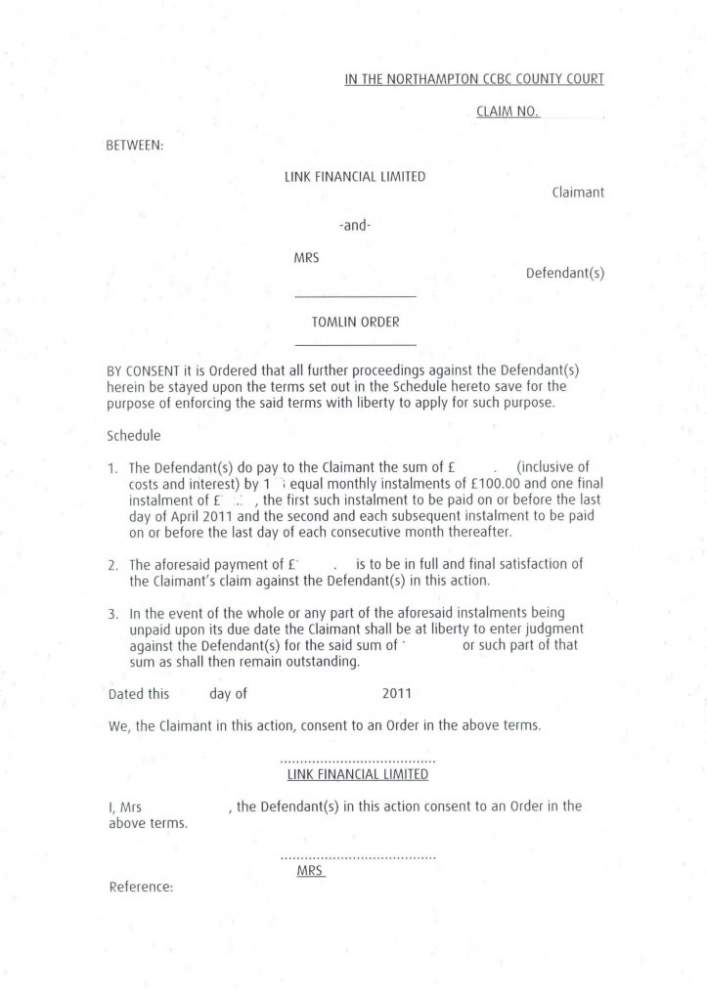

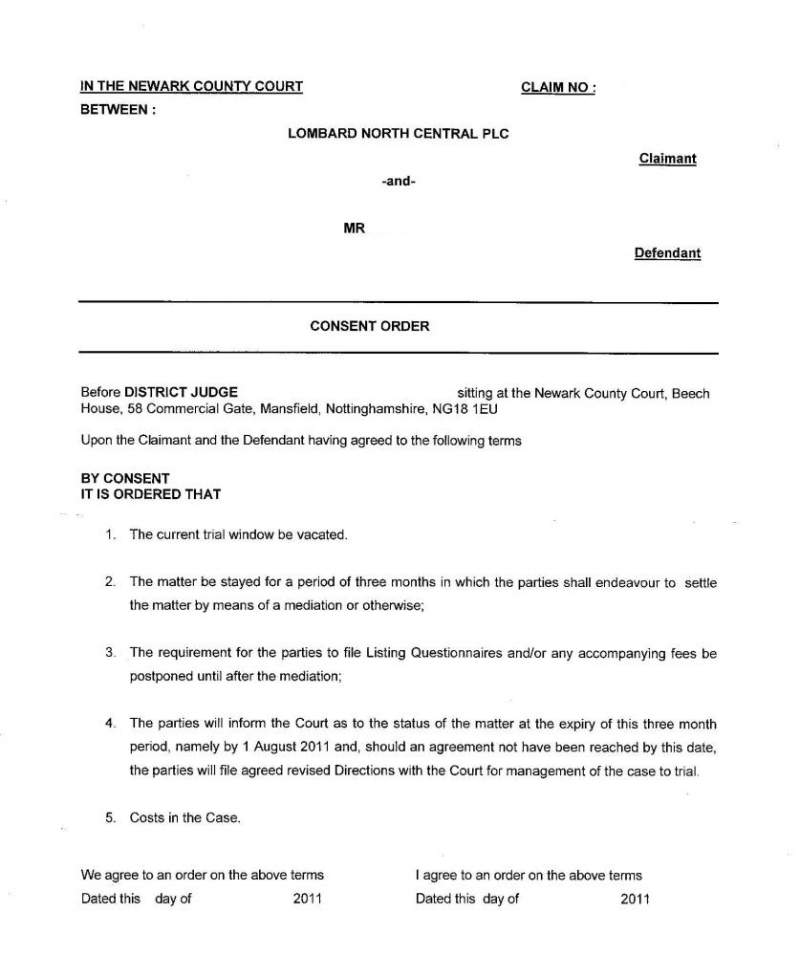

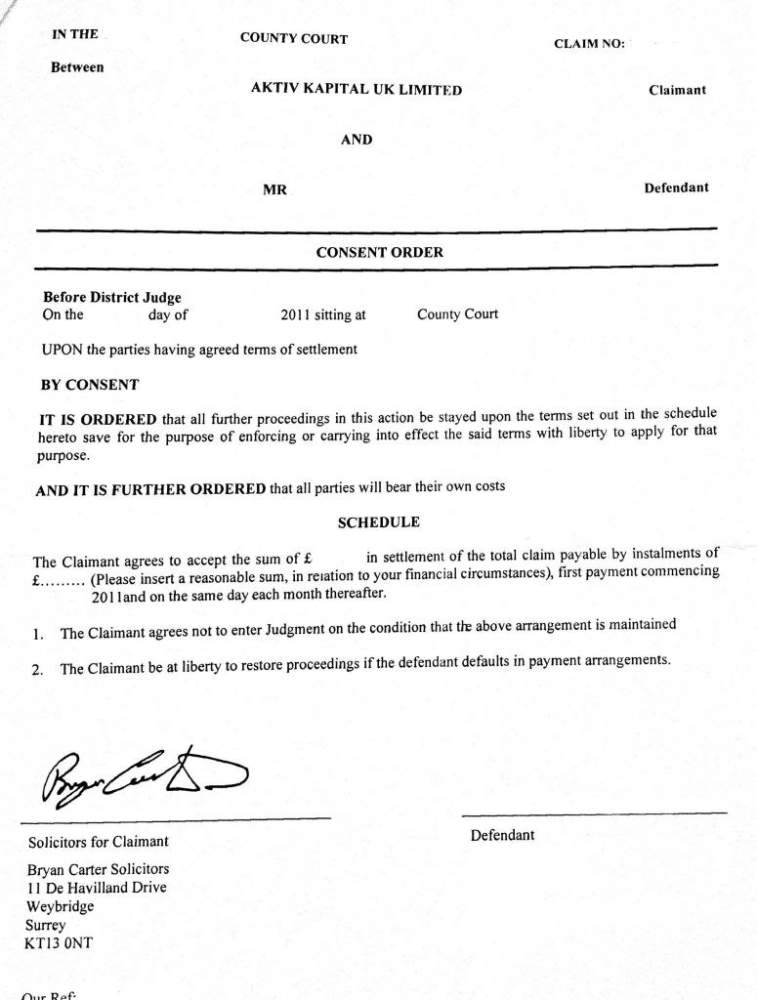

Tomlin Order - basically a consent order, you agree a settlement or instalment arrangement with the claimants on the condition the claim is just held in court and no judgment is asked for whilst you keep up with your side of things, and they have it as security in case you default (I'll find an example for you) Once agreed you both sign and lodge that with the court, then if either of you break the terms of that agreement you can return to court (more likely to be them to get judgment if you failed in your payments)

Here's a couple examples

http://i390.photobucket.com/albums/o...rs/bcsett2.jpg

http://s236.photobucket.com/user/rip...tter4.jpg.html

http://i1238.photobucket.com/albums/...1.jpg~original

Most often these will be offered by the claimant when they have a weakened position - for example after you have entered your defence and while they are unable to provide you with documents, but sometimes you can instigate the order if you wish to just get the claim settled at any point. Every case is different and you should always post on your thread on the forum for help from others who are experienced dealing with these types of claims.

Tomlin Order - basically a consent order, you agree a settlement or instalment arrangement with the claimants on the condition the claim is just held in court and no judgment is asked for whilst you keep up with your side of things, and they have it as security in case you default (I'll find an example for you) Once agreed you both sign and lodge that with the court, then if either of you break the terms of that agreement you can return to court (more likely to be them to get judgment if you failed in your payments)

Here's a couple examples

http://i390.photobucket.com/albums/o...rs/bcsett2.jpg

http://s236.photobucket.com/user/rip...tter4.jpg.html

http://i1238.photobucket.com/albums/...1.jpg~original

Comment