Hi,

I'm looking for a bit of advice please.

I have received the bellow letter from the Court:

I have acknowledge the service online via moneyclaim.gov.uk and

in reply I have sent this letter:

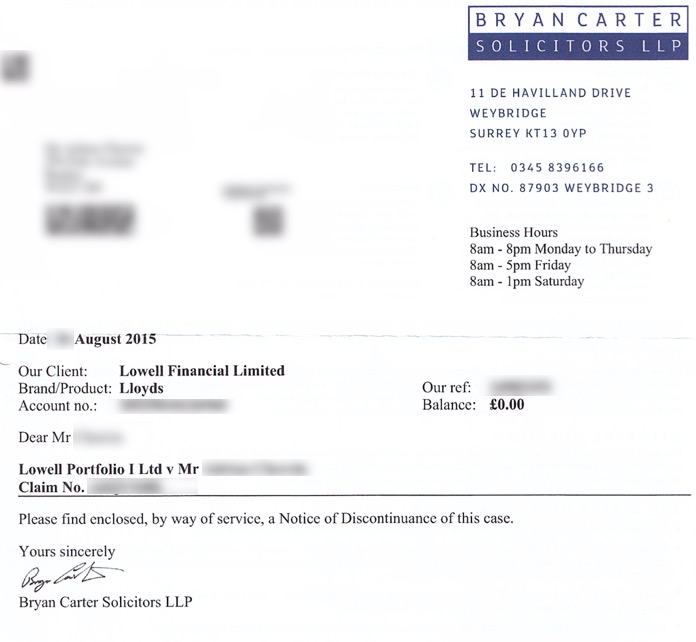

Today I am in receipt of this reply from Bryan Carter:

Can anyone please advice what to do next, I haven't got any legal knowledge whatsoever

Thanks a lot!

I'm looking for a bit of advice please.

I have received the bellow letter from the Court:

I have acknowledge the service online via moneyclaim.gov.uk and

in reply I have sent this letter:

Today I am in receipt of this reply from Bryan Carter:

Can anyone please advice what to do next, I haven't got any legal knowledge whatsoever

Thanks a lot!

Comment