Hey Beagles! I would massively appreciate some guidance and help on my issues! I have now received a claim form. I have just completed the AOS and now I need help building a defence or change the plea depending on the guidance provided by you brainiacs

How I have got here:

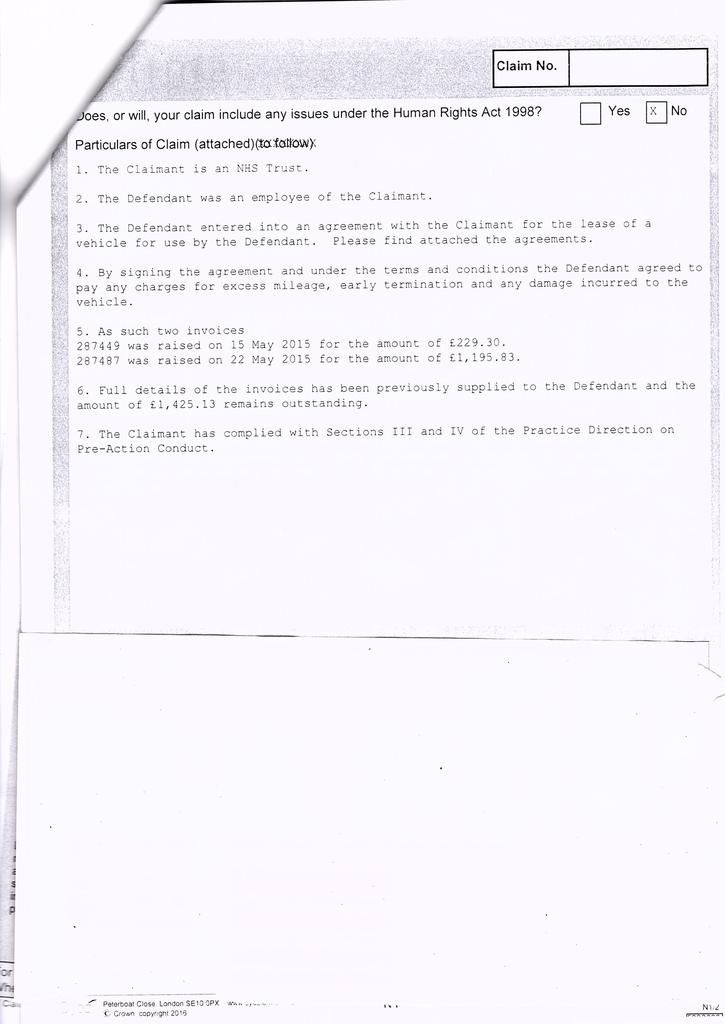

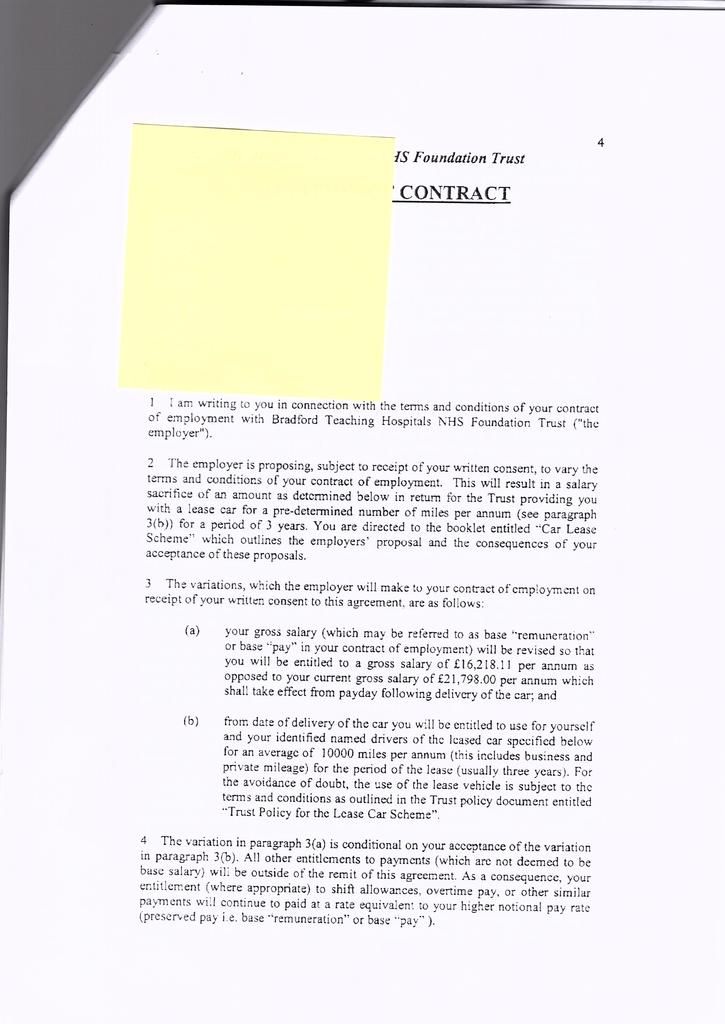

I am currently being chased for outstanding moneys for a vehicle i had on lease from a Hospital Trust. I was an employee of the trust and had a car on a Salary Sacrifice Scheme. There are two outstanding invoices that i am being chased for - early termination and for a month where the company did not pick up the car even though it was dropped off at the location they requested.

Now i thought i had actually dealt with this issues years ago when i was in conversation with a NHS finance department worker and after i had sent him everything i never heard back. and now some years later I am in the same position I was in. unfortunately i do not have any evidence of this.

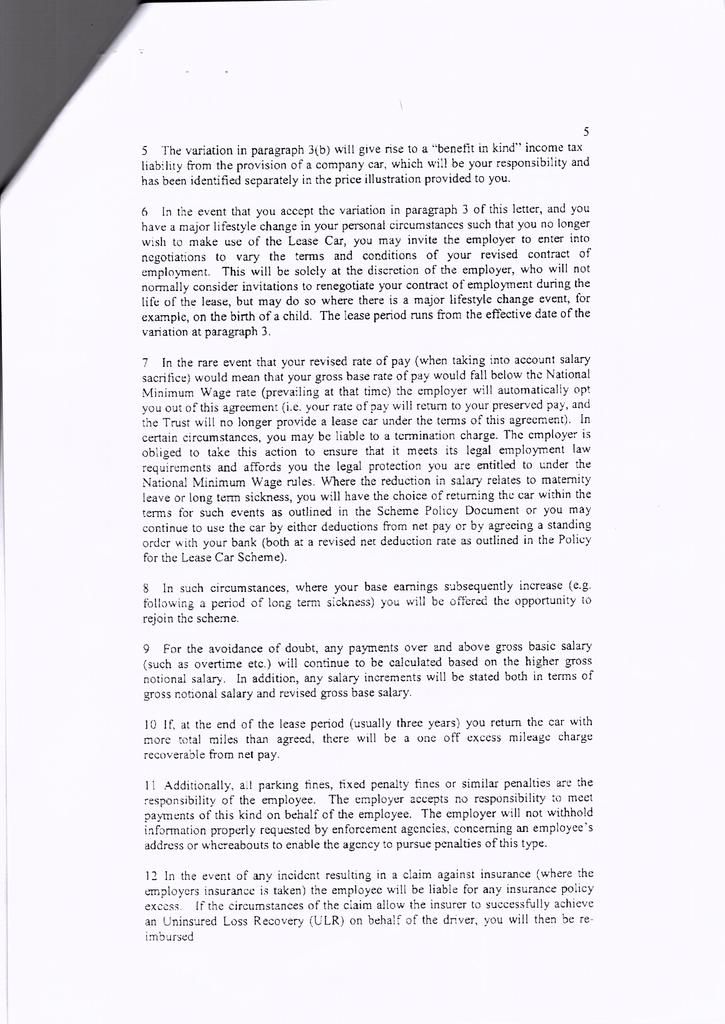

I disputed the charges because part of the charges being sanctioned on me were when i did not have the vehicle and it had already gone back to the supplier. The other part of the charges i disputed as I was off sick from work and then my contract was terminated without me present as they would not re-arrange. therefore I put the onus on the hospital for the reason i could not complete the term of the car lease making any charges void.

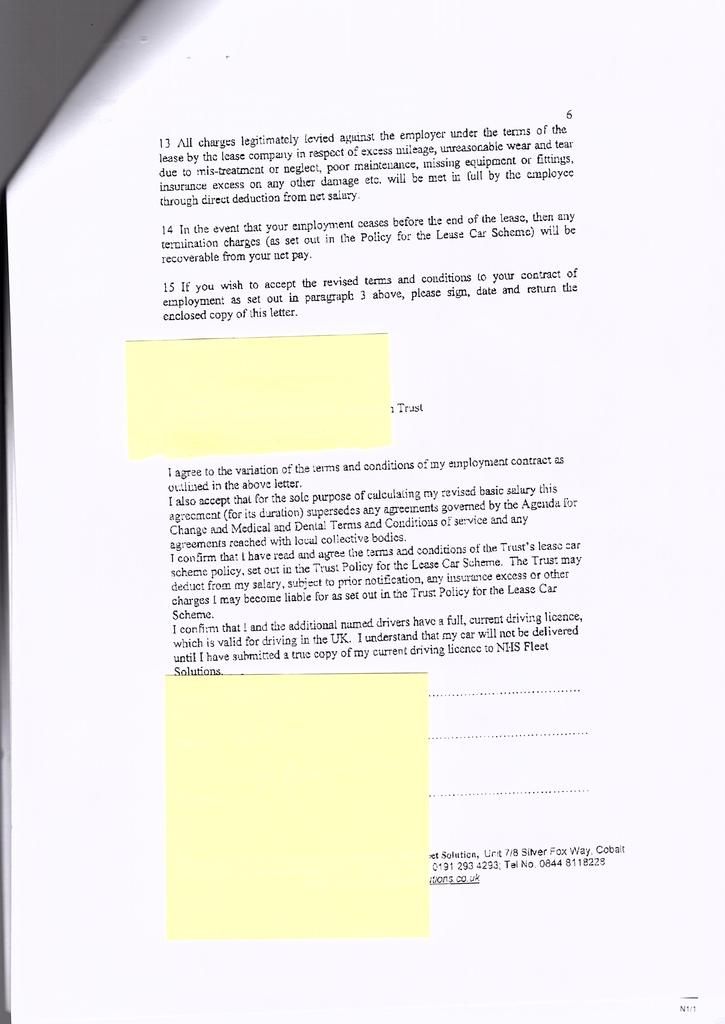

I have had a look at the agreement form I signed back in 02/2011 and under the declaration it says

'I understand that the car will be ordered on my behalf and I shall be bound to the scheme until the contract formally expires or my employment with the employing organisation ceases'

Am I snookered because of this? I genuinely that that meant if i was Sacked accordingley from the Job or left on my own accord.

The information provided by the claimant shows an invoice from 2015 that they have been chasing the debt from, however the car was returned and my contract terminated in June 2012. If that's the case and as the amount of debt is under 2K would I still be potentially able to get the debt Statute barred?

Would appreciate some guidance on this please!

Thank you!

How I have got here:

I am currently being chased for outstanding moneys for a vehicle i had on lease from a Hospital Trust. I was an employee of the trust and had a car on a Salary Sacrifice Scheme. There are two outstanding invoices that i am being chased for - early termination and for a month where the company did not pick up the car even though it was dropped off at the location they requested.

Now i thought i had actually dealt with this issues years ago when i was in conversation with a NHS finance department worker and after i had sent him everything i never heard back. and now some years later I am in the same position I was in. unfortunately i do not have any evidence of this.

I disputed the charges because part of the charges being sanctioned on me were when i did not have the vehicle and it had already gone back to the supplier. The other part of the charges i disputed as I was off sick from work and then my contract was terminated without me present as they would not re-arrange. therefore I put the onus on the hospital for the reason i could not complete the term of the car lease making any charges void.

I have had a look at the agreement form I signed back in 02/2011 and under the declaration it says

'I understand that the car will be ordered on my behalf and I shall be bound to the scheme until the contract formally expires or my employment with the employing organisation ceases'

Am I snookered because of this? I genuinely that that meant if i was Sacked accordingley from the Job or left on my own accord.

The information provided by the claimant shows an invoice from 2015 that they have been chasing the debt from, however the car was returned and my contract terminated in June 2012. If that's the case and as the amount of debt is under 2K would I still be potentially able to get the debt Statute barred?

Would appreciate some guidance on this please!

Thank you!

Comment