Hi Guys,

Sorry if this is in the wrong place but this is my first post on the forum, moderators feel free to move if necessary.

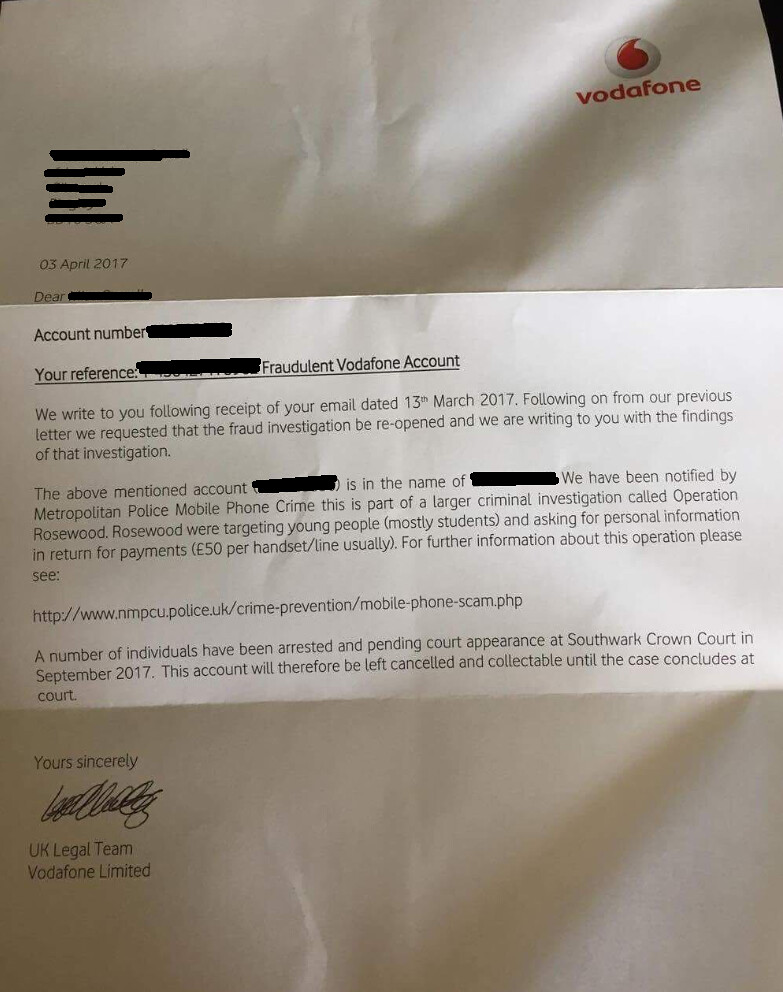

I am in the middle of a long battle with Vodafone over a fraudulent account set up in my name back in 2014. This was discovered in July 2015 and immediately reported to the Police and ActionFraud who provided a crime reference number. It was also reported to my bank who, having conducted an investigation, determined that the signature used to set up the Direct Debit Instruction was fraudulent. As a result of this, the bank recovered all monies paid to Vodafone.

Since then, Vodafone have not accepted that this account was created fraudulently and have continued to send correspondence to an unknown to me address provided by the fraudsters when they created the account. They have also applied default notices to my credit record and have refused to remove them. I have made repeated requests asking them to supply me with details of any fraud investigation conducted, the identification documents and proof of address given when the account was opened and all other information pertinent to the fraud investigation and I have numerous email responses where they have refused to supply me with these.

In 30/10/16 I sent a letter to Vodafone by recorded delivery advising that I plan on pursuing them through the Consumer Ombudsman and will take legal action if necessary, if they refuse to remove the default notices from my credit score. They confirmed receipt of the letter but refused to remove the default notices or provide me with the information I requested. As a result I contacted the consumer ombudsman who stated that, having previously investigated the account when I was still gathering evidence and subsequently closed their investigation, will no longer investigate.

On 12/12/16 I made a request for information under the provisions of the Data Protection Act 1998 and obtained documents relating to the account. This was supplied on the 23rd of January and showed that Vodafone had been told by my bank that the Direct Debit Instruction contained a fraudulent signature and that the account had been referred to their internal Fraud team numerous times. It also has all my correspondence and repeated requests for further information but specifically does not include details of the fraud investigation or the identification documents and proof of address used to open the account.

As a result of this I feel I am now left with no option but to pursue Vodafone through a smalls claim court (?) to get them to remove the default notice. I have sent a Pre Action Protocol stating my intent. In my Basis of Claim I assert that Vodafone have been negligent in allowing this contract to be opened with insufficient documentation and have incorrectly applied a debt and default notices to my name/credit score. I further assert that the fraud investigation carried out by Vodafone has been insufficient. I can and have provided evidence to back up these claims.

So in summary, itís a horrible situation that has caused me untold stress for nearly 2 years. Vodafone have yet to respond to my Pre Action Protocol letter and have until next week to do so (within the 28 days). I am preparing my next steps either way but wish I had posted on here sooner as I need advice on the following:

Can a small claim court force a company to remove a default notice?

Should I be pursuing Vodafone for damages?

Is there any way to get the Ombudsman to re-investigate now that I have all the evidence I need?

Any help appreciated guys!

Thanks, Abbie!

Sorry if this is in the wrong place but this is my first post on the forum, moderators feel free to move if necessary.

I am in the middle of a long battle with Vodafone over a fraudulent account set up in my name back in 2014. This was discovered in July 2015 and immediately reported to the Police and ActionFraud who provided a crime reference number. It was also reported to my bank who, having conducted an investigation, determined that the signature used to set up the Direct Debit Instruction was fraudulent. As a result of this, the bank recovered all monies paid to Vodafone.

Since then, Vodafone have not accepted that this account was created fraudulently and have continued to send correspondence to an unknown to me address provided by the fraudsters when they created the account. They have also applied default notices to my credit record and have refused to remove them. I have made repeated requests asking them to supply me with details of any fraud investigation conducted, the identification documents and proof of address given when the account was opened and all other information pertinent to the fraud investigation and I have numerous email responses where they have refused to supply me with these.

In 30/10/16 I sent a letter to Vodafone by recorded delivery advising that I plan on pursuing them through the Consumer Ombudsman and will take legal action if necessary, if they refuse to remove the default notices from my credit score. They confirmed receipt of the letter but refused to remove the default notices or provide me with the information I requested. As a result I contacted the consumer ombudsman who stated that, having previously investigated the account when I was still gathering evidence and subsequently closed their investigation, will no longer investigate.

On 12/12/16 I made a request for information under the provisions of the Data Protection Act 1998 and obtained documents relating to the account. This was supplied on the 23rd of January and showed that Vodafone had been told by my bank that the Direct Debit Instruction contained a fraudulent signature and that the account had been referred to their internal Fraud team numerous times. It also has all my correspondence and repeated requests for further information but specifically does not include details of the fraud investigation or the identification documents and proof of address used to open the account.

As a result of this I feel I am now left with no option but to pursue Vodafone through a smalls claim court (?) to get them to remove the default notice. I have sent a Pre Action Protocol stating my intent. In my Basis of Claim I assert that Vodafone have been negligent in allowing this contract to be opened with insufficient documentation and have incorrectly applied a debt and default notices to my name/credit score. I further assert that the fraud investigation carried out by Vodafone has been insufficient. I can and have provided evidence to back up these claims.

So in summary, itís a horrible situation that has caused me untold stress for nearly 2 years. Vodafone have yet to respond to my Pre Action Protocol letter and have until next week to do so (within the 28 days). I am preparing my next steps either way but wish I had posted on here sooner as I need advice on the following:

Can a small claim court force a company to remove a default notice?

Should I be pursuing Vodafone for damages?

Is there any way to get the Ombudsman to re-investigate now that I have all the evidence I need?

Any help appreciated guys!

Thanks, Abbie!

Comment