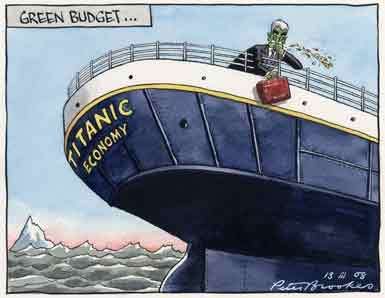

Here are the key points from Chancellor Alistair Darling's 2008 Budget:

CIGARETTES AND ALCOHOL

• Cigarettes up 11p a packet of 20 from 1800 GMT; five cigars up 4p.

• Beer up by 4p a pint, wine 14p a bottle, spirits 55p a bottle and cider 3p a litre by Sunday.

• Duties on alcohol will go up by 2% above inflation for next four years.

CARS, FUEL AND ROAD PRICING

• From 2009, major reform of the vehicle excise duty. For new cars from 2010, the lowest-polluting cars will pay no road tax in the first year. Higher-polluting cars will pay more.

• Funding set aside for road-pricing proposals.

• 2p increase in fuel duty is postponed until October this year.

• For environmental reasons, fuel duty will rise by 0.5p per litre in real terms in 2010.

HOUSING

• From April, key workers, such as teachers and nurses, will be able to borrow money from shared equity schemes.

• Stamp duty on shared ownership homes will not be required until people own 80% of their home.

• More people should have the chance to have a long-term fixed mortgage, which a report shows can reduce the risks for first-time buyers and can keep them on the housing ladder.

• Sites for 70,000 more houses have been identified.

PENSIONERS

• Winter fuel allowance will go up from £200 to £250 for the over 60s and from £300 to £400 for the over 80s.

BENEFITS

• From October 2009, rules for housing and council tax benefit will mean families on benefit are better off in work.

• From April, 2009, child benefit will be increased to £20 a week.

• From April 2010, all long-term recipients of incapacity benefit will attend work capacity programmes.

BUSINESS

• £60m over three years for equipping people to return to the workplace.

• Corporation tax will fall from 30% to 28% by April this year, with simpler taxes for small companies.

• More help for small businesses, with capital gains tax remaining at 10%.

• Funds available through the small firms loans guarantee will increase by 60% in the next year.

• There will be a capital fund of £12.5m to encourage more women entrepreneurs.

AIRPORTS AND AIR TRAVEL

• New measures at Heathrow and other airports, using biometric technology, to speed up the time it takes to get through security checks.

ENVIRONMENT

• Laws will be introduced by 2009 to tax plastic bags if shops do not do more to charge for their use.

• £26m to help make homes greener.

• New non-domestic buildings to become zero-carbon from 2019.

• The government is asking the European Commission for tougher targets on car fuel emissions

• Consideration is being given to raising the UK target for emissions cuts to 80% by 2050.

EDUCATION

• There will be £200m extra for schools to raise GCSE results. By 2011, every school "will be an improving school".

• There will be a £30m fund to improve science teaching.

POVERTY

• Child poverty must be eradicated in Britain. Total of 600,000 fewer children in relative poverty and 150,000 fewer children in absolute poverty.

• Five million customers on pre-paid meters should get a "better deal". Energy companies should spend £150m on social tariffs.

• £17 more a week for poor families with one child.

• A family with two children earning up to £28,000 a year will be £130 a year better off. A further £125m to be spent over the next three years to help families.

SAVINGS

• The government will launch the "savings gateway" nationally with the first accounts available by 2010.

• Cash ISA limit confirmed as £3,600 a year from April.

ECONOMY

• Turbulence in global financial markets, starting in the US, has spread across the world - and this poses a major risk to the world economy.

• The British economy will continue to grow. "This Budget is about equipping Britain for the times ahead...about building a fairer society," Mr Darling said.

• Britain is more resilient and more prepared to deal with global shocks.

• The UK's GDP per head has gone from the lowest in the G7 in the 1990s to second highest now.

• The British economy will this year grow from between 1.75% and 2.25%, down from 3% last year.

• "There will be no return to the inflation rates of the early 1990s," Mr Darling said.

• To provide certainty, the chancellor said he is writing to the governor of the Bank of England to keep a 2% target on inflation.

• Borrowing next year will rise to £43bn, some 2.9% of national income. It will fall to 1.3% by 2012/13.

• By 2011, investment will have increased by 500%, trebling as a share of national income.

• Public spending in the coming three years will grow by 2.2% a year.

ARMED FORCES

• an extra £2bn will be spent on troops in the frontline, including £900m on military equipment.

PUBLIC SERVICES

• Spending on government departments must be matched by reform.

• The focus for the next decade on the NHS will be creating "world-class services".

NON DOMICILES

• The government welcomes the contribution made by people from outside the UK. But non domiciled families should pay a "reasonable charge" after seven years.

CIGARETTES AND ALCOHOL

• Cigarettes up 11p a packet of 20 from 1800 GMT; five cigars up 4p.

• Beer up by 4p a pint, wine 14p a bottle, spirits 55p a bottle and cider 3p a litre by Sunday.

• Duties on alcohol will go up by 2% above inflation for next four years.

CARS, FUEL AND ROAD PRICING

• From 2009, major reform of the vehicle excise duty. For new cars from 2010, the lowest-polluting cars will pay no road tax in the first year. Higher-polluting cars will pay more.

• Funding set aside for road-pricing proposals.

• 2p increase in fuel duty is postponed until October this year.

• For environmental reasons, fuel duty will rise by 0.5p per litre in real terms in 2010.

HOUSING

• From April, key workers, such as teachers and nurses, will be able to borrow money from shared equity schemes.

• Stamp duty on shared ownership homes will not be required until people own 80% of their home.

• More people should have the chance to have a long-term fixed mortgage, which a report shows can reduce the risks for first-time buyers and can keep them on the housing ladder.

• Sites for 70,000 more houses have been identified.

PENSIONERS

• Winter fuel allowance will go up from £200 to £250 for the over 60s and from £300 to £400 for the over 80s.

BENEFITS

• From October 2009, rules for housing and council tax benefit will mean families on benefit are better off in work.

• From April, 2009, child benefit will be increased to £20 a week.

• From April 2010, all long-term recipients of incapacity benefit will attend work capacity programmes.

BUSINESS

• £60m over three years for equipping people to return to the workplace.

• Corporation tax will fall from 30% to 28% by April this year, with simpler taxes for small companies.

• More help for small businesses, with capital gains tax remaining at 10%.

• Funds available through the small firms loans guarantee will increase by 60% in the next year.

• There will be a capital fund of £12.5m to encourage more women entrepreneurs.

AIRPORTS AND AIR TRAVEL

• New measures at Heathrow and other airports, using biometric technology, to speed up the time it takes to get through security checks.

ENVIRONMENT

• Laws will be introduced by 2009 to tax plastic bags if shops do not do more to charge for their use.

• £26m to help make homes greener.

• New non-domestic buildings to become zero-carbon from 2019.

• The government is asking the European Commission for tougher targets on car fuel emissions

• Consideration is being given to raising the UK target for emissions cuts to 80% by 2050.

EDUCATION

• There will be £200m extra for schools to raise GCSE results. By 2011, every school "will be an improving school".

• There will be a £30m fund to improve science teaching.

POVERTY

• Child poverty must be eradicated in Britain. Total of 600,000 fewer children in relative poverty and 150,000 fewer children in absolute poverty.

• Five million customers on pre-paid meters should get a "better deal". Energy companies should spend £150m on social tariffs.

• £17 more a week for poor families with one child.

• A family with two children earning up to £28,000 a year will be £130 a year better off. A further £125m to be spent over the next three years to help families.

SAVINGS

• The government will launch the "savings gateway" nationally with the first accounts available by 2010.

• Cash ISA limit confirmed as £3,600 a year from April.

ECONOMY

• Turbulence in global financial markets, starting in the US, has spread across the world - and this poses a major risk to the world economy.

• The British economy will continue to grow. "This Budget is about equipping Britain for the times ahead...about building a fairer society," Mr Darling said.

• Britain is more resilient and more prepared to deal with global shocks.

• The UK's GDP per head has gone from the lowest in the G7 in the 1990s to second highest now.

• The British economy will this year grow from between 1.75% and 2.25%, down from 3% last year.

• "There will be no return to the inflation rates of the early 1990s," Mr Darling said.

• To provide certainty, the chancellor said he is writing to the governor of the Bank of England to keep a 2% target on inflation.

• Borrowing next year will rise to £43bn, some 2.9% of national income. It will fall to 1.3% by 2012/13.

• By 2011, investment will have increased by 500%, trebling as a share of national income.

• Public spending in the coming three years will grow by 2.2% a year.

ARMED FORCES

• an extra £2bn will be spent on troops in the frontline, including £900m on military equipment.

PUBLIC SERVICES

• Spending on government departments must be matched by reform.

• The focus for the next decade on the NHS will be creating "world-class services".

NON DOMICILES

• The government welcomes the contribution made by people from outside the UK. But non domiciled families should pay a "reasonable charge" after seven years.

Comment