Hi All,

What a great site, I've had a look around the forum before posting this and have a rough idea of what sort of route I should perhaps be heading with this but just could do with a bit of reassurance that what I respond with would be suitable in my particular case.

So I had a bank account with Lloyds about 13 years ago and got into financial difficulty, I ended up with unarranged overdraft charges on top of charges which sent my bank account into arrears and due to being ill advised by someone at Lloyds I ended up nearly 1000 pounds in debt.

The account was defaulted on 21/04/2010 and I have not acknowledged the debt or paid any from well before that date so it is most certainly statute barred.

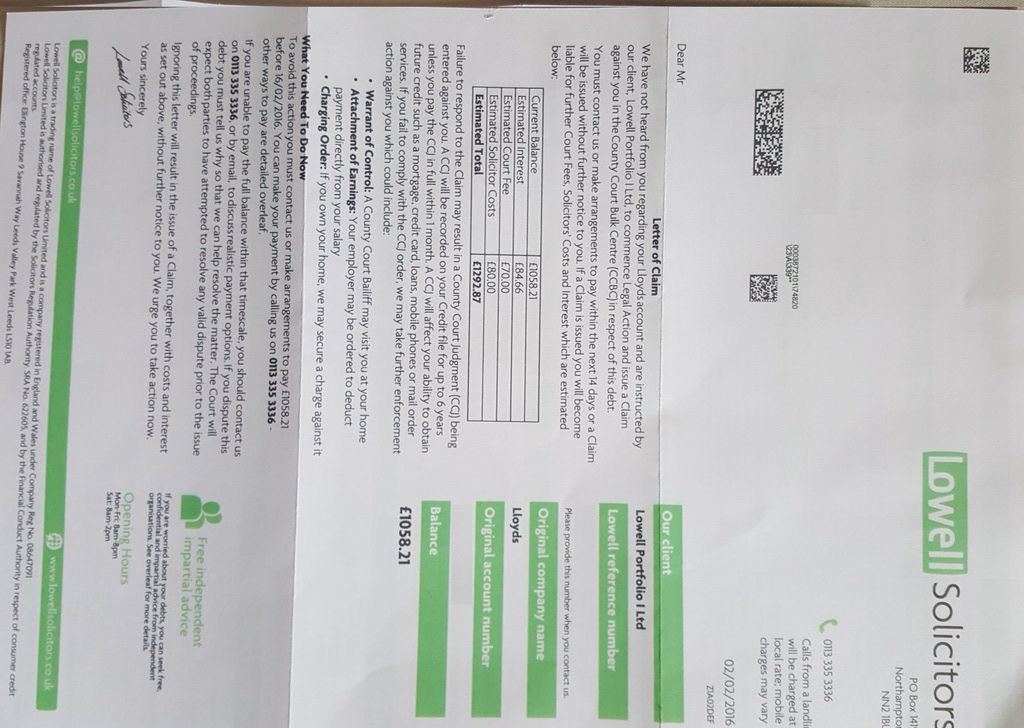

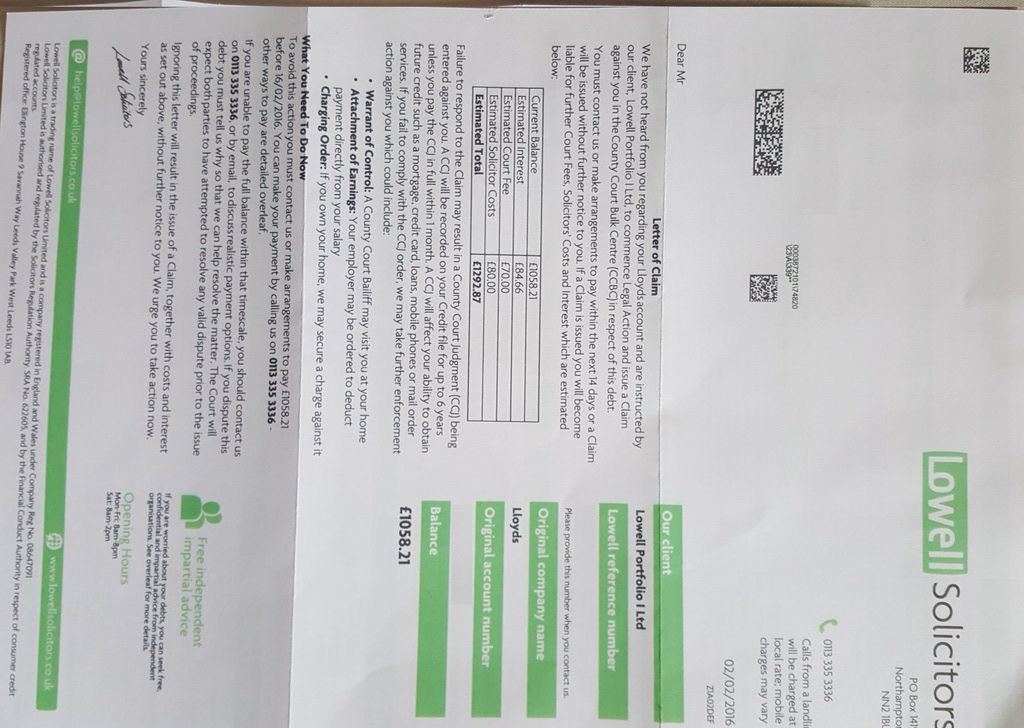

This debt has been passed from pillar to post and ended up with Lowell Porfolio and subsequently Lowell Solicitors, I have now received a 'letter of claim'.

Here is the letter:

As you can see the letter is dated 02/02/2016 so 4 days old, I understand I now have 10 more days to respond to this prior to a claim being submitted by the claimant.

What sort of documentation should I be asking them for with a CPR 31.14? Or is there another template I should follow to simply ask them to prove that this debt is not statute barred?

Any Help would be greatly appreciated, thank you!

Warren

What a great site, I've had a look around the forum before posting this and have a rough idea of what sort of route I should perhaps be heading with this but just could do with a bit of reassurance that what I respond with would be suitable in my particular case.

So I had a bank account with Lloyds about 13 years ago and got into financial difficulty, I ended up with unarranged overdraft charges on top of charges which sent my bank account into arrears and due to being ill advised by someone at Lloyds I ended up nearly 1000 pounds in debt.

The account was defaulted on 21/04/2010 and I have not acknowledged the debt or paid any from well before that date so it is most certainly statute barred.

This debt has been passed from pillar to post and ended up with Lowell Porfolio and subsequently Lowell Solicitors, I have now received a 'letter of claim'.

Here is the letter:

As you can see the letter is dated 02/02/2016 so 4 days old, I understand I now have 10 more days to respond to this prior to a claim being submitted by the claimant.

What sort of documentation should I be asking them for with a CPR 31.14? Or is there another template I should follow to simply ask them to prove that this debt is not statute barred?

Any Help would be greatly appreciated, thank you!

Warren

Comment