A friend went to check her wages had gone into her bank,she discovered that around £500 was missing from her balance, their were 6 transactions made in China,

The last time she had used an ATM was at a Tesco store, after making enquiries it seems there had been several similiar cases all at Tescos ATMs,the bank refunded her money,and said cards had been cloned with a card reader

The last time she had used an ATM was at a Tesco store, after making enquiries it seems there had been several similiar cases all at Tescos ATMs,the bank refunded her money,and said cards had been cloned with a card reader

When you insert your debit or credit card into a cash machine, there’s a reader on the inside of the machine that interprets the information on your card’s magnetic strip and that, coupled with the PIN you type into the keypad, gives you access to the money in your bank accounts.

When you insert your debit or credit card into a cash machine, there’s a reader on the inside of the machine that interprets the information on your card’s magnetic strip and that, coupled with the PIN you type into the keypad, gives you access to the money in your bank accounts.

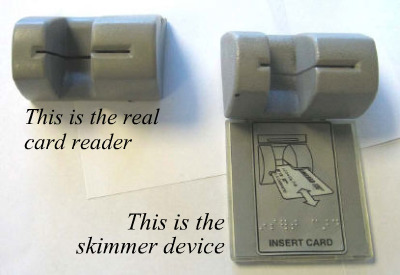

How the skimmer fits over the top of the real card slot

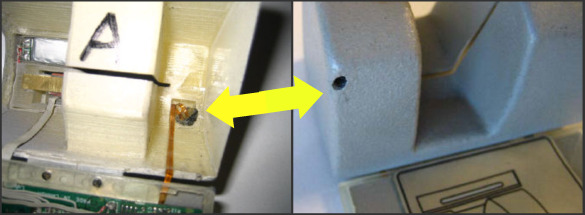

How the skimmer fits over the top of the real card slot Pinhole for camera on the device

Pinhole for camera on the device While

While

Comment