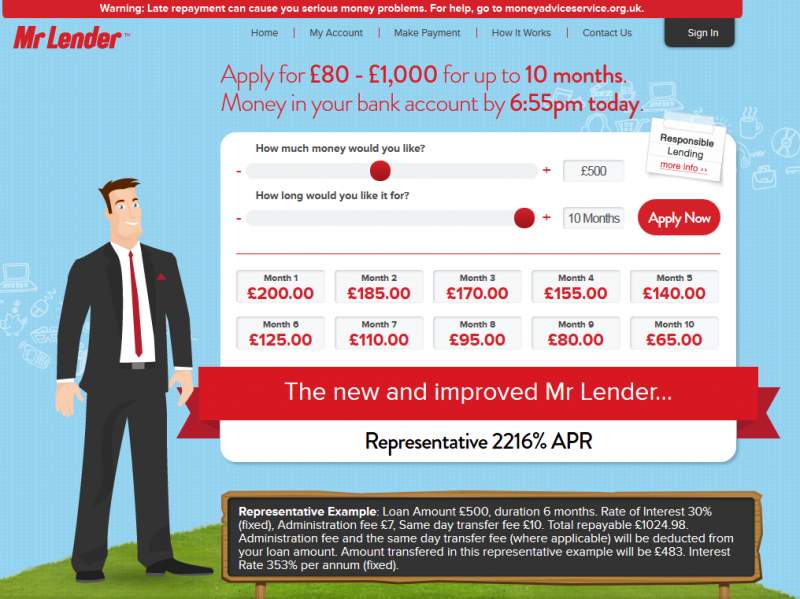

This is an example of a Mr Lender loan agreement - please post in the forum if you are having issues with Mr Lender and we will try and help.

Short term credit loans are not a suitable solution for people in financial difficulty and for longer term borrowing.

If you fail to make a repayment on due date a default fee will be charged and this may have a negative impact on credit rating more info >.

To have the funds within an hour, you will incur a fee of £10 (the amount will be deducted from your loan amount). Alternatively you can receive the funds within 3 days with no extra charge (funds are transferred straight away but may take 3 days to clear by BACS).

Every application will be subject to credit checks and affordability assessment in line with responsible lending.

FIXED SUM LOAN AGREEMENT REGULATED BY THE CONSUMER CREDIT ACT 1974

PARTIES

PDL Finance Limited trading as Mr

Lender

Mr Lender, PO Box 366, Loughton, IG10 9EW ("we, us,

our")

Customer ("you, your"):

Credit intermediary: Mr Lender Suite 105W, Sterling House, Langstone Road,

Loughton, IG10 3TS

FINANCIAL DETAILS

Amount of credit: £450

Administration Fee:

(deducted from Amount of credit)

£7

Same day transfer fee:

(deducted from Amount of credit)

£10

Repayment: Pay £585.00 on 13/07/2012.

Additionally, in each successive month (or part of a month) after entering into this agreement including, where

we have agreed to defer repayment, in months after the due date for repayment, you will pay an amount

sufficient to pay the interest accrued in the previous month (or part of a month) calculated as set out in the

Interest section below. Such repayments will be made on the same date of the month as the due date for

repayment shown above.

Total amount payable: £585.00

Duration of agreement: 27 days

You have a right to settle all or part of this agreement at any time.

INTEREST

Initial borrowing rate: (fixed) 1% per day; equivalent to 391% per annum

Rolled-over borrowing rate: (fixed) 1% per day; equivalent to 391% per annum

Interest at the Initial borrowing rate, multiplied by the number of days constituting the duration of the

agreement, will be applied as at the date of the agreement. Interest will be payable on the Amount of credit,

the Administration Fee and, where applicable, the Same day transfer fee. Where we have agreed to defer

repayment, interest at the Rolled-over borrowing rate, multiplied by the number of days in any period after the

repayment date shown above, will be applied to the balance outstanding under this agreement at the start of

that period.

Interest will be continue to be payable until the balance due under this agreement is fully repaid.

APR: 3614%

For the purposes of calculating the total charge for credit and APR it shall be assumed: that the consumer

credit agreement is to remain valid for the period agreed; that we and you will perform our obligations under

the terms and by the dates specified in the agreement; and that there are 30 days in every month.

IMPORTANT INFORMATION

We will send you a reminder by email on or before the date your repayment is due. If you contact us to inform

us that you are unable to make the repayment on the due date we may, at our sole discretion, allow you to

defer making payment until a date which we will tell you, which will be no more than 31 days after the due

date.

If you fail to make a repayment on the due date we shall charge you a late payment fee of £20.

Unless we have agreed that you may defer making payment the following provisions will apply. If we have to

write to you regarding your breach of this agreement, we will charge a fee of £20 on each occasion we write.

If we have to serve you with a default notice we will charge you a fee of £20. If any payment is not paid on its

due date, then you will be liable to pay us interest calculated on the overdue amount at the Borrowing rate

until the date of actual payment. Interest will be payable before and after any judgement we may obtain

against you. You will compensate us for any costs or expenses that we incur in enforcing the terms of this

agreement. Without limitation, this will include legal costs, and costs incurred in tracing you and any costs of

our agents in attempting to collect any sum you owe under this agreement.

MISSING PAYMENTS

If you fail to make repayments it could have severe consequences and make obtaining credit in future more

difficult. If you fail to make any repayment on its due date we will report this to the credit reference agency we

use. Other lenders use information from credit reference agencies when deciding whether to lend or not. We

may also sell your debt to a third party debt collector.

YOUR RIGHT TO WITHDRAW

Once you have signed the agreement you will have the right to withdraw from it. The withdrawal period lasts

from the day after you sign the agreement and ends 14 calendar days later. You do not have to give any

reason for withdrawing. If you wish to withdraw you can call us on 0208-502-1288 or write to

customer.services@mrlender.co.uk us at the address set out above. If you withdraw from the agreement you

will have to repay the amount of credit and we may charge you interest on the amount of credit from the date

of this agreement until you repay it. You should repay us using the details given above without undue delay

will have to repay the amount of credit and we may charge you interest on the amount of credit from the date

of this agreement until you repay it. You should repay us using the details given above without undue delay

and no later than the end of the period of 30 days beginning with the day after the day on which the notice of

withdrawal was given.

YOUR RIGHT TO REPAY EARLY

You can settle all or part of this agreement at any time by giving notice to us, either in writing or orally. If you

want to settle in full you will need to tell us the date on which you want to settle the agreement. We will then

send you a statement showing what you must pay, after deducting any rebate to which you are entitled. If you

want to settle part of the agreement, once we have received your payment we will work out any rebate to

which you are entitled, apply it to your agreement and recalculate your repayments. If you make a partial early

settlement you may ask us to send you a statement.

STATEMENT OF ACCOUNT

At any time when there is a balance outstanding under this agreement, you have the right to ask for a

statement showing the repayments still outstanding, when these are payable and a breakdown of the

repayments showing how much comprise capital, interest or any other charges, which we will provide free of

charge.

This agreement consists of the terms above and the terms and conditions.

TERMS AND CONDITIONS

1. Once we have signed the agreement we will pay the amount of credit into a bank account nominated by

you. This agreement will come into force as soon as it has been signed by the borrower and signed on our

behalf.

2. You agree to repay the amount of credit together with the interest and any charges by the repayment shown

by no later than 8.00 pm on the date shown.

3. You grant us permission to debit all sums due under this agreement from your bank account using either a

cheque or debit card provided by you, or a standing order set up by you at our option. You must ensure that

sufficient funds are available to make the payment but if we are unable to collect the full repayment due when

we attempt to do so you authorise us to attempt to collect full repayment in the following tranches:

3.1 interest;

3.2 [50% + £10] of the balance outstanding and

3.3 [50% - £10] of the balance outstanding

We will make not more than three attempts to collect sums due under this agreement on the due date for

repayment and the same number of attempts to collect such sums on the next three successive dates of the

month that the repayment is due.

You are responsible for ensuring that any payments sent to us by post reach us in time for the funds to be paid

into your account and clear on the account by the due date. Prompt payment is essential. You cannot pay any

amount toward your loan using a credit card or any other type of credit.

4. Subject to the requirements of the Consumer Credit Act 1974, we will be entitled to demand that you

repay the whole of the balance due under this agreement if any of the following events occur:

4.1 you fail to make any repayment within 14 days of its due date; or

4.2 any information you have given us was incorrect in a material respect; or

4.3 you enter into any form of debt management programme; or

4.4 you become bankrupt or be unable to pay your debts; or

4.5 you die.

5. If we do not enforce our rights under this agreement at any time we will not be prevented from doing so

later.

6. Any payment you make which is less than the payment then due will be applied firstly to pay interest and

charges and then to reduce the Amount of credit then outstanding.

7. You agree that, to the extent permitted by law, we may communicate with you for the purposes of this

agreement electronically using the email address provided to us. Any notice or demand we send to you by

email will be assumed to have been properly delivered at the time of the completion of transmission by us if

sent before 8.00pm or at 8.00am on the next day if sent later. Any other communication will be assumed to

have been properly delivered when given, if served on you personally, or left or sent by prepaid envelope

addressed to you at your last known address. If sent by first class post it will be assumed to have been

received by you 48 hours after posting. If you change your email or postal address you must tell us at once.

8. In the absence of any manifest error, our records will be deemed to be conclusive of the matters they

record. You must let us know, in writing, within seven days about any change of your address.

9. We may assign or transfer all or any of our rights under this agreement which will not affect your liabilities

or reduce your rights. You may not assign or transfer any of your rights under this agreement.

10. If any provision of this agreement is found to be invalid or unenforceable, it will not affect the remaining

provisions.

11. If you find yourself in financial difficulties you should contact us by email on collections@mrlender.co.uk

to discuss how we may be able to assist you.

12. If you have a complaint about our service then you should contact us at complaints@mrlender.co.uk. We

will acknowledge the complaint within five working days and review it under the British Cheque & Credit

Association's complaint handling procedures. The BCCA may be contacted on 01925-426-090. If we

cannot resolve the complaint then you may ask the Financial Ombudsman Service to consider it. You can

will acknowledge the complaint within five working days and review it under the British Cheque & Credit

Association's complaint handling procedures. The BCCA may be contacted on 01925-426-090. If we

cannot resolve the complaint then you may ask the Financial Ombudsman Service to consider it. You can

write to the Ombudsman at South Quay Plaza, 183 Marsh Wall, London E14 9SR, call them on 0845 080

1800 or by emailing complaint.info@financial-ombudsman.org.uk.

13. The supervisory authority for this agreement is the Office of Fair Trading, Fleetbank House, 2 6 Salisbury

Square, London EC4Y 8JX.

14. In this agreement a "working day" is any Monday - Friday which is not a bank holiday in England.

15. If you live in Scotland or Northern Ireland this agreement will be governed by the laws of Scotland or

Northern Ireland respectively, otherwise it will be governed by the laws of England and Wales.

This agreement consists of the terms above and the terms and conditions.

By signing this agreement you declare:

1. That you are not under any notice of having to leave your employment through redundancy or otherwise

and you have no intention of leaving your current employment before you have fulfilled your obligations under

this agreement.

2. You are not currently in, or planning to enter in to, a debt management programme or an Individual

Voluntary Arrangement and you do not intend to apply to be made bankrupt.

This is a credit agreement which you should only sign

if you want to be legally bound by its terms.

Signature:

Dated:

By inserting my surname, mother's maiden name and

my IP address I agree to be bound by this

agreement.

Signed for and on behalf of PDL Finance Limited.

Signature:

Dated:

which is the date of this agreement

Short term credit loans are not a suitable solution for people in financial difficulty and for longer term borrowing.

If you fail to make a repayment on due date a default fee will be charged and this may have a negative impact on credit rating more info >.

To have the funds within an hour, you will incur a fee of £10 (the amount will be deducted from your loan amount). Alternatively you can receive the funds within 3 days with no extra charge (funds are transferred straight away but may take 3 days to clear by BACS).

Every application will be subject to credit checks and affordability assessment in line with responsible lending.

FIXED SUM LOAN AGREEMENT REGULATED BY THE CONSUMER CREDIT ACT 1974

PARTIES

PDL Finance Limited trading as Mr

Lender

Mr Lender, PO Box 366, Loughton, IG10 9EW ("we, us,

our")

Customer ("you, your"):

Credit intermediary: Mr Lender Suite 105W, Sterling House, Langstone Road,

Loughton, IG10 3TS

FINANCIAL DETAILS

Amount of credit: £450

Administration Fee:

(deducted from Amount of credit)

£7

Same day transfer fee:

(deducted from Amount of credit)

£10

Repayment: Pay £585.00 on 13/07/2012.

Additionally, in each successive month (or part of a month) after entering into this agreement including, where

we have agreed to defer repayment, in months after the due date for repayment, you will pay an amount

sufficient to pay the interest accrued in the previous month (or part of a month) calculated as set out in the

Interest section below. Such repayments will be made on the same date of the month as the due date for

repayment shown above.

Total amount payable: £585.00

Duration of agreement: 27 days

You have a right to settle all or part of this agreement at any time.

INTEREST

Initial borrowing rate: (fixed) 1% per day; equivalent to 391% per annum

Rolled-over borrowing rate: (fixed) 1% per day; equivalent to 391% per annum

Interest at the Initial borrowing rate, multiplied by the number of days constituting the duration of the

agreement, will be applied as at the date of the agreement. Interest will be payable on the Amount of credit,

the Administration Fee and, where applicable, the Same day transfer fee. Where we have agreed to defer

repayment, interest at the Rolled-over borrowing rate, multiplied by the number of days in any period after the

repayment date shown above, will be applied to the balance outstanding under this agreement at the start of

that period.

Interest will be continue to be payable until the balance due under this agreement is fully repaid.

APR: 3614%

For the purposes of calculating the total charge for credit and APR it shall be assumed: that the consumer

credit agreement is to remain valid for the period agreed; that we and you will perform our obligations under

the terms and by the dates specified in the agreement; and that there are 30 days in every month.

IMPORTANT INFORMATION

We will send you a reminder by email on or before the date your repayment is due. If you contact us to inform

us that you are unable to make the repayment on the due date we may, at our sole discretion, allow you to

defer making payment until a date which we will tell you, which will be no more than 31 days after the due

date.

If you fail to make a repayment on the due date we shall charge you a late payment fee of £20.

Unless we have agreed that you may defer making payment the following provisions will apply. If we have to

write to you regarding your breach of this agreement, we will charge a fee of £20 on each occasion we write.

If we have to serve you with a default notice we will charge you a fee of £20. If any payment is not paid on its

due date, then you will be liable to pay us interest calculated on the overdue amount at the Borrowing rate

until the date of actual payment. Interest will be payable before and after any judgement we may obtain

against you. You will compensate us for any costs or expenses that we incur in enforcing the terms of this

agreement. Without limitation, this will include legal costs, and costs incurred in tracing you and any costs of

our agents in attempting to collect any sum you owe under this agreement.

MISSING PAYMENTS

If you fail to make repayments it could have severe consequences and make obtaining credit in future more

difficult. If you fail to make any repayment on its due date we will report this to the credit reference agency we

use. Other lenders use information from credit reference agencies when deciding whether to lend or not. We

may also sell your debt to a third party debt collector.

YOUR RIGHT TO WITHDRAW

Once you have signed the agreement you will have the right to withdraw from it. The withdrawal period lasts

from the day after you sign the agreement and ends 14 calendar days later. You do not have to give any

reason for withdrawing. If you wish to withdraw you can call us on 0208-502-1288 or write to

customer.services@mrlender.co.uk us at the address set out above. If you withdraw from the agreement you

will have to repay the amount of credit and we may charge you interest on the amount of credit from the date

of this agreement until you repay it. You should repay us using the details given above without undue delay

will have to repay the amount of credit and we may charge you interest on the amount of credit from the date

of this agreement until you repay it. You should repay us using the details given above without undue delay

and no later than the end of the period of 30 days beginning with the day after the day on which the notice of

withdrawal was given.

YOUR RIGHT TO REPAY EARLY

You can settle all or part of this agreement at any time by giving notice to us, either in writing or orally. If you

want to settle in full you will need to tell us the date on which you want to settle the agreement. We will then

send you a statement showing what you must pay, after deducting any rebate to which you are entitled. If you

want to settle part of the agreement, once we have received your payment we will work out any rebate to

which you are entitled, apply it to your agreement and recalculate your repayments. If you make a partial early

settlement you may ask us to send you a statement.

STATEMENT OF ACCOUNT

At any time when there is a balance outstanding under this agreement, you have the right to ask for a

statement showing the repayments still outstanding, when these are payable and a breakdown of the

repayments showing how much comprise capital, interest or any other charges, which we will provide free of

charge.

This agreement consists of the terms above and the terms and conditions.

TERMS AND CONDITIONS

1. Once we have signed the agreement we will pay the amount of credit into a bank account nominated by

you. This agreement will come into force as soon as it has been signed by the borrower and signed on our

behalf.

2. You agree to repay the amount of credit together with the interest and any charges by the repayment shown

by no later than 8.00 pm on the date shown.

3. You grant us permission to debit all sums due under this agreement from your bank account using either a

cheque or debit card provided by you, or a standing order set up by you at our option. You must ensure that

sufficient funds are available to make the payment but if we are unable to collect the full repayment due when

we attempt to do so you authorise us to attempt to collect full repayment in the following tranches:

3.1 interest;

3.2 [50% + £10] of the balance outstanding and

3.3 [50% - £10] of the balance outstanding

We will make not more than three attempts to collect sums due under this agreement on the due date for

repayment and the same number of attempts to collect such sums on the next three successive dates of the

month that the repayment is due.

You are responsible for ensuring that any payments sent to us by post reach us in time for the funds to be paid

into your account and clear on the account by the due date. Prompt payment is essential. You cannot pay any

amount toward your loan using a credit card or any other type of credit.

4. Subject to the requirements of the Consumer Credit Act 1974, we will be entitled to demand that you

repay the whole of the balance due under this agreement if any of the following events occur:

4.1 you fail to make any repayment within 14 days of its due date; or

4.2 any information you have given us was incorrect in a material respect; or

4.3 you enter into any form of debt management programme; or

4.4 you become bankrupt or be unable to pay your debts; or

4.5 you die.

5. If we do not enforce our rights under this agreement at any time we will not be prevented from doing so

later.

6. Any payment you make which is less than the payment then due will be applied firstly to pay interest and

charges and then to reduce the Amount of credit then outstanding.

7. You agree that, to the extent permitted by law, we may communicate with you for the purposes of this

agreement electronically using the email address provided to us. Any notice or demand we send to you by

email will be assumed to have been properly delivered at the time of the completion of transmission by us if

sent before 8.00pm or at 8.00am on the next day if sent later. Any other communication will be assumed to

have been properly delivered when given, if served on you personally, or left or sent by prepaid envelope

addressed to you at your last known address. If sent by first class post it will be assumed to have been

received by you 48 hours after posting. If you change your email or postal address you must tell us at once.

8. In the absence of any manifest error, our records will be deemed to be conclusive of the matters they

record. You must let us know, in writing, within seven days about any change of your address.

9. We may assign or transfer all or any of our rights under this agreement which will not affect your liabilities

or reduce your rights. You may not assign or transfer any of your rights under this agreement.

10. If any provision of this agreement is found to be invalid or unenforceable, it will not affect the remaining

provisions.

11. If you find yourself in financial difficulties you should contact us by email on collections@mrlender.co.uk

to discuss how we may be able to assist you.

12. If you have a complaint about our service then you should contact us at complaints@mrlender.co.uk. We

will acknowledge the complaint within five working days and review it under the British Cheque & Credit

Association's complaint handling procedures. The BCCA may be contacted on 01925-426-090. If we

cannot resolve the complaint then you may ask the Financial Ombudsman Service to consider it. You can

will acknowledge the complaint within five working days and review it under the British Cheque & Credit

Association's complaint handling procedures. The BCCA may be contacted on 01925-426-090. If we

cannot resolve the complaint then you may ask the Financial Ombudsman Service to consider it. You can

write to the Ombudsman at South Quay Plaza, 183 Marsh Wall, London E14 9SR, call them on 0845 080

1800 or by emailing complaint.info@financial-ombudsman.org.uk.

13. The supervisory authority for this agreement is the Office of Fair Trading, Fleetbank House, 2 6 Salisbury

Square, London EC4Y 8JX.

14. In this agreement a "working day" is any Monday - Friday which is not a bank holiday in England.

15. If you live in Scotland or Northern Ireland this agreement will be governed by the laws of Scotland or

Northern Ireland respectively, otherwise it will be governed by the laws of England and Wales.

This agreement consists of the terms above and the terms and conditions.

By signing this agreement you declare:

1. That you are not under any notice of having to leave your employment through redundancy or otherwise

and you have no intention of leaving your current employment before you have fulfilled your obligations under

this agreement.

2. You are not currently in, or planning to enter in to, a debt management programme or an Individual

Voluntary Arrangement and you do not intend to apply to be made bankrupt.

This is a credit agreement which you should only sign

if you want to be legally bound by its terms.

Signature:

Dated:

By inserting my surname, mother's maiden name and

my IP address I agree to be bound by this

agreement.

Signed for and on behalf of PDL Finance Limited.

Signature:

Dated:

which is the date of this agreement

Comment