Hi everyone

Patience with a newby here please

Over the weekend, Court Papers received for an very old MBNA debt have kicked my butt into action and I have been reading weekend swotting up on the court process and letters to serve etc. Been all day and getting my head around thing and process to follow

Amethyst has been very helpful confirming due process to follow

Court papers have been acknowledged for 28 day extension and letters have been sent record delivery to Cabot and Restons for proof of the debt and proof of the contract signed. Sent today, my main issue is sorted

Now on a side note, in the early 2000s I had over a dozen credit cards & loans across various banks & credit card and loan companies for varying amounts. Total debts ended up being over £60,000 across around a 12-15 different companies

ALL accounts have been unpaid & in default since early 2009 so approaching statue barred stage of 6 years VERY soon in 2015

Today, upon checking my credit files today for the first time in many, many years I see i ONLY actually have recorded x3 negative credit records to my dark past. A BIG SURPRISE. I thought all the gory details would be there to see after 100s of letters i have had over the years and pass the parcel across different DCAs

This is a great surprise to me! Hopefully encouraging

I have read and believe to be true that after 6 years the default on your credit file drops off and is lost.

But looking at the visuals representations on the Experian, Equifax, Noddle and Credit Compass I can see unpaid payment records going back 6 years

So my question, is the the earliest default is removed first?

but the remaining 5 years and 11 months worth of unpaid defaulted payments would will still remain visible for lenders to see?

The largest debt still visible for me personally, is one entry i have from 1st Credit Limit

Added default date recorded of 09/01/2009 for approx £14,000

So i think it should drop off my file next month (after 6 years)

So will ALL details relating to this debt be removed in their entirety ?

Lots of other credit cards & loans MUST have been visible on my credit file in the past 10 years, debts i had much bigger debts some £20,000+ that cannot be seen on any of my files despite it being.

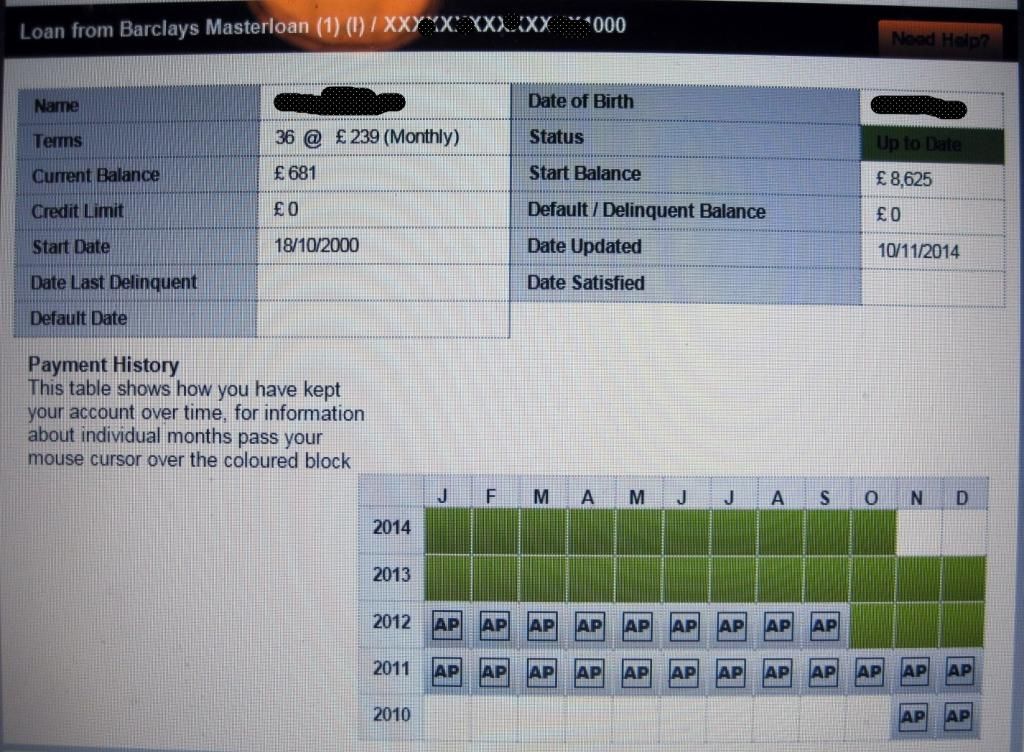

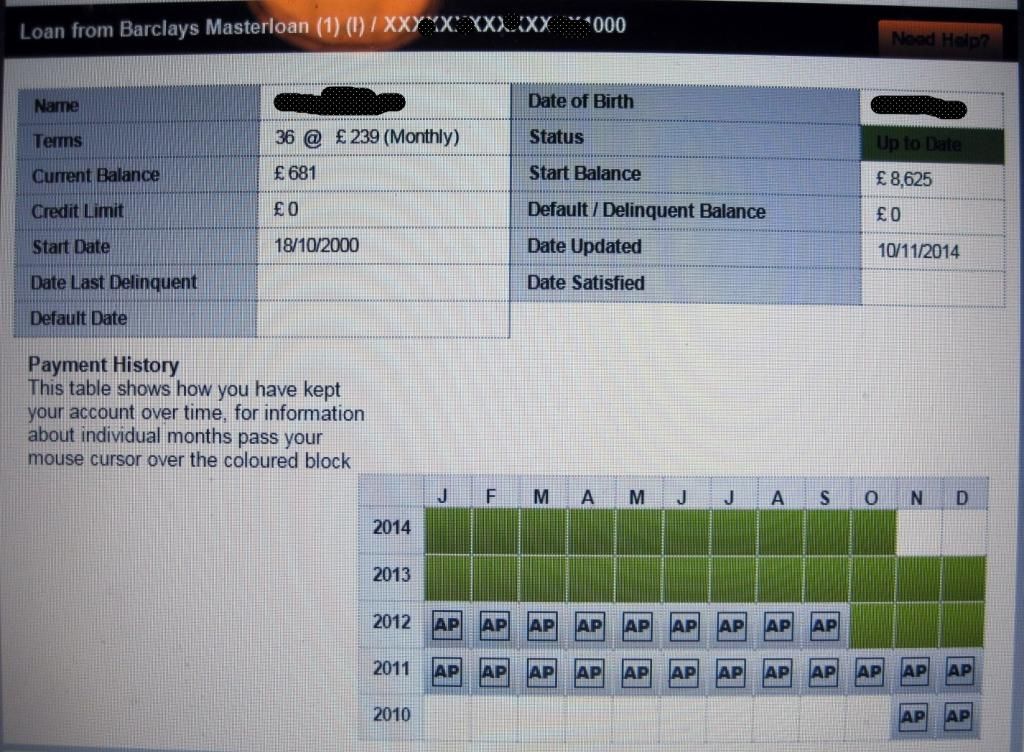

and a second query on my files relates to a Barclays Masterloan entry

Loanfrom Barclays Masterloan (1) (I) / XXXXXXXXXXXXXXXXX

Name MrX Date of Birth XX/XX/XXXX

Terms 36 @ £ 240 (Monthly) Status Up to Date

CurrentBalance £ 681

StartBalance £ 8,000

CreditLimit £ 0

Default/ Delinquent Balance £ 0

StartDate 18/10/2000

DateUpdated 10/11/2014

DateLast Delinquent

Date Satisfied

DefaultDate

This account has had no payment made to it since mid 2000s as well.

Now looking at the Equifax visuals, in my eyes everything looking perfect and i am actually getting positive payment history against my credit file for this account. It looks like i have been making payment since October 2012

However i have no monthly payment arrangement set up, it doesn't state the account is in default (as it should be)

Given that the amount owed only £680 i am in a position to afford to pay this off if need be just to settle my loose ends up and would be happy to do so in February 2015 if I can be certain this main millstone debt from 1st credit for £14000 listed above drops off next month

Any advice or guidance anyone who has been through this I would greatly appreciate.

Again sorry to say, but i have looked at my credit file in over 10 years so it is a lot to take in.

Much appreciated everyone who has read this far.

Best wishes everyone.

Hopefully a new fresh start for me next year in 2015

Patience with a newby here please

Over the weekend, Court Papers received for an very old MBNA debt have kicked my butt into action and I have been reading weekend swotting up on the court process and letters to serve etc. Been all day and getting my head around thing and process to follow

Amethyst has been very helpful confirming due process to follow

Court papers have been acknowledged for 28 day extension and letters have been sent record delivery to Cabot and Restons for proof of the debt and proof of the contract signed. Sent today, my main issue is sorted

Now on a side note, in the early 2000s I had over a dozen credit cards & loans across various banks & credit card and loan companies for varying amounts. Total debts ended up being over £60,000 across around a 12-15 different companies

ALL accounts have been unpaid & in default since early 2009 so approaching statue barred stage of 6 years VERY soon in 2015

Today, upon checking my credit files today for the first time in many, many years I see i ONLY actually have recorded x3 negative credit records to my dark past. A BIG SURPRISE. I thought all the gory details would be there to see after 100s of letters i have had over the years and pass the parcel across different DCAs

This is a great surprise to me! Hopefully encouraging

I have read and believe to be true that after 6 years the default on your credit file drops off and is lost.

But looking at the visuals representations on the Experian, Equifax, Noddle and Credit Compass I can see unpaid payment records going back 6 years

So my question, is the the earliest default is removed first?

but the remaining 5 years and 11 months worth of unpaid defaulted payments would will still remain visible for lenders to see?

The largest debt still visible for me personally, is one entry i have from 1st Credit Limit

Added default date recorded of 09/01/2009 for approx £14,000

So i think it should drop off my file next month (after 6 years)

So will ALL details relating to this debt be removed in their entirety ?

Lots of other credit cards & loans MUST have been visible on my credit file in the past 10 years, debts i had much bigger debts some £20,000+ that cannot be seen on any of my files despite it being.

and a second query on my files relates to a Barclays Masterloan entry

Loanfrom Barclays Masterloan (1) (I) / XXXXXXXXXXXXXXXXX

Name MrX Date of Birth XX/XX/XXXX

Terms 36 @ £ 240 (Monthly) Status Up to Date

CurrentBalance £ 681

StartBalance £ 8,000

CreditLimit £ 0

Default/ Delinquent Balance £ 0

StartDate 18/10/2000

DateUpdated 10/11/2014

DateLast Delinquent

Date Satisfied

DefaultDate

This account has had no payment made to it since mid 2000s as well.

Now looking at the Equifax visuals, in my eyes everything looking perfect and i am actually getting positive payment history against my credit file for this account. It looks like i have been making payment since October 2012

However i have no monthly payment arrangement set up, it doesn't state the account is in default (as it should be)

Given that the amount owed only £680 i am in a position to afford to pay this off if need be just to settle my loose ends up and would be happy to do so in February 2015 if I can be certain this main millstone debt from 1st credit for £14000 listed above drops off next month

Any advice or guidance anyone who has been through this I would greatly appreciate.

Again sorry to say, but i have looked at my credit file in over 10 years so it is a lot to take in.

Much appreciated everyone who has read this far.

Best wishes everyone.

Hopefully a new fresh start for me next year in 2015

Comment