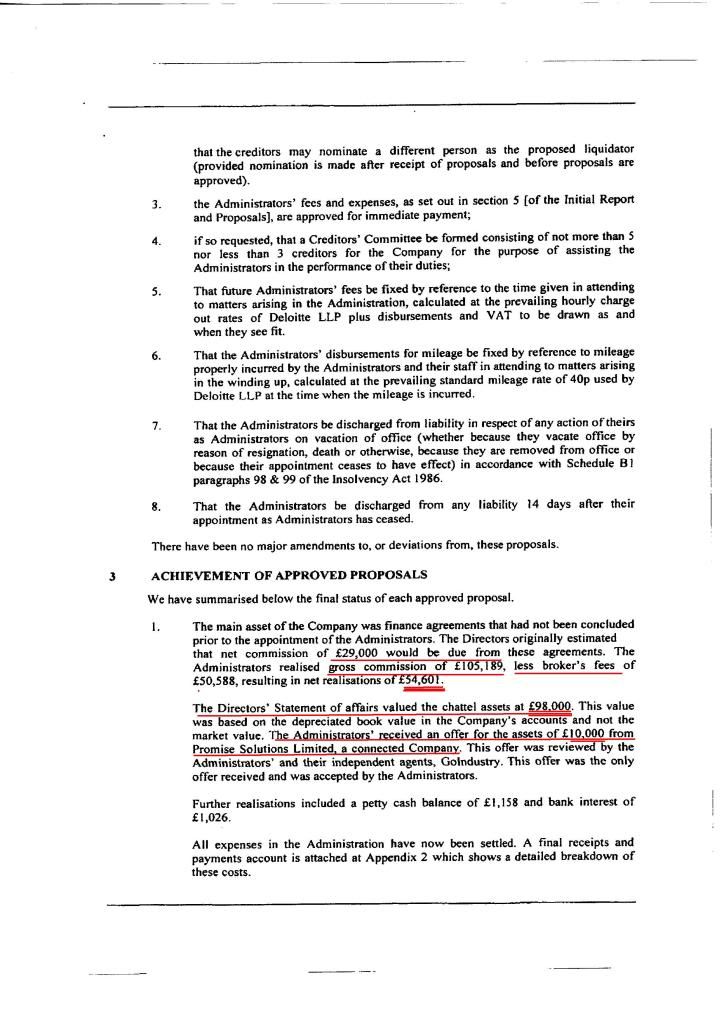

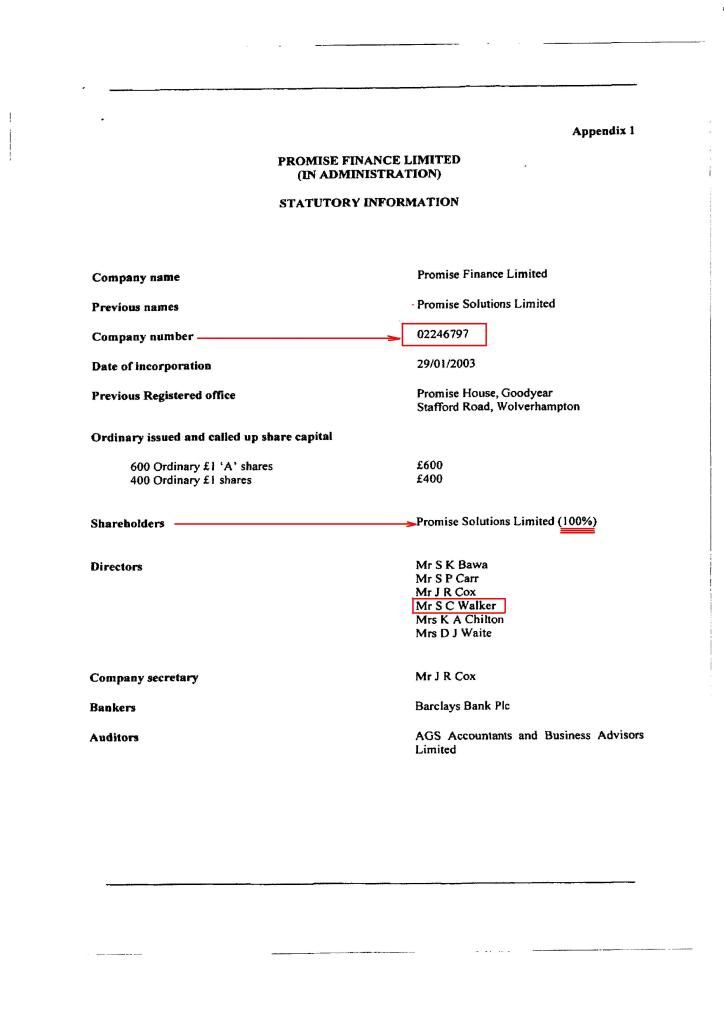

I have started this thread about Promise Finance Ltd who went into voluntary liquidation in 2008 & Promise Solutions Ltd, which was the parent Company of Promise Finance Ltd, who then bought the company in Liquidation for £ 10,000 (Assets of over £ 90,000)

That’s a good investment for a start isn’t it??

I’ll be posting some very interesting aspects about this “buy back” a bit later.

But the first thing I would like people to be aware of is that this is linked to Swift Advances plc.

Promise Finance Ltd were our Brokers in our loan deal with Swift Advances plc, Promise Finance Ltd at no time even hinted that they would receive commission.

In Court under oath Mr Mark White stated quite categorically and clearly in front of two independent witness’s who were in court at the hearing all day, that “Swift” (his word) do not pay commission.

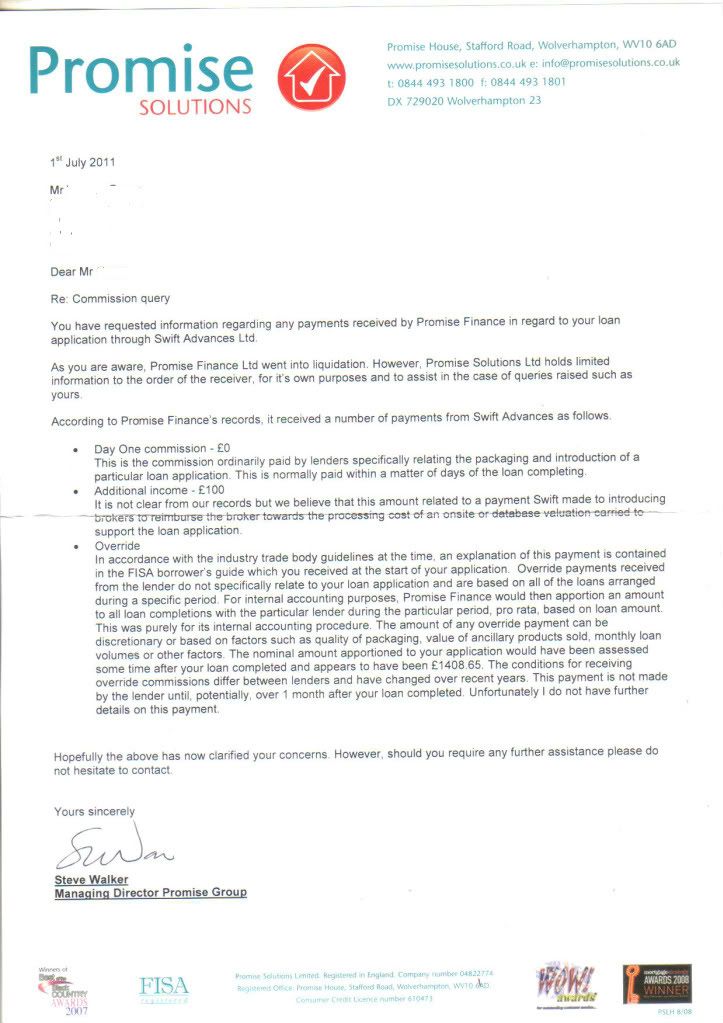

This is what the managing director of Promise Solutions Ltd has to say on the issue of what is now known and confirmed that “secret commission”. was paid by Swift Advances plc on ALL loans arranged by Promise Finance Ltd.

Therefore there is now no doubt whatsoever that Mr White committed perjury and has committed it on two other occasions in two other courts.

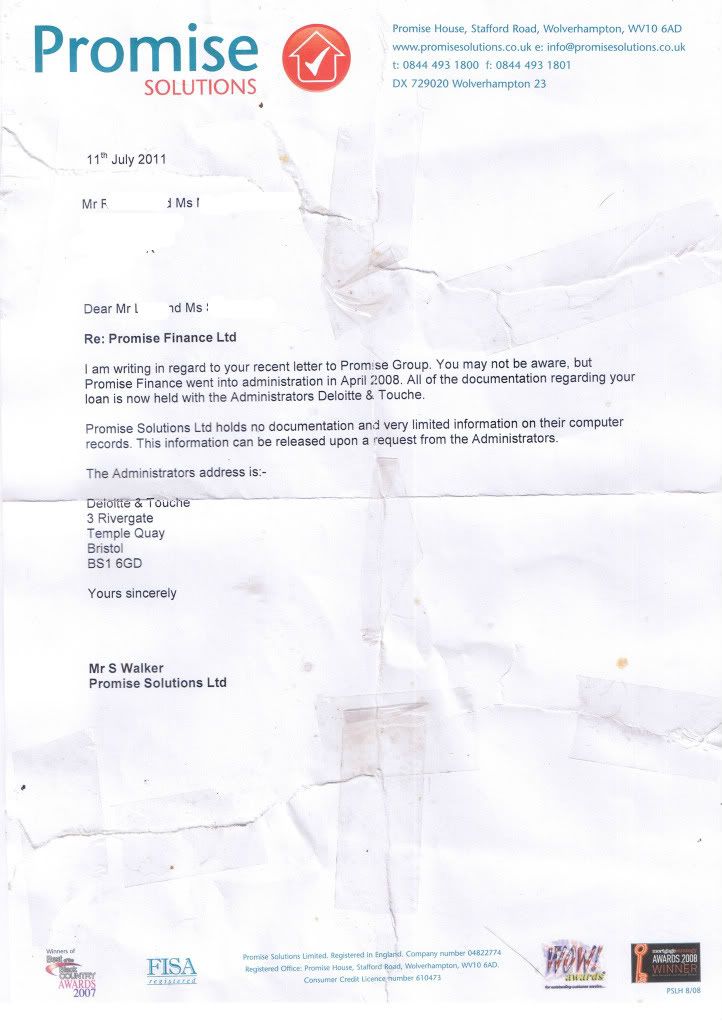

The next letter is a letter to another customer of Swift Advances plc who on my advice made the same enquiry to Promise Solutions Ltd about the commission on their loan.

You will note that it is from the same named person ( the managing director of Promise Solutions Ltd) who has not signed it nor stated his position in the company.

In this letter he is telling a different story and saying that the administrator/Promise Finance Ltd has the information, and they should contact either Promise Finance Ltd or the administrator.

How can they contact a company that no longer exists?

The administrator advised me in 2009 that all documentation about Promise Finance Ltd had been filed and archived in Companies House and even he could not access them once they had been filed, and advised that I made an SDAR to Promise Finance Ltd as they would hold the information I was seeking, they kept hold of all the computers that were used by Promise Finance Ltd, which would have that information on as they both used the same computers from the same offices.

Every single borrower of Swift Advances plc and Swift 1st Ltd now have confirmation and proof that commission was paid by Swift Advances plc and Swift 1st ltd and received by Promise Finance Ltd, on their loan, and that commission was a minimum of £1408.65 plus the £100 EXTRA income ( the documentary fee for the “packaging” I believe )……Isn’t that what we pay brokers their fee for. ? We paid the £3225 in fees and we were led to believe that was all they would receive.

Lots of further information will be posted later

Sparkie

I take full resposibility for this post ....No liability can be placed on Legal Beagles whatsoever

That’s a good investment for a start isn’t it??

I’ll be posting some very interesting aspects about this “buy back” a bit later.

But the first thing I would like people to be aware of is that this is linked to Swift Advances plc.

Promise Finance Ltd were our Brokers in our loan deal with Swift Advances plc, Promise Finance Ltd at no time even hinted that they would receive commission.

In Court under oath Mr Mark White stated quite categorically and clearly in front of two independent witness’s who were in court at the hearing all day, that “Swift” (his word) do not pay commission.

This is what the managing director of Promise Solutions Ltd has to say on the issue of what is now known and confirmed that “secret commission”. was paid by Swift Advances plc on ALL loans arranged by Promise Finance Ltd.

Therefore there is now no doubt whatsoever that Mr White committed perjury and has committed it on two other occasions in two other courts.

The next letter is a letter to another customer of Swift Advances plc who on my advice made the same enquiry to Promise Solutions Ltd about the commission on their loan.

You will note that it is from the same named person ( the managing director of Promise Solutions Ltd) who has not signed it nor stated his position in the company.

In this letter he is telling a different story and saying that the administrator/Promise Finance Ltd has the information, and they should contact either Promise Finance Ltd or the administrator.

How can they contact a company that no longer exists?

The administrator advised me in 2009 that all documentation about Promise Finance Ltd had been filed and archived in Companies House and even he could not access them once they had been filed, and advised that I made an SDAR to Promise Finance Ltd as they would hold the information I was seeking, they kept hold of all the computers that were used by Promise Finance Ltd, which would have that information on as they both used the same computers from the same offices.

Every single borrower of Swift Advances plc and Swift 1st Ltd now have confirmation and proof that commission was paid by Swift Advances plc and Swift 1st ltd and received by Promise Finance Ltd, on their loan, and that commission was a minimum of £1408.65 plus the £100 EXTRA income ( the documentary fee for the “packaging” I believe )……Isn’t that what we pay brokers their fee for. ? We paid the £3225 in fees and we were led to believe that was all they would receive.

Lots of further information will be posted later

Sparkie

I take full resposibility for this post ....No liability can be placed on Legal Beagles whatsoever

layball:and when????

layball:and when????

Comment