I'm having a long standing battle with my local TS over their complete indifference and lack of action concerning the many complaints I have made to them.

In my latest bun fight, I've complained about NEXT and the fact they sent me a blank form in response to my complaint.

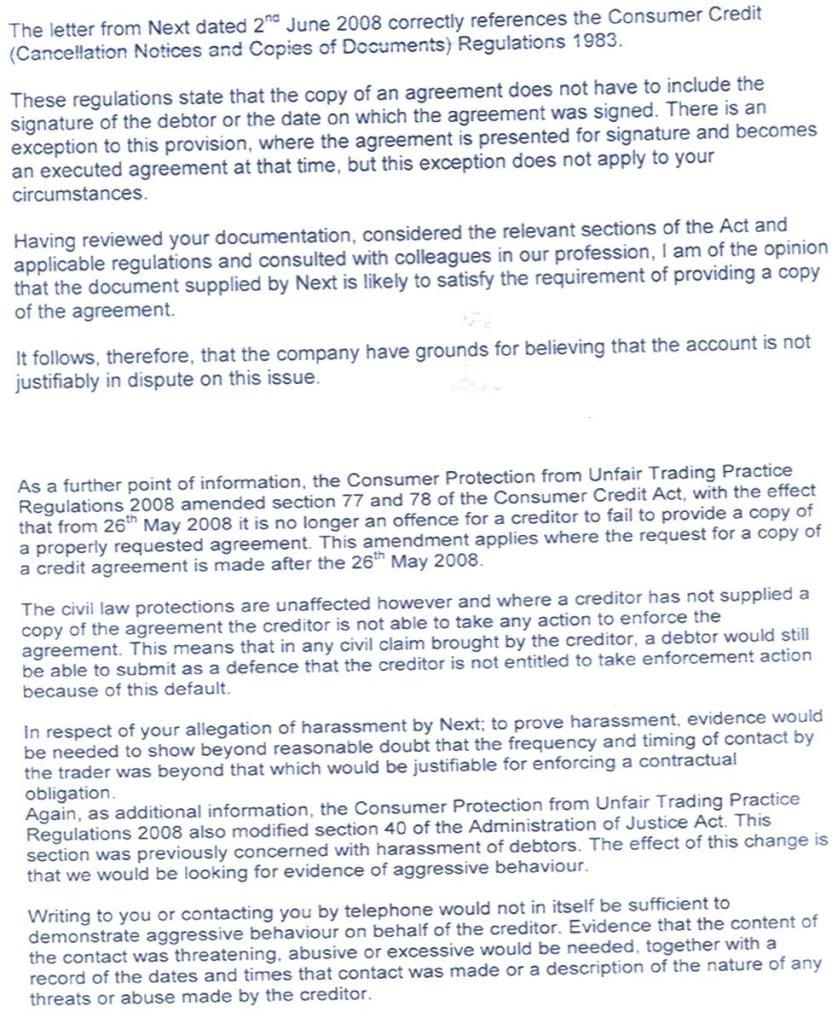

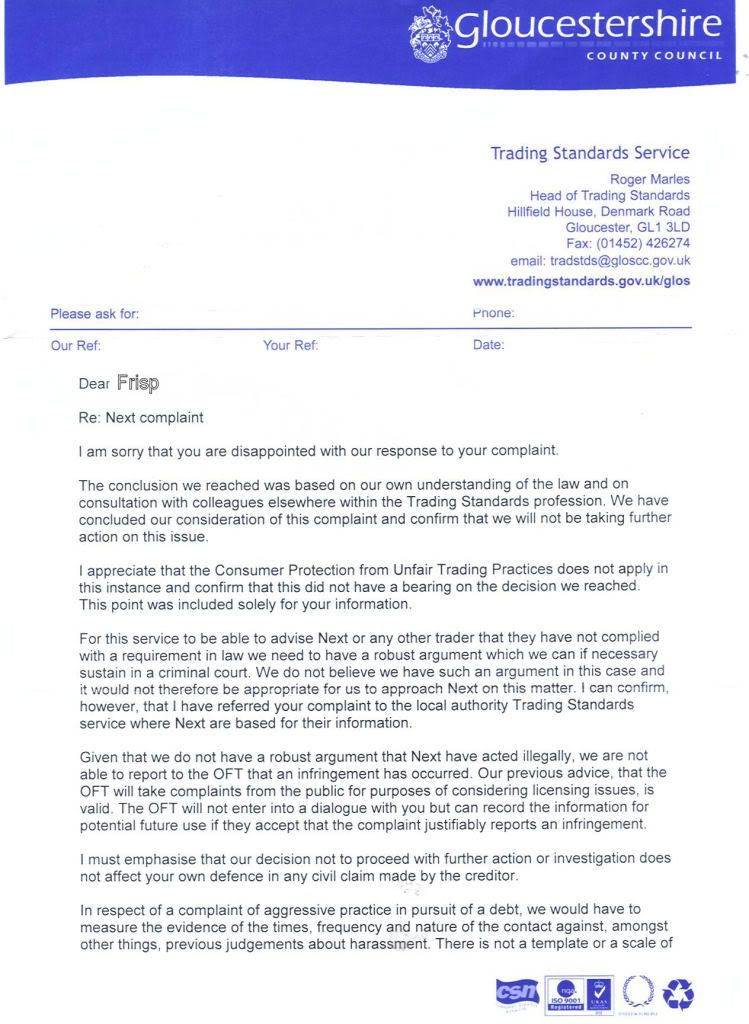

Next say that they do not need to supply a document with my signature, DUH I know, now TS have said that the blank doc I copied to them satisfies the requirement of supplying a copy of the agreement, they do agree it won't hold up in court.

They consider that there is no dispute as a blank agreement is good enough to satisfy the requirement to send a copy.

TS go on to explain that UTPR removed the criminality of not providing a copy of an agreement if the request was made post May 08, DUH I know but my request beat that deadline.

It would also appear that to investigate a complaint of harrassment that the changes to UTPR 08 also amended s40 where they will only now investigate where there has been agrressive harrassment, this is classed as threatening, abusive or excessive.

Writing to you or telephoning continuously are not in themselves sufficient to be classed as abusive or aggressive.

Can anyone give me some pithy responses that will help me in my dealings with this lot.

As an aside I have a complaint against my Local TS being investigated by their Chief Executives chosen lacky. Thats another story for another day.

Why idn't there a thread for complaints and arguements that deals specifically with the TS and OFT

Have tol rush may chk back l8r, any comments suggestions welcome.

In my latest bun fight, I've complained about NEXT and the fact they sent me a blank form in response to my complaint.

Next say that they do not need to supply a document with my signature, DUH I know, now TS have said that the blank doc I copied to them satisfies the requirement of supplying a copy of the agreement, they do agree it won't hold up in court.

They consider that there is no dispute as a blank agreement is good enough to satisfy the requirement to send a copy.

TS go on to explain that UTPR removed the criminality of not providing a copy of an agreement if the request was made post May 08, DUH I know but my request beat that deadline.

It would also appear that to investigate a complaint of harrassment that the changes to UTPR 08 also amended s40 where they will only now investigate where there has been agrressive harrassment, this is classed as threatening, abusive or excessive.

Writing to you or telephoning continuously are not in themselves sufficient to be classed as abusive or aggressive.

Can anyone give me some pithy responses that will help me in my dealings with this lot.

As an aside I have a complaint against my Local TS being investigated by their Chief Executives chosen lacky. Thats another story for another day.

Why idn't there a thread for complaints and arguements that deals specifically with the TS and OFT

Have tol rush may chk back l8r, any comments suggestions welcome.

Comment